In the complex world of personal finance, maintaining a good credit score is often considered a crucial factor in securing loans and managing one’s financial affairs. However, life is unpredictable, and financial challenges can arise, leading to a poor credit history.

In the Philippines, individuals with poor credit histories often find it challenging to secure loans from traditional banks or government agencies, leading to a sense of financial insecurity. Fortunately, alternative lending options exist in the Philippines that cater to those with bad credit, offering hope and assistance during financial crises.

This article aims to shed light on the landscape of bad credit loans in the Philippines, exploring their benefits, potential risks, and presenting various options for guaranteed approval.

What is a Bad Credit Loan?

A bad credit loan, also known as a personal or multi-purpose loan, is a financial product primarily designed for individuals who have a less-than-stellar credit history. It’s important to note that bad credit loans are not exclusively for those with poor credit; individuals with no credit history can also apply and be approved for this type of loan. In essence, bad credit loans offer a lifeline to those facing financial hardships, regardless of their credit history.

Benefits of Loans for Bad Credit in the Philippines

Despite the apprehensions and concerns associated with bad credit loans, they offer several advantages, which are often overlooked:

- No Strict Credit History Requirement: Bad credit loans are not limited to individuals with poor credit histories. Those who have zero credit or are borrowing money for the first time can also benefit from lenders in this sector. This means that even financially responsible individuals with no prior credit experience can access these loans in times of need.

- Higher Approval Chances: Many companies that provide bad credit loans typically have more lenient requirements. By furnishing basic personal information and valid identification documents (and possibly collateral if required), applicants significantly enhance their chances of loan approval. However, it’s important to note that approval criteria can vary among different lenders.

- Quick Turnaround Time: A significant portion of bad credit loans are available online, streamlining the application and approval process. Since many lenders in this sector do not impose strict requirements, they can expedite loan processing. Depending on the specific lender and loan amount, borrowers may find the funds deposited in their bank accounts within as little as 30 minutes.

- Versatile Use of Funds: Bad credit loans are inherently multi-purpose, allowing borrowers to allocate the funds as needed. Whether the financial requirement is an emergency expense, medical bills, debt consolidation, or even a planned purchase, these loans offer the flexibility needed to address diverse financial needs. However, it is essential to use these funds responsibly and avoid engaging in activities that could further worsen one’s financial situation, such as gambling.

- High Borrowing Limits: This advantage is particularly relevant to collateral or secured loans, such as OR/CR (Official Receipt/Certificate of Registration) loans. In these cases, borrowers can access funds up to 70% of their vehicle’s assessed value. Additionally, rare jewelry pieces and high-end items can serve as collateral, enabling individuals to secure significant loan proceeds.

Risks Associated with Bad Credit Loans

While bad credit loans can be a lifeline for individuals facing financial difficulties, they come with their fair share of risks and potential drawbacks:

- High Interest Rates: One of the most significant concerns associated with bad credit loans is the elevated interest rates. To compensate for the increased credit risk, many lenders in this sector charge considerably higher interest rates than traditional banks. Monthly interest rates for these loans can range from 4% to 7.5%, rendering them more expensive in comparison.

- Short Repayment Periods: Some lenders specializing in bad credit loans mandate shorter repayment periods, typically ranging from one to 18 months. These brief timelines can exert considerable strain on an individual’s monthly budget, potentially leading to a debt trap if not managed diligently.

- Collateral Risk: Secured loans, which are common in the bad credit loan sector, often require collateral. If a borrower defaults on their loan, they risk losing the pledged assets, further exacerbating their financial troubles and negatively impacting their credit history.

Before applying for a bad credit loan in the Philippines, it is crucial for individuals to thoroughly evaluate their financial situation, their capacity to manage the associated risks, and proceed with caution.

How to Obtain Personal Loans for Bad Credit in the Philippines

Contrary to common misconceptions, bad credit loans in the Philippines are not as elusive as they may seem. Various financial innovations have made borrowing money more accessible, and there are well-established methods to secure the financial assistance needed. Here are the primary ways to access a bad credit loan, even with a less-than-ideal credit history:

- Family Members or Friends: When in need of quick and immediate cash, turning to family or close friends can be the first step. Borrowing from loved ones can be easier and more accommodating, especially when they understand your financial predicament. However, it is imperative to approach such arrangements with caution, as these personal relationships are the collateral.

- Private Lenders: Private loan providers offer an array of loan types, including cash loans, instant loans, online loans, payday loans, personal loans, salary loans, and emergency loans. Irrespective of their names, these loans generally have minimal requirements, promise swift approval and disbursement, and offer a convenient online application process. To apply, individuals can visit the lender’s website, complete an online application form, upload the required documents, and await a call from the company’s representative for data verification. Approval can be granted as quickly as 5 to 10 minutes. However, it is essential to note that these loans typically come with higher interest rates, ranging from 4% to 7.5%, compared to traditional bank loans, which often have around a 1% monthly interest rate.

- Pawnshops: For individuals with poor credit histories, pawnshops provide another avenue to secure a loan in the Philippines. This type of loan is secured by the borrower’s assets, such as jewelry or gadgets, thereby eliminating the need for a credit check. The loan amount is contingent on the assessed value of the collateral. However, failing to repay the loan within the agreed-upon timeframe can result in the pawnshop selling the pledged item to recover its losses.

- 5-6 Lenders: The 5-6 lending scheme has garnered a negative reputation due to its exorbitant interest rate of 20%. Nevertheless, it remains deeply ingrained in Filipino culture, and many individuals, especially micro and small business owners, continue to borrow from these lenders.

