In the quest for quick financial assistance, individuals often find themselves navigating the labyrinth of traditional bank loans, facing hurdles such as collateral requirements and extended approval processes. However, the financial landscape in the Philippines is evolving, with the emergence of lending companies offering non-collateral loans, notably unsecured loans. In this article, CashLoanPH will delves into the benefits of unsecured loans, with a spotlight on Digido, a prominent player in the Philippines’ financial sector.

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 20,000Approval in

5 minutesFirst loan free

no

Loan type

Long termFor a period of

4 monthsRate (PSK)

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 50,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

noWho Qualifies for a Digido Loan?

To unlock the benefits of Digido’s unsecured loans, prospective borrowers need to meet specific criteria:

- Age: Between 21 and 70 years old

- Citizenship: Filipino

- Identification: Possession of a valid government ID

Unpacking Personal Loans Without Collateral

Exploring Types of Non-Collateral Loans

Unsecured loans manifest in various forms, catering to diverse financial needs:

- Personal Loans: Versatile loans for legitimate purposes such as debt consolidation, vacations, or unexpected expenses.

- Credit Cards: A predominant form of unsecured credit, evaluating credit scores and household income for favorable interest rates.

- Student Loans: Tailored to support post-secondary education expenses.

- Payday Loans: Short-term, high-interest solutions designed for emergency expenses.

Features of No-Collateral Loans: A Comparative Analysis

Secured Loans:

- Require collateral (e.g., car, house)

- Typically boast lower interest rates

- Loan amount correlates with the value of collateral

- Defaulting may result in collateral loss

- Suited for larger loan amounts

- Approval process extended due to asset evaluation

- Often accessible to those with lower credit scores

Unsecured Loans:

- No collateral required

- Generally entail higher interest rates due to increased risk

- Loan amount determined by creditworthiness and income

- Default impacts credit score but spares assets

- Ideal for smaller, short-term financial needs

- Expedited approval process with no asset valuation

- Typically require a good credit score for approval

Where to Attain a Quick Cash Loan Without Collateral?

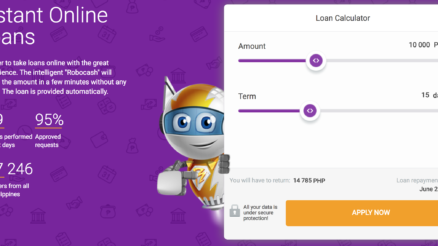

While numerous financial institutions extend quick loans, the convenience and speed offered by online loan companies, such as Digido, stand out. In the Philippines, Digido is gaining traction due to its minimal requirements and a user-friendly platform.

The Distinctive Benefits of Digido Non-Collateral Loans

- Easy and Favorable Conditions: Digido eliminates the need for guarantors or collateral, making credit history less of a barrier. The processing time averages between 10-30 minutes, ensuring swift results.

- Minimal Documentation: Simplifying the application process, Digido requires only a single government-issued document.

- Convenient Online Application: Borrowers can apply from the comfort of their homes, bypassing the hassle of physical visits. The streamlined process facilitates funds directly to cards, e-wallets, or remittance centers.

- Low Interest Rate: Digido boasts competitive interest rates, dependent on the loan amount and duration. Notably, first-time borrowers enjoy a 0% interest rate on loans up to ₱10,000.

Navigating the Application Process for No-Collateral Loans

At Digido, obtaining a no-collateral loan is accessible and straightforward. Eligible individuals, including those aged 21 to 70, employed professionals, and Filipino residents, can complete the entire process online, ensuring efficiency and convenience. The only requirement is a single government-issued ID.

Digido’s Loan Range and Application Process in Detail

Digido extends non-collateral loans ranging from ₱1,000 to ₱25,000 PHP. First-time borrowers can secure up to ₱10,000, with the credit limit increasing upon timely repayment. The approval process, averaging 10 minutes, includes a thorough check of claimed data and credit history, even accommodating clients with credit history errors.

The Streamlined 4-Step Process to Obtain a Loan Without Collateral in 30 Minutes

- Initiate the Process: Click “Apply Now” on Digido’s official website or use the mobile app to input your desired loan amount and phone number.

- SMS Verification: Await an SMS confirmation to proceed with registration and create a personal account securely.

- Submit Essential Details: Navigate to the designated online section, upload a valid ID, and provide necessary personal details. Ensure all fields are filled accurately.

- Get Your Money: Upon approval (typically within 30 minutes), confirm the online contract with an electronic signature. The loan amount will be disbursed through the borrower’s preferred method, whether a bank account, e-wallet, or remittance center.

