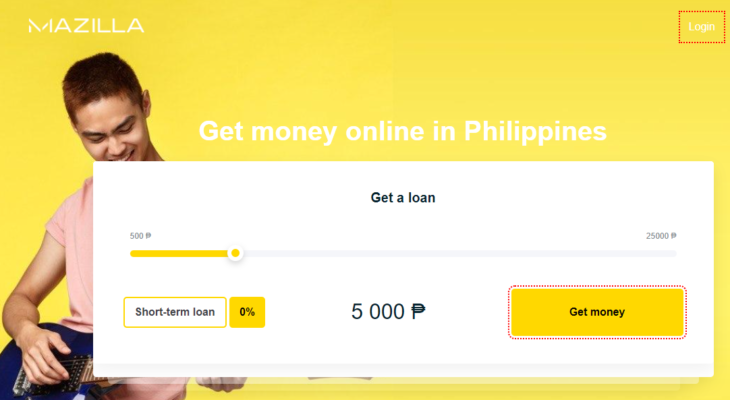

Mazilla Philippines · ₱25,000 maximum amount of loan · 91 – 2 years Maturity · Interest 30 % · 10 minutes Loan processing time.

| First loan | up to 10 000 PHP |

| Amount | 500 – 25 000 PHP |

| Age | 18+ |

| Term | 91 days – 2 years |

What is Mazilla Loan?

Mazilla PH is one of the members of the online lending industry in the Republic of the Philippines. This industry is developing rapidly, since various financial difficulties can affect everyone. Mazilla makes favorable loan offers to its customers.

The website has a convenient online calculator helping its customers to find favorable offers for calculating the amount and term of the loan. The convenience of our service is based on the fact that the method of receiving funds is diverse; it is possible to transfer funds to the bank card, bank account or e-wallet.

The process of submitting the loan application is as simple as possible and takes no more than 10 minutes. The customer does not need to collect any documents and attract guarantors or provide a surety. You can remotely (24/7) submit the application without visiting the office. At the same time, you do not have to make copies of documents and transfer them to someone else. All you need to do is provide the requested information.

The Mazilla PH Loan service will help you get money at your convenience, which significantly expands the scope of possibilities for solving financial and other problems. The period for the transfer of loan payments as well as the interest on the loan are as follows: the loan repayment period ranges from 91 days to 2 years, while the interest rate reaches 30% per annum (minimum) and 365% (maximum).

Contact Mazilla Service:

- Hotline: +44 (131) 608-05-01 (you cannot complete an application by calling this number)

- Email: [email protected]

Terms and Conditions for Submitting Application and Fees

- Initial registration: The registration process on our website takes no more than 10 minutes. In the questionnaire, you need to specify the data from your identity document, mobile phone number for the further confirmation (SMS), e-mail and details of your debit or credit card (MasterCard/VISA) issued by any bank registered in the Philippines.

- Service Fee: The service is absolutely free.

- Individual Offer: Each customer is offered with personalized recommendations. In this way, only the data obtained from open sources, which are then analyzed to assess the borrower’s solvency, may be used.

- Loan Repayment Period and Interest Rates: The minimum loan period is 91 days, and the maximum loan period is 2 years. The annual interest rate ranges from 30 to 365%.

Who is eligible to get a loan online from Mazilla PH?

- From 18 years old.

- The Philippines citizenship

- Have Bank card

- Have Mobile phone

How to Apply Mazilla Loan?

The application process has been made as simple as possible. It only takes a few minutes to complete. The customer does not have to assemble documents, involve guarantors, or present a surety. You do not have to come into the office to fill out an application. You can complete an application remotely via the Internet.

- Create an account: The first thing to do is to familiarize yourself with the service rules and submit an application. To do this, you must fill out your profile with your full name as well as information about your phone number and email address. You must choose your region and city of residence.

- Enter your Passport Number: Second. You will need to enter your own Passport Number. You must be very careful when filling out this information, since the submitted information must be accurate.

- Obtain a result: Third. Your data will be processed in real time so that we can present you with the most relevant loan offers.

Options for obtaining funds:

- By bank transfer

- Transfer to your wallet

- Transfer to your card

- In cash

- Transfer to your account

Tip 1: You must only enter truthful information in your profile. If you enter false information, then it is much more likely that your loan application will be rejected. Applicants are not only able to borrow money by providing reliable information about themselves, but they are also able to build a credit history about themselves this way.

Why Mazilla Online services are safe

The Mazilla online service, specializing in the choice of financial products, guarantees the confidentiality of the private data of its customers. The company provides borrowers with the secure channel for the communication with lenders, while protecting the personal data of the users from both the employees of the service and hackers.

Confidentiality

Your relatives and friends will not be aware of your loan application to the financial institution for the following reasons:

- When completing the personal online profile, the service does not require any documentary confirmation of the data entered (no income statements from the accounting department are needed, and there is no need to contact the HR department for a copy of the employment record book).

- The employees of the company will not contact any colleagues at work and family members trying to verify the accuracy of the data entered.

- There is no need to visit the bank or the lender’s office, since all applications are processed remotely.

- There is no need to contact the employees of the service by telephone. All negotiations are held using SMS messages or on the website in My Account.

You are given the opportunity to independently solve any financial problems, while not hiding anything from your environment. All you have to do is complete the online loan application at your convenience.

