The way Filipinos manage their money has evolved dramatically. Long gone are the days when opening a bank account meant waiting in line at a branch. With just a few taps on a smartphone, anyone can now save, invest, transfer, and borrow money – anytime, anywhere.

If you’re searching for a modern, hassle-free way to grow and protect your finances, this comprehensive guide will introduce you to the digital banks operating in the Philippines in 2025. You’ll also discover their top features, compare your options, and learn how to choose the right one based on your needs.

What Are Digital Banks?

Digital banks are fully licensed financial institutions that operate almost exclusively online, without traditional brick-and-mortar branches. They offer essential banking services – from savings and checking accounts to loans and payment solutions – through mobile apps or websites.

The primary advantage of digital banks is convenience. You can open an account in minutes, manage your savings, send money, pay bills, or apply for loans – all from the comfort of your home, with no paperwork or in-person appointments required.

How the Bangko Sentral ng Pilipinas (BSP) Regulates Digital Banks

The Bangko Sentral ng Pilipinas (BSP) plays a vital role in ensuring digital banks operate securely and responsibly. In 2021, the BSP issued regulations specifically for digital banks, requiring them to maintain robust cybersecurity, conduct regular audits, and meet strict capitalization requirements.

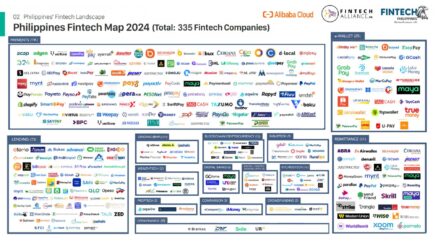

In August 2024, after a temporary moratorium, the BSP allowed the establishment of new digital banks, increasing the number permitted to operate to 10 starting in 2025. This move aims to boost competition, promote financial inclusion, and encourage innovation in the banking sector.

How Many Digital Banks Are There in the Philippines in 2025?

As of 2025, six digital banks are fully licensed and operational in the Philippines:

- Maya Bank

- Overseas Filipino Bank

- Tonik Digital Bank

- GoTyme Bank

- UnionDigital Bank

- UNOBank

With the BSP opening the doors to more digital banks, expect this list to grow soon.

List of Digital Banks in the Philippines (2025) and Their Top Features

1. GoTyme Bank

Best for: Everyday Banking and Rewards

GoTyme Bank is the result of a powerful partnership between Tyme (a South African fintech) and the Gokongwei Group (owners of Robinsons Bank and Robinsons Retail Holdings).

Through this collaboration, GoTyme offers a robust and secure banking experience designed for Filipino consumers.

Key Features:

- “Pay One, Free One” Transfers: For every PHP 8 you pay for a transfer, the next transfer is free.

- Free GoTyme-to-GoTyme Transfers: Instantly send money to fellow GoTyme users without fees.

- Shopping Rewards: Earn up to 3x Go Rewards points when using the GoTyme Visa debit card at partner merchants.

- High Savings Rates: Earn 4% p.a. interest on Go Save accounts, with customizable savings goals and timelines.

GoTyme aims to reach 9 million customers in 2025 by expanding services like Buy Now Pay Later (BNPL) and crypto solutions.

2. Maya Bank

Best for: MSMEs and Entrepreneurs

Built by Voyager Innovations, Maya Bank is designed to serve both individual consumers and micro, small, and medium enterprises (MSMEs).

Key Features:

- Savings and Time Deposits: Competitive rates for both retail and business accounts.

- Flexible Credit Options: Access to personal loans, flexi loans, and a Maya Credit line.

- Business Tools: Payment links, e-commerce integrations like Shopify plugins, and Maya Terminals for physical stores.

Maya Bank stands out for seamlessly integrating business banking services with personal finance solutions.

3. Overseas Filipino Bank (OFBank)

Best for: Overseas Filipinos and OFWs

A subsidiary of LANDBANK, Overseas Filipino Bank is tailored to meet the unique needs of Filipinos abroad.

Key Features:

- Visa Debit Card with Remittance Services: Send money quickly via Visa Direct partnerships.

- Mobile Banking App: Easy access to deposits, loans, remittance, and investment options.

- Government-Backed: Proudly known as the first digital-only government bank in the Philippines.

OFBank helps OFWs manage their finances remotely with maximum security and minimal hassle.

