Accessing higher education in the Philippines can be a challenging journey – especially when financial resources are limited. 🎒📚 But the good news is: you don’t have to walk this path alone. A wide range of government-backed and private student loan options are available to help you or your loved ones achieve academic dreams without drowning in debt. 💪💰

Whether you’re aiming for a college degree, technical certification, or even graduate school, this comprehensive 2026 guide to student loans in the Philippines will walk you through the best programs, eligibility requirements, and how to apply – complete with expert tips and smart choices.

🇵🇭 Why Student Loans Matter in the Philippines

In a country where many families live paycheck to paycheck, the cost of tuition, books, and daily expenses can turn dreams into distant goals. But education remains one of the most powerful tools for social mobility in the Philippines.

🎯 Student loans are more than just money – they’re opportunities. These financing options bridge the gap between aspirations and reality, enabling thousands of students every year to step into classrooms and shape their future.

🛡️ Government-Backed Student Loans and Financial Assistance Programs

Government initiatives are often more affordable and accessible than private loans. Here’s a deep dive into each major program:

🎓 CHED StuFAPs and Scholarships

CHED (Commission on Higher Education) runs several scholarship and financial assistance programs designed for low-income families and deserving students.

⭐ Notable Programs:

- CHED Merit Scholarship Program (CMSP) – For high-performing students.

- Financial Assistance for Vulnerable Groups – Targets PWDs, solo parents, IPs, and senior citizens.

- Cash Grant to Medical Students (CGMS-SUCs) – For aspiring doctors in public medical schools.

- ESTATISTIKOLAR Program – For future statisticians.

- Stipendium Hungaricum – Offers a chance to study in Hungary 🇭🇺!

💰 Benefits:

- Tuition coverage up to ₱20,000 per year (private schools).

- Free tuition for State and Local Universities (SUCs/LUCs).

- Monthly stipend: ₱35,000–₱100,000 depending on the program.

- Book, internet, and transportation allowances.

📝 Eligibility:

- Filipino citizen

- GWA of 93%+ for merit programs

- Family income ≤ ₱400,000/year (with exceptions)

- Must enroll in CHED-approved priority courses

📂 Requirements:

- Birth certificate

- High school grades

- Income documents (ITR, Indigency Certificate)

- Valid certificates for special groups

📌 How to Apply:

- Watch for announcements via CHED regional offices or website.

- Submit documents via physical office or online if available.

- Processing takes ~40 days.

🛑 Pro Tip: Only trust official CHED sites to avoid scams!

📑 SSS Educational Assistance Loan Program (EALP)

SSS EALP helps members or their beneficiaries pursue college or vocational education with a loan that’s co-funded by the National Government.

👥 Who’s Eligible:

- SSS members earning ≤ ₱25,000/month

- 36 posted contributions, 6 within the last 12 months

- Beneficiaries: legal spouse, kids, siblings

💸 Loan Details:

- Up to ₱20,000 per term

- Max of ₱160,000–₱200,000 depending on the course

- 50/50 funding by NG and SSS

🕰️ Repayment:

- Starts 1.5 years after graduation

- Up to 5 years repayment term

🏥 Pag-IBIG HELPs

The Health and Education Loan Program (HELPs) offers funding for tuition and healthcare costs. Great for members with long-term Pag-IBIG contributions.

✅ Eligibility:

- Active Pag-IBIG member with 24 contributions

- At least one monthly contribution in the last 6 months

💰 Loan Amount:

- Up to 80% of total Pag-IBIG savings

- 10.5% interest/year

- No processing fees!

🧾 How to Apply:

- Get a billing statement from a HELPs-accredited school.

- Complete the application form.

- Submit to any Pag-IBIG branch.

⏳ Processing time: 3 business days.

🏛️ GSIS GFAL – Education Loan

If you’re a GSIS member, this long-term education loan is ideal for your children or dependents.

📌 Loan Features:

- Max ₱100,000/year, ₱500,000 total

- 8% interest/year

- 10-year repayment with a 5-year grace period

👨👩👦 Eligibility:

- 15+ years in service

- No pending cases or unpaid GSIS loans

- Student must not be a scholar under RA 10931

🧾 Apply via eGSISMO or email with tuition assessments and school ID.

🏫 Landbank I-STUDY Lending Program

Launched to support tuition fees during the pandemic, I-STUDY is still helpful for families with college-bound students.

💼 Target Borrowers:

- Parents/guardians of students

- School must be CHED/DepEd/TESDA recognized

💵 Loan Terms:

- Up to ₱150,000 per student

- Max ₱300,000 per borrower

- 5% annual interest

- 3-year repayment term (1-year grace period)

📝 Visit the nearest Landbank Lending Center for updates and application.

🏢 DBP ESKWELA Program (Education Finance Program)

Unlike other loans, DBP’s ESKWELA provides funding to schools, which then lend directly to students.

🏫 Eligible Institutions:

- LGUs, private/public schools, MFIs

- Must be CHED/DepEd/TESDA accredited

📚 For Students (via schools):

- Up to 90% of school costs (books, tuition, travel, etc.)

- Interest rates vary, with a 2% max spread added by institutions

- Loan terms up to 10 years

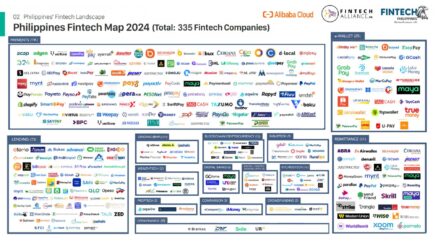

🏦 Private Student Loan Providers

💡 Bukas

Bukas is a popular education financing platform trusted by partner schools across the country.

⚙️ Features:

- Up to 100% tuition covered

- 3–12 months repayment

- Interest starts at 1.9%/month

- Online process – no need to visit offices

👨👩👧 Requirements:

- Filipino student and co-borrower

- Enrolled in a partner school

- Proof of enrollment, income, residence

💻 Application is done at app.bukas.ph

📱 Online Lending Apps (Digido, Maya, HoneyLoan)

Not true “student loans,” but some use them for educational costs.

⚠️ Pros:

- Fast approval (sometimes in minutes)

- Minimal paperwork

⚠️ Cons:

- High interest rates

- Short repayment terms

- Not ideal for long-term tuition planning

👀 Use with caution, and only if you have a solid repayment plan.

📊 What to Consider Before Applying

Here are essential factors to help you choose wisely:

📉 Interest Rate

Lower rates mean smaller repayments. Compare offers carefully.

🗓️ Repayment Terms

Longer terms = smaller monthly payments. Consider your future income.

🧾 Fees & Charges

Watch for service fees, penalties, and hidden charges.

🧠 Financial Literacy

Only borrow what you need, and make sure you understand repayment rules.

🎯 Final Thoughts

📚 Education should be a right, not a privilege. Thanks to these student loan programs – both public and private – Filipino learners now have more opportunities to reach their goals, regardless of financial background.

Always read the fine print, apply early, and ask questions. The future is bright, and it starts with a well-financed education! 🌟🇵🇭