Legal compliance

Different banking institutions licensed to provide various financial services in the Philippines cooperate with Mazilla as lenders.

Their activities are legal. The service complies with all legal standards and requirements, while not violating any laws when processing, storing and transferring the personal data of its customers.

The IT activities of the resource are performed in accordance with the security requirements of banking institutions.

Security

All borrowers can complete the online loan application using their computers or smartphones. There is no need to personally deal with loan officers.

It is not required to provide any copies of the documents with the personal data of applicants, so there is no chance that such copies can be used by someone to commit any fraudulent activities. All customers should provide only reliable information.

How Is the Confidentiality of the Personal Data of the Customers Ensured in the Processing of Applications?

The employees of the service cannot view the entered personal data of borrowers. They are automatically encrypted and only then processed by loan officers. According to the information obtained from the customer, the relevant financial products may be chosen.

The scoring assessment (assessment of the customer’s ability to repay debts (in points from 0 to 400 performed considering credit histories and the credit rating of each customer) is performed.

The personal data about family, children, place of residence and salary are not available to the employees of the service and other unauthorized persons. It is guaranteed that no one will be able to use such data. Only a limited number of employees have access to the databases.

There is no risk of information leakage

Each team member has own permission level, and all sessions used to view the information about the service are recorded. Each login is registered. If the company’s employee tries to use the proprietary information in an improper way, he/she will be immediately identified.

Third parties do not have access to the system. All information data are encrypted using the SSL protocol and transferred in compliance with all banking precautions. Therefore, there is no risk of information leakage.

FAQ About Loans Online Mazilla PH

How do I register on the site?

In order to apply for a loan, you do not need a personal account. All that the online service asks you to indicate is your full name, mobile phone number, and e-mail address. APPLY NOW

I completed an application. How do I get a loan now?

After that, a credit rating will be calculated for you, and we will prepare a personalized financing program, including measures to improve your credit history.

All you need to do is choose the appropriate option and provide the requested information after you confirm that you agree to the terms of the proposed offer.

Am I able to get a loan if I have a bad credit history?

Yes, Mazilla have more than 40 partners financial organizations, including certain very loyal lenders who are ready to help borrowers to improve their creditworthiness. Mazilla will provide options for customers with any credit history.

How fast does it take for a loan application to be processed?

You can receive your money in as little as 15 minutes: your profile will be processed automatically, and your application will be reviewed instantly. We will search for pre-approved offers that match your application. Therefore, your loan will be approved and you will not be rejected in 95% of cases.

Loan payment period and interest rates

Annual loan interest rate is 30%, maximum – 365%. Loan period is from 91 days to 2 years.

Example of online loan calculations

If you take out a loan for 30.000 PhP at 4.5% monthly interest for 3 months, you will pay 4050 PhP extra by the loan due date. So, you will, in fact, pay 34.050 PhP. See below for calculations of interests, so that you can figure out the amount of repayment (including interest) for average service users. Loan amount – 30.000 PhP, monthly interest – 4.5%, loan term – 3 months. 4.5(%) * 3(months) = 13.5% for the 3 months (13.5% * 30.000 PhP (loan amount))/100% = 4.050 PhP (accrued interest) 30.000 PhP + 4.050 PhP = 34.050 PhP is the amount payable in three months. In the event of overdue payment, the penalty is 0.10% of the amount daily, but not to exceed 10% of the loan amount. In the event that the payment is substantially overdue, information will be submitted to a credit rating agency. A loan extension may be granted if the creditor is informed in a timely manner (prior to the due date of the loan) and interest is paid for the initial loan period. There are no additional fees for a loan extension.

Will I receive the money on Saturday evening, or will it be transferred first thing on Monday morning?

Our service operates around the clock. We do not take any breaks or days off. Applications are processed at all hours of the day and night as soon as they are received. The only thing that can prevent you from receiving your money within 10-15 minutes is a loan funds payout method that takes a longer period of time to process.

Therefore, when the approved amount is sent to a bank account using your account details or if the funds are issued to a card number, it may take several hours or even days for the money to reach the customer. You are unlikely to receive your borrowed funds in your bank account on a Saturday evening, and you will only receive the payout of funds on Monday for loans that are issued on Sunday.

How do I repay my online loans?

The borrower may choose from one of several options for remitting loan payments: payment by money transfer or at a payment terminal, by card at an ATM or in your personal account, by bank transfer using the lender’s payment details, or by paying cash at an office location. Choose the method that charges the smallest commission fee, and send money to your lender without delay.

What happens if the loan is not paid off

In the event that a payment of the loan or loan interest is overdue, the creditor is forced to apply an overdue fee. These fees are applied if, for example, a bank transfer takes longer than usual. However if you do not respond for a long time, an overdue fee will be charged in the amount, on average, of 0.10% of the initial loan amount and, on average, 0.03% of the amount of consumer loans and credit cards. If you fail to comply with the terms of the loan, your information may be submitted to a credit rating agency, which may adversely affect your credit history and credit rating. The amount owed may be submitted to a debt collection agency for debt collection. A loan extension may not be granted if the amount is past due. When you pay your loan on time, you build a good credit history, which improves not only your credit rating but also your chances of better loan offers in the future.

Note! Mazilla.ph is not a lending company. Mazilla.ph offers access to comparative soft to ease the searching process of a licensed lending company.