4. Tonik Digital Bank

Best for: High-Interest Savings

Tonik is a neobank backed by Singapore’s Tonik Financial Pte Ltd, with local ownership complying with Philippine banking laws.

Key Features:

- Flexible Savings: Tonik Account and Stashes for specific savings goals like emergencies, tuition, or vacations.

- Group Stashes: Save together with friends or family and earn up to 4.5% p.a. interest.

- High-Yield Time Deposits: Earn up to 6% p.a. on fixed-term deposits – among the highest in the market.

Tonik is ideal if you want to maximize your savings with minimal effort.

5. UnionDigital Bank

Best for: Free Transfers and Tiered Savings Rates

UnionDigital is the digital arm of UnionBank of the Philippines, a trusted and established name in local banking.

Key Features:

- Free Transfers: Internal transfers and PESONet transfers to other banks and e-wallets are free. InstaPay transfers cost PHP 10.

- Tiered Interest Rates:

- Balances below PHP 5 million earn 3% p.a.

- Balances of PHP 5 million and above earn 4% p.a.

- Cash Loans and Time Deposits: Available for retail customers.

UnionDigital Bank is a solid choice for individuals seeking no-fuss digital banking with reliable services.

6. UNOBank

Best for: Banking + Insurance Protection

Owned by Singapore-based UNOAsia Pte Ltd, UNOBank combines traditional banking with innovative insurance offerings.

Key Features:

- Savings, Loans, and Time Deposits: Competitive products for individual needs.

- UNO X Singlife Partnership: Offers insurance plans covering medical emergencies, COVID-19, dengue, accidents, and income loss.

UNOBank caters to customers who value a one-stop shop for savings, credit, and insurance protection.

How to Choose the Best Digital Bank for Your Needs

When selecting a digital bank, keep these important factors in mind:

- Security: Choose only BSP-licensed banks with strong security protocols like multi-factor authentication (MFA).

- Interest Rates: Look for high savings rates and low loan rates.

- Ease of Use: A user-friendly mobile app with intuitive navigation is crucial.

- Integration with e-Wallets: Ensure seamless transfers to and from popular e-wallets like GCash, Maya, or GrabPay.

- Customer Service: Check online reviews to see how responsive their customer support teams are.

- Special Features: Consider perks like cashback rewards, flexible credit lines, or business solutions.

Comparing Digital Banks in the Philippines (2025)

| Bank | Ownership | Target Customers | Key Services |

|---|---|---|---|

| Maya Bank | Voyager Innovations | Retail and MSMEs | Savings, loans, business tools |

| Overseas Filipino Bank | LANDBANK | OFWs and Overseas Filipinos | Remittance, loans, investments |

| GoTyme Bank | Tyme and Gokongwei Group | Retail shoppers | Everyday banking, rewards |

| UnionDigital Bank | UnionBank of the Philippines | Retail customers | Free transfers, savings |

| Tonik Digital Bank | Tonik Financial Pte Ltd | Retail customers | High-yield savings |

| UNOBank | UNOAsia Pte Ltd | Retail customers | Banking + Insurance |

What’s Next for Digital Banking in the Philippines?

The digital banking landscape is on the cusp of massive transformation:

- New Entrants: With the BSP lifting restrictions, expect new players – including Islamic digital banks from Malaysia – to join the market.

- AI-Driven Services: Personalized financial advice, automated savings, and spending insights powered by artificial intelligence are set to become standard.

- Embedded Finance: Banking services will continue integrating into everyday platforms like shopping apps and ride-hailing services.

- Stronger Cybersecurity: As banking becomes more digital, expect banks to strengthen security systems to prevent fraud and cyberattacks.

Digital banking is becoming smarter, safer, and more seamlessly integrated into daily life.

Frequently Asked Questions (FAQs)

Are digital banks safe to use?

Yes. All BSP-licensed digital banks must follow stringent regulations, including cybersecurity protocols and fraud protection measures.

How do I open a digital bank account?

Simply download the bank’s app, submit a valid ID, complete the Know Your Customer (KYC) process, and fund your account.

Can I deposit cash into a digital bank?

Many digital banks partner with cash-in centers like 7-Eleven, GCash, or bank affiliates for over-the-counter cash deposits.

Which digital bank has the highest interest rate?

As of 2025, Tonik Digital Bank offers one of the highest rates, with up to 6% p.a. on time deposits.