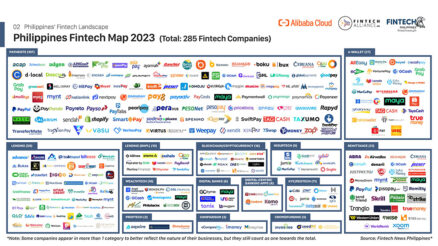

The financial landscape in the Philippines has undergone a significant transformation in recent years. The advent of technology and the rise of digital banking have paved the way for a plethora of quick cash loan apps that cater to the financial needs of Filipinos. In 2026, these apps have become more accessible and efficient than ever before, making it easier for individuals to secure the funds they require for various purposes.

In this article, CashLoanPH will delve into the top 15 best quick cash loan apps in the Philippines, offering insights into their features, benefits, and drawbacks to help you make an informed decision when seeking financial assistance.

The Philippines’ Financial Landscape

The Philippines, like many countries, faces economic challenges, and a significant portion of its population grapples with financial instability. According to recent data, nearly 47.1% of Filipino adults have outstanding loans, highlighting the pressing need for accessible and reliable financial assistance options. With the cost of living in the Philippines steadily rising, loans have become an essential tool for managing expenses, covering emergencies, and achieving personal goals.

However, the traditional process of applying for loans through brick-and-mortar banks can be cumbersome, time-consuming, and restrictive. This is where quick cash loan apps come into play, offering a streamlined and convenient solution for Filipinos in need of fast and accessible financial support. These apps leverage technology to simplify the loan application process, making it possible to secure loans with just a few clicks, often without the need for collateral.

Quick Cash Loan Apps: A Convenient Solution

Quick cash loan apps have gained immense popularity in the Philippines, and for a good reason. They offer several advantages that set them apart from traditional lending institutions:

1. Speed: Quick cash loan apps live up to their name by providing rapid approval and disbursement of funds. In many cases, borrowers can receive their approved loans within 24 hours, making them an ideal choice for emergencies and urgent financial needs.

2. Convenience: Unlike traditional banks that require in-person visits and extensive paperwork, quick cash loan apps enable borrowers to complete the entire application process online. This means you can apply for a loan from the comfort of your home, eliminating the need for time-consuming trips to a bank branch.

3. Accessibility: These apps are designed to be user-friendly, making them accessible to a wide range of individuals. They often have minimal eligibility requirements, allowing more people to qualify for loans.

4. Flexibility: Quick cash loan apps offer various loan types and repayment terms, allowing borrowers to select the option that best aligns with their financial situation and goals.

5. No Collateral: Many of these apps do not require collateral, making them accessible to individuals who may not have valuable assets to secure a loan.

Given the plethora of quick cash loan apps available in the Philippines, it can be challenging to choose the right one for your needs. To help you navigate this landscape, we have curated a list of the top 15 best quick cash loan apps in the Philippines for 2023. Each app has its unique features and offerings, allowing you to select the one that suits your requirements.

15 Best Quick Cash Loan Apps in the Philippines for 2026

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 20,000Approval in

5 minutesFirst loan free

no

Loan type

Long termFor a period of

4 monthsRate (PSK)

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 50,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no1. Tonik Bank Quick Loan (Fast, Easy, No Collateral)

Tonik Bank Quick Loan is a standout option for Filipinos seeking a quick and hassle-free borrowing experience. This neobank offers loan amounts ranging from PHP 5,000 to PHP 50,000, and what sets it apart is its commitment to providing fast approval without the need for collateral. With Tonik Bank, you can expect to receive your requested funds within 24 hours of submitting your application, making it an excellent choice for urgent financial needs.

Pros:

- Licensed and regulated by the Bangko Sentral ng Pilipinas (BSP), ensuring a secure lending experience.

- Streamlined and fast approval process.

- Flexible due date options, allowing borrowers to choose a repayment schedule that suits their financial situation.

- Offers a variety of loan types, including Big Loan, Flex Loan, Quick Loan, and Shop Installment Loan.

- Loans are 100% digital and accessible 24/7 through the Tonik mobile app.

Cons:

- The annual savings interest rate on Tonik Bank’s savings account is relatively low, currently at 4%.

- Some users have reported subpar customer service experiences.

- Occasional reports of slow response times on the Tonik app.

2. Online Loans Pilipinas (Fast Approval, Super Easy Application, Disburse to GCash)

Online Loans Pilipinas is tailored for those who want to avoid the tedious process associated with traditional banks. This quick cash loan app offers a straightforward and hassle-free borrowing experience, with no collateral required. First-time borrowers can access loans of up to PHP 7,000, while repeat borrowers have the potential to secure loans as high as PHP 20,000. The app’s fast approval process ensures that both the application and approval can be completed 100% online.

