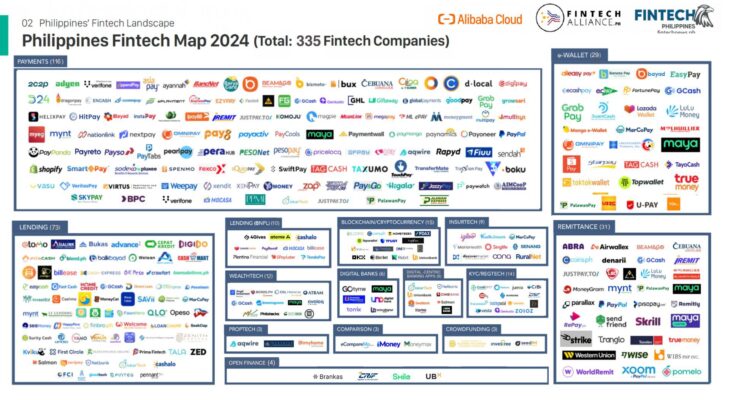

The e-Wallet sector in the Philippines has seen tremendous growth in recent years, driven by the increasing adoption of digital payments and financial technology. With a large population of tech-savvy consumers and a significant percentage of unbanked individuals, e-Wallets provide accessible and convenient financial services. Below is a detailed list of 29 prominent e-Wallet companies operating in the Philippines, showcasing their features, services, and unique selling propositions.

Top 29 e-Wallet Companies in the Philippines

| No. | Company Name | Description |

|---|---|---|

| 1 | GCash | One of the leading e-wallets in the Philippines, GCash allows users to pay bills, transfer money, and make purchases online. It also offers savings accounts and loans. |

| 2 | PayMaya | A digital wallet that enables users to shop online, pay bills, and send money to anyone with a mobile number. PayMaya also offers a physical card for offline purchases. |

| 3 | Coins.ph | A mobile wallet that provides services like cryptocurrency trading, bill payments, and remittances. It aims to provide financial inclusion to the unbanked population. |

| 4 | GrabPay | Integrated within the Grab app, GrabPay allows users to pay for rides, food deliveries, and bills while offering cashback rewards for transactions. |

| 5 | ShopeePay | A feature of the Shopee e-commerce platform, ShopeePay facilitates secure payments for online purchases and allows users to pay bills and send money. |

| 6 | Zalora Wallet | A digital wallet integrated with the Zalora shopping app, offering users secure payment options for online fashion purchases and cashback rewards. |

| 7 | Alipay | Originally a Chinese payment platform, Alipay allows users to make transactions in local currencies and pay for goods and services in the Philippines. |

| 8 | Lazada Wallet | Part of the Lazada e-commerce platform, it provides users with a secure payment option for shopping, along with promotional discounts and cashback offers. |

| 9 | Bank of the Philippine Islands (BPI) Online | BPI offers an e-Wallet service through its online banking platform, allowing users to transfer funds, pay bills, and shop online securely. |

| 10 | UnionBank Online | UnionBank’s digital wallet enables users to send money, pay bills, and manage their finances through a user-friendly mobile app. |

| 11 | RCBC DiskarTech | A mobile banking app that includes an e-wallet feature, providing users with savings accounts, loan options, and financial management tools. |

| 12 | EastWest Mobile Banking | Offers an e-wallet service allowing users to manage their accounts, pay bills, and transfer money conveniently through their smartphones. |

| 13 | CIMB Bank | A digital bank that offers an e-wallet service, allowing users to save money, invest, and transfer funds without any fees. |

| 14 | HelloMoney | A digital wallet and micro-lending platform that provides users with easy access to loans and allows for cashless transactions. |

| 15 | M Lhuillier | A financial service provider that offers a digital wallet for sending money, paying bills, and receiving remittances. |

| 16 | Smart Padala | A remittance and e-wallet service that allows users to send and receive money quickly, with a wide network of partners. |

| 17 | Salarium | A payroll solution that includes an e-wallet feature for employees, enabling them to receive salaries, bonuses, and incentives digitally. |

| 18 | Pera Hub | An e-wallet service providing a platform for money transfers, bill payments, and online shopping, targeted at the unbanked population. |

| 19 | eSkwela | A digital wallet designed for educational purposes, allowing students and parents to pay tuition fees and other school-related expenses online. |

| 20 | Petron Value Card | An e-wallet service linked to the Petron loyalty program, enabling customers to earn rewards and pay for fuel and other purchases. |

| 21 | Cebuana Lhuillier | A comprehensive financial services provider offering a digital wallet for remittances, bill payments, and other transactions. |

| 22 | BDO Digital Banking | BDO’s digital banking platform includes an e-wallet feature for fund transfers, bill payments, and online shopping. |

| 23 | OneMoney | A mobile wallet that allows users to manage their money, pay bills, and transfer funds easily and securely. |

| 24 | Kumu Wallet | Integrated within the Kumu app, it allows users to send money, buy gifts, and donate to content creators. |

| 25 | OPay | An online payment platform that enables users to make transactions, pay bills, and purchase mobile load easily. |

| 26 | PayMongo | A payment processing platform that offers e-wallet features for merchants, allowing businesses to accept online payments seamlessly. |

| 27 | SpeedyPay | A digital wallet that provides quick payment solutions for bills, online shopping, and money transfers. |

| 28 | ePayment Solutions | A comprehensive e-wallet service that offers users the ability to send money, pay bills, and shop online securely. |

| 29 | BPI Family Savings Bank Online | An online platform that includes an e-wallet service for users to transfer funds, pay bills, and manage their finances conveniently. |

Conclusion

The e-Wallet sector in the Philippines is rapidly evolving, with numerous players providing innovative solutions for consumers and businesses alike. As digital payments become more mainstream, these e-Wallets are poised to play a crucial role in promoting financial inclusion and convenience in everyday transactions. Each company listed offers unique features and services, catering to a diverse range of user needs and preferences, further driving the growth of digital finance in the country.

With advancements in technology and increasing smartphone penetration, the future of e-Wallets in the Philippines looks promising, opening doors to more financial opportunities and services for both urban and rural populations.