Apply for a quick cash loan philippines online and loan up to PHP 25 000 at low interest. Compare lenders, apply for a loan and get money in your bank account!

#1. MoneyCat is a multinational finance company, now available in the Philippines. We are an effective assistant in all your financial matters. You will be advised and guided carefully on how to create a loan. MoneyCat service will bring you financial solutions easily and quickly: Get started by completing the online registration application, and we will review and transfer money to your bank account within 24 hours.

#2. Digido PH is an online lending company that offers fast loans up to 10 000 PHP (first loan) and up to 25 000 PHP (second loan).

#3. Online Loans Pilipinas Corporation is a Philippine-based financial technology company powered by the Online Loans Pilipinas international line of fintech companies and focused in online micro- and consumer financing, one of the first to offer online loans in the Philippines

What is the Best Loan Philippines

Determining the best loan in the Philippines depends on a variety of factors, such as the borrower’s financial situation, credit history, loan amount, and repayment terms. Different loans are designed to meet different needs, so the best loan for one borrower may not be the best loan for another.

That being said, there are a few common types of loans in the Philippines that may be a good fit for certain borrowers:

-

Personal loans: Personal loans are a common type of unsecured loan that can be used for a variety of purposes, such as debt consolidation, home improvement, or unexpected expenses. They typically have fixed interest rates and repayment terms, and can be a good option for borrowers with good credit who need to borrow a larger sum of money.

-

Salary loans: Salary loans are a type of short-term loan that are designed to provide borrowers with quick access to cash to cover unexpected expenses or emergencies. They are typically offered by banks and other financial institutions, and require proof of employment and a steady salary.

-

Business loans: Business loans are designed to provide funding to small business owners and entrepreneurs to help them start or grow their business. They can be secured or unsecured, and may have variable or fixed interest rates.

-

Housing loans: Housing loans are designed to help borrowers purchase or refinance a home. They typically have longer repayment terms and lower interest rates than other types of loans, and can be a good option for borrowers who need to borrow a large sum of money over a longer period of time.

Ultimately, the best loan in the Philippines will depend on the borrower’s specific needs and financial situation. It’s important for borrowers to research and compare different loan options, read the terms and conditions carefully, and choose a reputable lender that offers competitive rates and fees.

Main requirements

- Must be a citizen of the Republic of the Philippines.

- At least 22 – 60 years old.

- Valid ID/documents.

- Bank account.

- Phone number.

Why Apply Loans Philippines?

- A Simple 2-step application.

- All lenders in one place.

- Fast and convenient.

- Money loan without collateral.

- Online cash loans.

FAQ

Why chose online loans?

What is a quick loan?

Conditions of receiving a loan

– be a citizen or resident of Philippines;

– be between 18 and 75 years old;

– have a bank account within a Philippines bank;

– have a valid phone number; do not have overdue loan payments or debt.

YOU WANT GET A QUICK LOAN PHILIPPINES

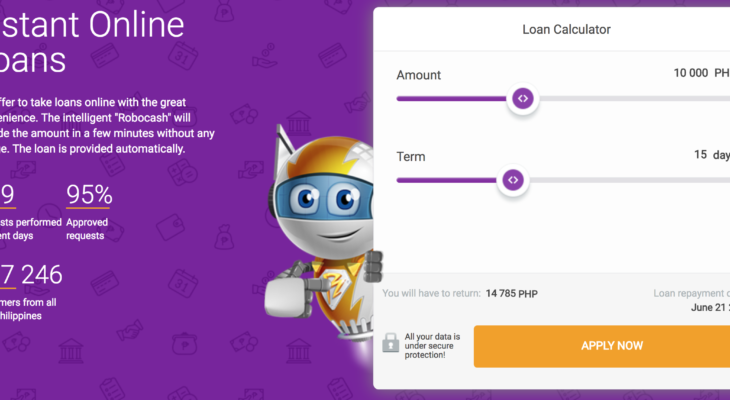

- ROBOCASH LOAN (Up to PHP 25 000): https://cashloanph.com/go/robocashph

- MONEYCAT LOAN (Get up-to PHP 10,000): https://cashloanph.com/go/moneycatph

- ONLINE LOANS PH: https://cashloanph.com/go/onlineloanph/

- CREDIFY PH 4000 ₱: https://cashloanph.com/go/credifyph/

- SOSCREDIT: https://cashloanph.com/go/soscreditph/

- MAZILLA: https://cashloanph.com/go/mazillaph/

- BINIXO: https://cashloanph.com/go/binixoph/

- Read more: Cash Loans Online Philippines

Telegram Channel: https://t.me/s/loanph

ALSO, If YOU are LENDER. Let share your INFO at COMMENT BELOW !!!