The Dynamics of No-Collateral Loans: Pros and Cons

Pros

- Asset Safety: Without collateral, there’s no risk of losing personal items or property if repayment becomes challenging.

- Speedy Fund Access: The absence of asset evaluations often leads to swift approval, making these loans suitable for urgent needs.

- Zero Initial Payments: Borrowers can secure these loans without upfront fees or down payments, easing the initial financial burden.

- Flexible Borrowing Limits: Ideal for those needing specific amounts without the temptation of over-borrowing.

Cons

- Tougher Approval Criteria: Lenders scrutinize creditworthiness more closely, posing challenges for some applicants.

- Elevated Interest Charges: Due to higher risk, these loans may incur steeper interest rates.

- Capped Borrowing: The available borrowing amounts might be limited, particularly for those with less-than-stellar credit scores.

- Brief Repayment Windows: Repayment periods can be shorter, potentially straining some borrowers’ finances.

Evaluating Unsecured Loan Applications: Key Considerations for Lenders

When evaluating unsecured loan applications, lenders consider several key factors to gauge creditworthiness and repayment ability. These factors include credit history, credit score, income and employment stability, debt-to-income ratio, loan purpose, residential status, and personal details.

Options for Securing No-Collateral Loans

A plethora of financial institutions and platforms offer unsecured loans with distinct terms and benefits. The following table presents some of the prominent players in the market, showcasing their maximum loan amounts and interest rates:

| Bank/Institution | Max Loan Amount (PHP) | Interest Rate |

|---|---|---|

| Metrobank Personal Loan | 1,000,000 | 1.25%-1.75% |

| UnionBank Personal Loan | 2,000,000 | 1.29% |

| BPI Personal Loan | 2,000,000 | 1.20% |

| Radiowealth Finance Corp. Loan | 150,000 | 4% |

| Maybank Personal Loan | 1,000,000 | 1.3% |

| Tonik Flex Loan | 250,000 | 2.49% |

| CIMB Personal Loan | 1,000,000 | 1.12%-1.95% |

| SB Finance Personal Loan | 2,000,000 | 1.89% |

| DIGIDO Philippines | 25,000 | 1.5% |

| Tala Quick Cash Loan | 25,000 | 0.5% daily |

| BlendPH Loans | 2,000,000 | 1%-8% |

| Asteria Lending, Inc. Loans | 20,000 (returning) | 0.9% daily |

Note: The information in the table is subject to change, and borrowers are advised to contact their chosen financial entity directly for updated information.

Preparing for a No-Collateral Loan in the Philippines: Expert Advice

Before diving into the realm of no-collateral loans, consider the following seven pieces of advice to make informed decisions:

- Research the Lender: Ensure the lender is reputable and licensed by relevant financial authorities in the Philippines. Seek reviews and testimonials from previous borrowers.

- Understand the Terms: Thoroughly read the loan agreement, focusing on interest rates, fees, and repayment terms. Look out for hidden charges or unfavorable clauses.

- Assess Repayment Capacity: Before borrowing, evaluate your financial situation. Ensure you can comfortably repay the loan within the stipulated period without straining your finances.

- Avoid Multiple Loans: Taking out multiple loans simultaneously can lead to a debt spiral. Clear existing debts before considering a new loan.

- Use the Loan Purposefully: Allocate the borrowed funds for their intended purpose, whether medical emergencies, education, or other pressing needs. Avoid non-essential expenses.

- Know Your Rights: Familiarize yourself with borrower rights in the Philippines. This knowledge empowers you in case of disputes or misunderstandings with the lender.

- Plan for Repayment: Allocate a portion of your income or savings specifically for loan repayment. Consider setting up automatic deductions or reminders to ensure timely payments and avoid penalties.

Conclusion: The Unmatched Appeal of No-Collateral Loans

In conclusion, no-collateral loans represent a revolutionary financial solution for those in immediate need, eliminating the stress associated with pledging assets. Digido, with its transparent terms and rapid approvals, emerges as a trustworthy option for Filipinos seeking unsecured loans. Approaching these loans with a clear understanding of terms and a robust repayment plan is paramount. For those contemplating where to borrow money without collateral, Digido stands out as a reliable and accessible choice, reshaping the landscape of financial assistance in the Philippines.

![Top 200 Free Finance Apps in Philippines [Latest Update] Top 200 Free Finance Apps in Philippines [Latest Update]](https://cashloanph.com/wp-content/uploads/2023/05/finance-apps-in-philippines-cashloanph-438x246.jpg)