Prima Loan provides a seamless and quick online lending solution tailored for individuals in the Philippines. Their platform offers personal installment loans designed to assist those in need of emergency funds. Officially registered as Prima Fintech (Philippines) Lending Corporation, they operate with full adherence to the lending regulations in the country. Prima Loan’s legitimacy is backed by its registration with the Securities and Exchange Commission (SEC) under Registration No. CS201951100, ensuring transparency and legal compliance.

What is Prima Loan – Online Peso Lending?

Prima Loan, under the corporate name Prima Fintech (Philippines) Lending Corporation, is a licensed and reliable lender in the Philippines. The company operates in full compliance with local policies, regulations, and lending rules, providing financial assistance to individuals facing urgent monetary needs.

Company Details:

- Legal Corporate Name: Prima Fintech (Philippines) Lending Corporation

- Registered Business Name: Prima Loan

- SEC Registration Number: CS201951100

- Certificate of Authority (CA): No. 2917

Quick, Secure, and Easy Online Lending

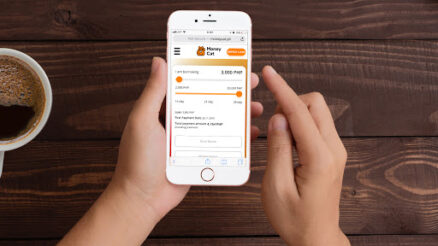

Prima Loan offers a convenient online platform for applying for personal peso cash loans with easy-to-follow steps. The process is designed to be fully digital, secure, and hassle-free. Whether for bills, medical emergencies, or unexpected costs, they provide emergency funding with minimal paperwork.

How to Apply for a Peso Cash Loan Online?

Applying for a loan through Prima Loan is quick and straightforward. Here’s how:

- Download the Prima Loan App on your smartphone.

- Select your desired loan limit.

- Fill out the application form in just 5 minutes.

- Wait for an SMS confirmation regarding your loan approval.

- Receive ₱1,000 directly into your bank account or e-wallet (GCash, PayMaya, or GrabPay) as a first-time applicant.

Key Advantages of Prima Loan

- Low Interest Rate: Enjoy a very competitive 0.095% interest rate for new applicants.

- No Collateral: Apply for unsecured loans, with no collateral required.

- No Office Visits: The entire process is online, eliminating the need for physical office visits.

- No Hidden Fees: First-time applicants incur no additional fees apart from the loan amount.

- Fast Disbursement: Receive your loan within 5 minutes of approval.

- Growing Credit Limit: With responsible borrowing, the credit limit can grow from ₱1,000 to ₱15,000 over time.

Who Can Apply for a Peso Cash Loan?

Prima Loan is open to any Filipino citizen who meets the following criteria:

- Age: At least 18 years old.

- Identification: Have at least one government-issued ID card.

- Employment: Employed or self-employed individuals.

Loan Requirements

To apply for a loan, you will need:

- One valid ID from the following options: Driver’s License, GSIS, SSS, TIN, Passport, PRC, UMID, Postal ID, PhilHealth ID, Voter ID, or PhilSys ID.

- A smartphone to access the application.

- A bank account or e-wallet (GCash, PayMaya, or GrabPay) for the loan disbursement.

Common Loan Purposes

Prima Loan is designed to cover a wide variety of personal needs, including:

- Utility bills

- Medical expenses

- Bike or vehicle repairs

- Gift purchases

- Emergency situations

- Leisure or personal spending

How to Receive Your Loan

Once approved, the loan will be deposited directly into your bank account or e-wallet (such as GCash, PayMaya, or GrabPay), ensuring quick access to your funds.

Loan Limits and Terms

- Initial Loan Limit: First-time applicants can borrow up to ₱1,000.

- Maximum Loan Limit: Repeat borrowers with a good credit record can access up to ₱15,000.

- Loan Term: Loan terms range from 91 days (3 months) to 365 days, depending on the applicant’s preference and loan renewal options.

- APR: The maximum Annual Percentage Rate (APR) is 34.67%.

Sample Loan Repayment Calculation

For a loan of ₱1,000 over 91 days at an interest rate of 34.67%:

- Total Interest: ₱1,000 * (34.67% / 365 * 91) = ₱86.45

- Total Repayment: ₱1,000 + ₱86.45 = ₱1,086.45

- Monthly Repayment: ₱1,086.45 / 3 months = ₱362.15

Privacy and Permissions

Prima Loan values user privacy and ensures that all personal information is handled securely. Government-issued IDs and other data will be scanned for identity verification and credit profile assessment. Rest assured, personal details will not be shared without the applicant’s direct consent.

Contact Information

For any queries regarding loans, applicants can reach Prima Loan through the following channels:

- Email: [email protected]

- Website: www.primaloanplus.com

- Operating Hours: Monday to Saturday, 8:30 AM – 5:30 PM

- Office Address: 1 Jade Drive Ortigas Center, San Antonio, Pasig, Metro Manila, Philippines

Conclusion

Prima Loan is a trustworthy and legally registered lending platform that offers fast and easy access to online peso cash loans for emergency situations. With simple application steps, low interest rates, and rapid disbursement, Prima Loan provides the financial assistance that Filipinos need to handle life’s unexpected challenges.