The future of finance in the Philippines is poised for a bright and promising outlook. As the economy continues to grow and evolve, there is an increasing demand for financial products and services that can cater to the diverse needs of Filipinos. With continued innovation and development, the financial sector has the potential to play a pivotal role in helping individuals and businesses achieve their financial goals.

The Growing Economy

One of the key factors contributing to the bright future of finance in the Philippines is the country’s growing economy. Over the years, the Philippines has experienced steady economic growth, driven by factors such as a young and dynamic workforce, a strong consumer market, and a thriving business environment.

This economic growth has resulted in an expanding middle class, with more Filipinos having disposable income to invest and save. As a result, there is a growing demand for financial products and services that can help individuals manage their wealth, plan for retirement, and secure their financial future.

Financial Inclusion

Another important aspect of the future of finance in the Philippines is the focus on financial inclusion. The government and financial institutions are working together to ensure that all Filipinos have access to affordable and convenient financial services.

Through initiatives such as the National Strategy for Financial Inclusion (NSFI), efforts are being made to improve financial literacy, expand the reach of banking services, and promote the use of digital payment systems. These initiatives aim to empower individuals, especially those in underserved areas, to participate in the formal financial system and benefit from its advantages.

Technological Advancements

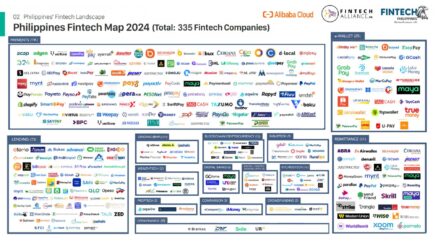

Technological advancements are also set to shape the future of finance in the Philippines. With the rise of fintech companies and the increasing adoption of digital banking services, Filipinos now have access to a wide range of innovative financial solutions.

Mobile banking, for instance, has gained significant traction in the country, allowing individuals to conveniently manage their accounts, transfer funds, and make payments using their smartphones. This accessibility and convenience have the potential to revolutionize the way Filipinos interact with their finances, making financial services more accessible and efficient for all.

Investment Opportunities

The future of finance in the Philippines also presents numerous investment opportunities. As the economy continues to grow, there is a need for investments in infrastructure, real estate, and other sectors. This opens up avenues for individuals and businesses to participate in the country’s development and potentially reap significant returns.

Additionally, the government has taken steps to attract foreign direct investment (FDI) by implementing policies that promote ease of doing business and provide incentives to investors. This creates a favorable investment climate and encourages both local and international investors to explore opportunities in the Philippines.

Role of Financial Education

As the future of finance in the Philippines unfolds, it is crucial to prioritize financial education. Improving financial literacy among Filipinos can empower individuals to make informed decisions about their finances, understand the risks and rewards of different financial products, and plan for their future.

Efforts should be made to integrate financial education into the school curriculum, provide accessible resources for adults, and promote awareness about the importance of financial planning. By equipping Filipinos with the necessary knowledge and skills, they can navigate the financial landscape with confidence and maximize the benefits offered by the evolving financial sector.

The Way Forward

The future of finance in the Philippines holds immense potential. With a growing economy, a focus on financial inclusion, technological advancements, investment opportunities, and an emphasis on financial education, the financial sector is well-positioned to support the financial goals of Filipinos.

However, it is essential to ensure that this growth is inclusive and sustainable. Collaboration between the government, financial institutions, and other stakeholders is crucial to address challenges, foster innovation, and create an environment that promotes financial stability and resilience.

By harnessing the opportunities presented by the future of finance, the Philippines can continue on its path towards economic prosperity and empower its citizens to achieve financial security and well-being.

![Legit Online Loans With Monthly Payments in the Philippines [New Updated] Legit Online Loans With Monthly Payments in the Philippines [New Updated]](https://cashloanph.com/wp-content/uploads/2023/06/online-loans-with-monthly-payments-philippines-cashloanph-438x246.jpg)