In times of financial crisis, a quick loan proves to be one of the most effective solutions to overcome immediate monetary challenges. Life often presents us with tasks that are impossible to fulfill without additional funds. Whether it’s the need to pay for educational expenses, cover medical bills, or address a sudden breakdown of essential household appliances, the urgency of these situations demands immediate financial support. Unfortunately, no reputable professional or seller offers their services or goods for free.

Contrary to outdated beliefs, obtaining a quick loan is not detrimental to one’s financial well-being. The evolution of the online lending industry has transformed the traditional dynamics between service providers and consumers. Online loans have emerged as the most attractive option for accessing funds to cover unforeseen but necessary expenses. The short-term nature of these loans ensures lower fees, making them a viable choice for quick financial relief.

User Instructions and Borrower Warnings

- Repayment and Interest Rates: When using quick loan services, it is crucial to prioritize timely repayment to avoid inflated interest rates. The shorter the loan term, the lower the commission charged for borrowing the funds. It is strongly advised not to delay the repayment of contractual contributions. Unforeseen circumstances can arise, and postponing repayments may lead to further complications. By promptly repaying the loan, borrowers can maintain a good track record and become eligible for larger loan amounts in the future.

- Importance of Reviewing the Loan Agreement: Experienced users recommend thoroughly reading every line of the loan agreement before signing. It is essential to understand all the terms and conditions, including potential hidden obligations. Rushing into a loan agreement without careful scrutiny can result in unexpected debt burdens. Reputable lenders often provide detailed information on their official websites, allowing borrowers to review and understand the terms before making a decision.

Why Can Choose Quick Loan with Finloo PH?

- Easy and Convenient Application Process: Finloo, a trusted platform, offers a hassle-free experience for borrowers in difficult financial situations. By utilizing Finloo, individuals can access a comprehensive database of loan offers that cater to their specific needs. The online application process is simple and can be completed in less than 15 minutes, eliminating the need for physical visits to banking institutions or offices.

- 24/7 Availability and Uninterrupted Service: One of the notable advantages of using Finloo is its round-the-clock availability. Regardless of weekends or holidays, borrowers can access the platform at any time. This uninterrupted service ensures that individuals can seek financial assistance whenever they need it most.

Step-by-Step Guide

Obtaining a quick loan follows a systematic approach. Here is a step-by-step guide to navigate the process effectively:

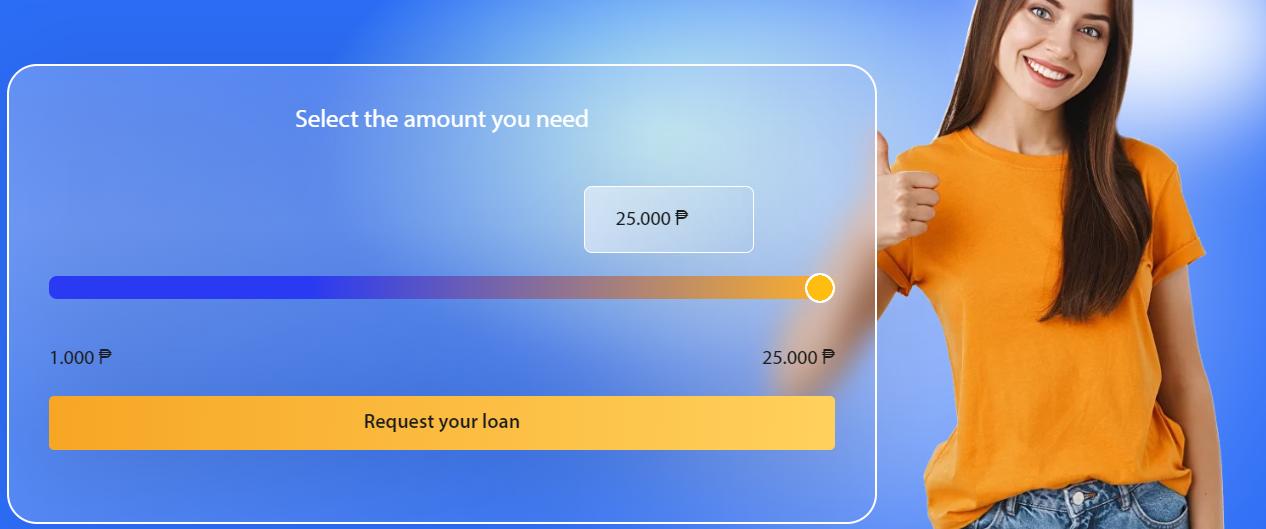

- Assess the Required Amount: Carefully evaluate the precise amount of money needed to address the financial situation at hand. This step ensures that borrowers request an appropriate loan amount and avoid unnecessary debt.

- Compare Loan Products: Research and compare various loan products offered by different lenders. Consider factors such as interest rates, repayment terms, and customer reviews to identify the best loan option that suits individual requirements.

- Complete the Online Form: Fill out the online form provided by the chosen lender. Ensure that all information entered is accurate and comprehensive. Attention to detail at this stage is crucial to avoid any delays or complications during the loan processing.

- Utilize Finloo’s Benchmarking Tool: Finloo offers a benchmarking tool that simplifies the loan selection process. By utilizing this tool, borrowers can gain confidence in their decision-making and save valuable time. With the extensive market for loan services in the Philippines, Finloo’s benchmarking tool provides clarity and streamlines the borrower’s experience.

Requirements for Quick Loan Eligibility:

To be eligible for a quick loan, borrowers generally need to meet the following criteria:

- Must be of legal age, typically the age of majority.

- Must possess Philippine citizenship.

- Must provide valid identification documents.

Lenders typically reject loan requests from borrowers with existing debt obligations. Therefore, prioritizing the repayment of existing debts enhances the chances of loan approval.

Additionally, lenders consider the borrower’s regular monthly income and ensure that loan payments do not exceed a certain percentage of that income. A history of irresponsible loan repayments or a damaged credit reputation can also lead to loan rejections.

Borrowers should understand that quick loans are not intended for paying off existing credit obligations within the country. Prudent borrowing is essential, and individuals should only borrow when confident in their ability to repay on time.

Conclusion

Quick loans serve as a lifeline during times of financial crisis. By adhering to the user instructions, borrower warnings, and the step-by-step guide discussed above, individuals can navigate the quick loan process with ease. Platforms like Finloo further streamline the experience by providing a comprehensive database and benchmarking tool, ultimately saving borrowers time and enhancing their confidence.

However, responsible financial management remains crucial. Timely loan repayments are necessary to safeguard one’s credit reputation and avoid future complications. By utilizing quick loans wisely, individuals can address immediate financial needs while ensuring a stable and secure financial future.