Pros:

- No collateral needed, simplifying the borrowing process.

- Online Loans Pilipinas Calculator allows clients to check the net proceeds before committing to a loan.

- Fast loan disbursement, ensuring that approved funds reach borrowers quickly.

- Simplified loan application process, making it accessible to a wide range of users.

- Application and approval are conducted entirely online for convenience.

Cons:

- Some customers have complained about hidden charges, emphasizing the importance of carefully reviewing loan terms.

- The app primarily offers smaller loan amounts.

- High-interest rates, with penalties for late payments.

3. Finbro (Fast Approval, 1 ID Only, 30 Days First Loan)

Finbro stands out as a quick cash loan app that simplifies the borrowing process, requiring only one valid ID and a selfie for loan approval. This app is accessible to all Filipino citizens aged 20 to 70, making it an inclusive option for a broad demographic. Notably, first-time borrowers can enjoy a 0% loan interest rate, and for loans of PHP 10,000 and above, the processing fee is waived. Finbro prioritizes client satisfaction and maintains a high loan approval rate.

Pros:

- Easy loan application process that requires minimal documentation.

- Fast loan release, ensuring that approved funds are disbursed promptly.

- No payslip required, making it accessible to individuals without traditional employment.

- Applicants receive an SMS confirming loan approval, adding transparency to the process.

- High loan approval rate, increasing the chances of securing the needed funds.

Cons:

- The 0% interest rate applies only to the first loan for first-time borrowers.

- Reports of loan denial after applicants provide personal banking information.

- High-interest rates, which borrowers should consider when planning their repayments.

4. Digido (Fast Approval, Reliable Portal, No Certificate of Employment Needed)

Digido positions itself as one of the reliable quick cash loan apps in the Philippines, offering a range of benefits to borrowers. This app stands out by providing a 0% interest rate for the first loan and offering loan amounts of up to PHP 25,000 for subsequent loans. Repayment terms range from 3 to 6 months, providing flexibility to borrowers. Digido employs a reliable digital platform to serve its clients, enhancing the overall lending experience.

Pros:

- 24/7 Application Processing, ensuring that borrowers can apply for loans at their convenience.

- Quick loan processing and approval, ideal for those with urgent financial needs.

- No certificate of employment needed, simplifying the eligibility requirements.

- No processing fee, reducing the overall cost of borrowing.

- Reliable and fully automated online system, enhancing the efficiency of the lending process.

Cons:

- While the app offers a 0% interest rate for first loans, subsequent loans have interest rates that borrowers should consider.

- Some users have reported high administrative fees.

- Personal data security concerns have been raised by users.

5. CashXpress (Fast Approval, Safe, Low-interest)

CashXpress is a reputable quick cash loan app in the Philippines, particularly valued during emergencies. The app operates legally and holds the necessary registrations, providing borrowers with peace of mind. First-time borrowers can benefit from a 0% interest rate, and loan amounts range from PHP 1,000 to PHP 20,000, with repayment options extending up to 180 days. CashXpress prides itself on offering transparent transactions, low-interest rates, and flexible due date extensions.

Pros:

- Quick loan approval, ensuring that borrowers receive the funds they need promptly.

- Low-interest rate, reducing the overall cost of borrowing.

- Loan due date extensions are allowed, providing flexibility in repayment.

- Data security measures protect users’ information.

- Transparent transaction fees, ensuring borrowers are fully informed about the costs associated with their loans.

Cons:

- Some users have reported poor customer service experiences.

- Occasional reports of loan disapproval, emphasizing the importance of understanding the app’s terms and eligibility requirements.

- The app does not operate 24/7, which may be a limitation for some borrowers.

6. PesoCash (High Amount, Low Interest, Easy Repayment)

For individuals seeking quick cash loan apps that offer higher loan amounts with low-interest rates, PesoCash is a compelling option. Borrowers can access loans of up to PHP 10,000, with repayment terms ranging from 96 to 365 days. PesoCash simplifies the loan repayment process, offering multiple payment channels, including bank transfers, LBC Express, 7-11 Convenience Stores, M. Lhuillier, quick cash loan Cebuana, and SM Department Store/Payment Counters.

Pros:

- Easy application process that streamlines the borrowing experience.

- High loan amounts, allowing borrowers to secure more substantial funds.

- Low-interest rate, reducing the overall cost of borrowing.

- Transparent and secure platform that safeguards user data.

- Multiple repayment options, offering convenience and flexibility to borrowers.

Cons:

- Late payment may incur a penalty fee.

- The app has been reported to take legal actions for default loans.

- Some users have noted high additional transaction fees.

