Online loans have become increasingly popular due to their fast disbursement time, simple process, and lack of collateral requirements. Online loan applications allow borrowers to quickly obtain the funds they need, often within 24 hours of approval. However, to ensure a successful online loan experience, borrowers must meet certain criteria and carefully read and understand the terms of the loan agreement.

To begin with, borrowers need to understand the true nature of online loan applications. Online loans are a type of borrowing activity that takes place between borrowers and lenders on platforms such as websites and loan applications. The application process is typically completed within one to two days, and the requested funds are directly disbursed into the borrower’s bank account. Online loans offer many advantages over conventional loans, including a simple process, no collateral requirements, and fast disbursement times.

However, borrowers must also consider several factors before obtaining an online loan. For example, they should carefully read the terms of the loan agreement to ensure they fully understand the interest rate, monthly term, and repayment terms. They should also contact consultants if they have any questions or concerns about the policy of the lender. Additionally, borrowers should provide correct personal information on the application to ensure a smooth and timely disbursement process.

To qualify for an online loan, borrowers must meet certain criteria. They must be of legal age (between 22 and 60 years old) and have full civil act capacity. They must also have at least one personal account or e-wallet to receive the loan and possess identification papers such as a citizen ID card or passport to verify their identity.

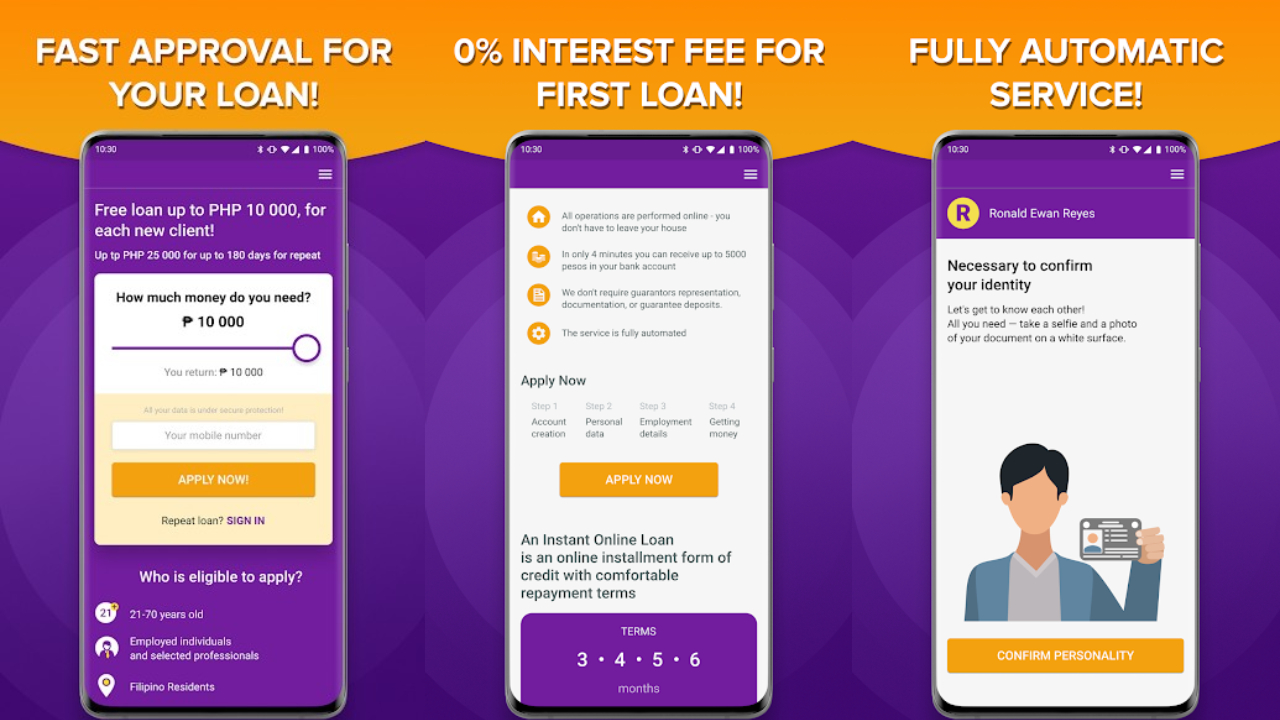

One of the most popular online loan applications is Digido. With its fast disbursement time, simple completion procedures, and dedicated team of consultants, Digido is suitable for all customers who want to experience fast online loan service. Digido also offers incentives for first-time users, such as preferential interest rates of 0% for the first loan.

In summary, online loan applications are a convenient and fast way to obtain funds for borrowers in need. However, borrowers must carefully read and understand the terms of the loan agreement, provide correct personal information, and meet certain criteria to ensure a successful online loan experience. With its many advantages, Digido is an excellent option for customers seeking a reliable and efficient online loan application.