7. Cashalo (Fast Processing, Convenient, Easy)

Cashalo is one of the most trusted fast cash loan app download options in the Philippines, with over 4 million users benefiting from its services. The app offers no-collateral loans ranging from PHP 1,000 to PHP 10,000, with repayment terms spanning 15 to 45 days. What sets Cashalo apart is its implementation of uniform interest rates, advanced technology to protect user data online, and financial literacy initiatives through Cashalo’s CashAcademy.

Pros:

- Easy application process that simplifies the borrowing experience.

- Fast disbursement, ensuring that approved funds reach borrowers promptly.

- Multiple repayment channels, providing convenience to borrowers.

- Convenient loan repayment options, enhancing the overall borrowing experience.

- Compliant with regulatory bodies such as BSP and SEC, ensuring a secure lending environment.

Cons:

- The app charges relatively high-interest rates.

- Borrowers may be required to pay a 5% one-time fee based on the granted loan amount.

- Strict requirements for loan applicants may limit accessibility for some individuals.

8. JuanHand (No Collateral, Fast Loan, 5-Star Customer Support)

JuanHand stands out with its high loan amounts, longer payment terms, quick loan approval, and a commitment to providing safe and trusted services. Borrowers can access loans ranging from PHP 2,000 to PHP 50,000, with repayment periods of up to 90 days. What makes JuanHand unique is its active customer service, where dedicated representatives help borrowers choose the perfect loan option to suit their needs and preferences.

Pros:

- Longer payment terms provide flexibility to borrowers.

- Easy and fast approval process expedites the lending experience.

- High loan amount, making it suitable for individuals with larger financial needs.

- Easy payout process ensures that borrowers receive their funds quickly.

- A focus on safety and trustworthiness enhances user confidence in the app.

Cons:

- The app imposes a low loan limit for some borrowers.

- Short installment period, with a maximum of 3 months.

- Additional service fees may apply, affecting the overall cost of borrowing.

9. PesoQ (Super-fast, Low Interest, Transparent)

PesoQ is an appealing option for borrowers seeking quick cash loan apps that offer a 0% interest rate for first-time borrowers. With PesoQ, you can apply for loans ranging from PHP 1,000 to PHP 10,000 and receive approval within 10 minutes. The app provides flexible repayment options, allowing borrowers to choose terms spanning 3 to 6 months. PesoQ prioritizes transparency, presenting essential loan details such as costs, interest rates, and processing fees during the application process.

Pros:

- Low-interest rate reduces the overall cost of borrowing.

- High loan amount, accommodating various financial needs.

- Easy application process streamlines the borrowing experience.

- Quick cash disbursement ensures that approved funds are readily available to borrowers.

- Robust data security measures protect user information.

Cons:

- Auto loan denial may occur for applicants with poor credit scores.

- Reports of hidden charges emphasize the importance of reviewing loan terms carefully.

- Additional fees may apply, impacting the overall cost of borrowing.

10. BillEase (Online Purchase Partner, Flexible Loans, Intuitive App)

BillEase is an attractive option for individuals looking to finance online purchases, cover expenses, or access funds for shopping and travel. The app offers two loan options: Buy Now, Pay Later, and the BillEase Cash Loan. New borrowers can secure loans ranging from PHP 2,000 to PHP 10,000, with the potential for the limit to increase to PHP 40,000 for reliable payers.

Pros:

- Quick application process simplifies the borrowing experience.

- Fast approval ensures that borrowers receive their requested funds promptly.

- Multiple payment channels provide convenience for borrowers.

- Diverse partner network enhances the app’s utility.

- Flexible credit line accommodates various financial needs.

Cons:

- Loans may not be available to individuals with no income.

- The approval rate may be limited to 70%.

- Daily penalties apply for missed payments.

11. Madaloan (High Loan Amount, Low Interest, Fast Disbursement)

Madaloan is a quick cash loan app that offers borrowers the ability to borrow up to PHP 20,000 without requiring credit checks. The app stands out with its low-interest rate of 0.08%, making it an appealing option for individuals seeking affordable financing solutions. Madaloan also provides multiple repayment options, including payment at 7-11, MLhuillier, RD Pawnshop, TrueMoney centers, and Palawan Pawnshop branches.

Pros:

- High loan amount accommodates substantial financial needs.

- Low-interest rate reduces the overall cost of borrowing.

- Fast approval and disbursement ensure that borrowers access funds promptly.

- Multiple repayment channels provide convenience to borrowers.

- No credit checks required, increasing accessibility for applicants.

Cons:

- Some users have reported difficulties with the application process.

- Late payment penalties apply.

- Limited loan duration may impact the repayment schedule for some borrowers.

12. Uploan (Longer Payment Terms, Low-Interest Rates, Personalized Service)

Uploan caters to borrowers seeking long-term loans with extended payment terms. The app provides loans ranging from PHP 10,000 to PHP 100,000, with repayment periods spanning 3 to 24 months. Uploan stands out with its low-interest rates and a commitment to offering personalized service to borrowers. Additionally, Uploan provides financial wellness programs to assist borrowers in managing their finances effectively.

Pros:

- Longer repayment terms provide flexibility to borrowers.

- Low-interest rates reduce the overall cost of borrowing.

- High loan amounts are suitable for individuals with substantial financial needs.

- Personalized service and financial wellness programs enhance the borrower experience.

- Compliant with regulatory bodies such as BSP and SEC, ensuring a secure lending environment.

Cons:

- The application process may be more extensive compared to other quick cash loan apps.

- Requirements include a government-issued ID, proof of address, and proof of income.

- The app may impose penalties for late payments.

13. LoanChamp (No Collateral, Low-Interest Rates, High Loan Amounts)

LoanChamp positions itself as a trusted quick cash loan app offering no-collateral loans with low-interest rates. The app provides loan amounts ranging from PHP 5,000 to PHP 30,000, with repayment terms spanning 3 to 6 months. LoanChamp is known for its simple application process and transparent fee structure, making it an accessible option for many Filipinos.

Pros:

- No collateral required, simplifying the borrowing process.

- Low-interest rates reduce the overall cost of borrowing.

- High loan amounts accommodate various financial needs.

- Fast approval and disbursement ensure that borrowers receive funds promptly.

- Transparent fee structure adds clarity to the borrowing process.

Cons:

- Some users have reported delays in loan approval.

- Late payment penalties apply.

- The app may require borrowers to provide additional documentation.

14. Lendpinoy (No Collateral, High Approval Rate, Low-Interest Rates)

Lendpinoy stands out as a quick cash loan app that prioritizes accessibility and a high loan approval rate. The app offers no-collateral loans ranging from PHP 2,000 to PHP 20,000, with repayment terms of up to 180 days. Lendpinoy emphasizes its low-interest rates and efficient loan approval process, making it an attractive choice for individuals in need of quick financial assistance.

Pros:

- No collateral needed, simplifying the borrowing process.

- High loan approval rate increases the chances of securing funds.

- Low-interest rates reduce the overall cost of borrowing.

- Multiple repayment channels provide convenience for borrowers.

- Loan application and approval can be completed entirely online.

Cons:

- Some users have reported issues with delayed disbursements.

- Reports of borrowers experiencing challenges with customer support.

- Late payment penalties apply.

15. Tala Philippines (Instant Approval, High Loan Amount, No Collateral)

Tala Philippines is a quick cash loan app designed for those who need instant financial assistance. With Tala, borrowers can access loan amounts of up to PHP 10,000, with repayment terms ranging from 21 to 30 days. Tala boasts instant approval and disbursement, allowing borrowers to address their urgent financial needs promptly. Additionally, Tala offers financial education resources to help borrowers make informed financial decisions.

Pros:

- High loan amounts accommodate various financial needs.

- Instant approval and disbursement ensure that funds are readily available to borrowers.

- No collateral required, simplifying the borrowing process.

- Financial education resources empower borrowers to manage their finances effectively.

- The app has a user-friendly interface that makes it accessible to a wide range of users.

Cons:

- The short loan duration may pose challenges for some borrowers.

- High-interest rates may impact the overall cost of borrowing.

- Borrowers should exercise caution to avoid excessive debt.

Conclusion

Quick cash loan apps have revolutionized the lending landscape in the Philippines, offering accessible and efficient solutions for individuals facing financial challenges. Each of the 15 best quick cash loan apps mentioned in this comprehensive review has its unique features and advantages, catering to a diverse range of borrower needs. When selecting a loan app, it’s essential to consider factors such as loan amount, interest rates, repayment terms, and eligibility requirements.

Before applying for a loan, carefully review the terms and conditions of the loan app to ensure that it aligns with your financial situation and goals. Additionally, exercise responsible borrowing practices by borrowing only what you need and committing to timely repayments to avoid incurring unnecessary fees and penalties.

In the ever-evolving world of fintech, quick cash loan apps continue to adapt and enhance their offerings, providing Filipinos with valuable financial resources. While these apps can be powerful tools for addressing short-term financial needs, they should be used responsibly as part of a broader financial strategy.

Remember that financial literacy is key to making informed financial decisions. Consider taking advantage of the financial education resources offered by some of these apps to improve your understanding of personal finance and money management. With the right knowledge and responsible borrowing habits, quick cash loan apps can be valuable tools on your journey toward financial stability and prosperity in 2026 and beyond.