- Online Lenders: The Philippines has witnessed the rise of fintech (financial technology), leading to the proliferation of online lenders offering quick cash solutions. This setup is ideal for those in dire need of funds, as it allows them to apply via a smartphone or computer without leaving their homes. Furthermore, the loan proceeds can be directly deposited into the borrower’s nominated bank account. However, individuals should exercise caution when selecting an online lender, as there have been reported cases of some online lending companies harassing borrowers for late payments. In some instances, lenders have contacted borrowers’ relatives and friends to shame them or compelled them to settle the debts on behalf of the borrower, which constitutes unauthorized processing of information, punishable by fines and sanctions. In case of such abuse, borrowers are encouraged to report the lender to the relevant authorities.

- Car Collateral Loans: For individuals who own a vehicle, car collateral loans, often referred to as OR/CR loans, provide an avenue to secure quick cash. These secured loans typically require only the presentation of the car’s official receipt and certificate of registration, with no credit history assessment. Some lenders may even allow borrowers to retain possession of their cars during the loan period.

- Home Equity Loans: In certain situations, homeowners can leverage their property to secure a home equity loan, even if they lack a credit history or credit cards. The loan amount is usually determined by the market value of the property. However, this type of loan carries the risk of losing one’s home in the event of non-payment, particularly if the homeowner has an existing mortgage.

Best Loans for Bad Credit in the Philippines with Guaranteed Approval

Not all providers of bad credit loans in the Philippines are created equal, making it essential for borrowers to exercise caution and conduct due diligence when selecting a lender. Here are some top picks for bad credit loans in the Philippines, each with unique features:

- RFC Cash/Financing Loan: For those facing various financial emergencies, Radiowealth Finance Company offers cash loans or financing loans with a quick and convenient processing system. Loan amounts can range from ₱10,000 to ₱3 million, with interest rates dependent on the type of loan, the borrowed amount, and the chosen repayment period. Approval can be obtained in as little as 24 hours, and borrowers can opt for payment terms spanning three to 36 months.

- Tala Loan: Tala offers a hassle-free solution for those seeking urgent loans for bad credit in the Philippines. The loan application process can be completed via an Android smartphone, and it does not require any guarantor or collateral. Loan amounts range from ₱1,000 to ₱25,000, with flat daily fees as low as 0.5%. Approval can be secured within 24 hours, and payment terms extend from one to 61 days.

- Tonik Big Loan: Tonik presents an appealing option for condo owners in Metro Manila, allowing them to pledge their condominium title as collateral. Credit history is not a requirement for this loan, and borrowers can access loan amounts ranging from ₱250,000 up to ₱5 million. To expedite the application process, Tonik offers pre-approval in less than an hour via its app, with loan disbursement occurring within seven business days. Payment terms are flexible, spanning 12, 24, 36, 48, or 60 months.

- Security Bank Home Equity Loan: This loan product enables homeowners to borrow an amount equivalent to up to 70% of their property’s value, suitable for a variety of financial needs such as medical emergencies, major purchases, or tuition fees. Application options include accredited developers, Security Bank’s website, or a Security Bank branch. Loan amounts can range from ₱1 million to ₱10 million, with varying interest rates and approval timeframes. Payment terms extend up to 15 years for owner-occupied properties and up to 10 years for others.

- SB Finance Car4Cash: Car owners looking for substantial loan amounts without surrendering their vehicles can explore the SB Finance Car4Cash option. Borrowers need to submit their car’s OR/CR and a few necessary documents for loan approval. Loan amounts range from ₱100,000 to ₱2 million, with interest rates between 1.25% and 2% per month, depending on the vehicle’s age and the chosen loan term. Approval typically takes five to seven banking days, and payment terms span 12 to 48 months.

- GDFI OR/CR Sangla: Global Dominion Financing, Inc. offers the OR/CR Sangla loan, providing borrowers with a high loan value at a competitive interest rate. GDFI does not require successful applicants to surrender their cars. Loan amounts are determined based on the car’s fair market value, ranging from 50% to 70% of the valuation. Interest rates start at 1%, depending on the vehicle’s age and loan term. Approval time can vary from 24 to 72 hours, with payment terms extending up to 48 months.

- Asialink Collateral Loan: Similar to OR/CR Sangla loans, Asialink Collateral Loan is secured by valuable property items pledged by borrowers. This loan type accommodates various assets, including cars, trucks, taxis, PUVs (Public Utility Vehicles), and multi-cabs. Borrowers can obtain higher loan amounts at affordable interest rates, without surrendering their vehicles. As an online financing company, Asialink offers a convenient online application process, with approval often granted within 24 hours. Loan amounts are contingent on the collateral’s valuation, with interest rates starting at 1.5% and payment terms spanning up to 48 months.

- PawnHero: PawnHero introduces an online pawnshop concept that enables individuals to secure quick cash by pawning items such as smartphones, luxury watches, jewelry, designer bags, cameras, gaming consoles, sunglasses, soundbars, belts, and designer shoes. The storage, insurance, pick-up, and return delivery of collateral items are provided free of charge. Loan amounts vary based on the valuation of the item, with interest rates starting at 3.5% for gold and jewelry and 4.99% for other categories. Approval typically occurs within one day, and payment terms extend up to three months (one month for gadgets).

- BlendPH Auto Sangla: Car owners seeking a bad credit loan in the Philippines can consider Blend PH Auto Sangla. It offers fast approval and flexible payment terms with minimal documentary requirements. Borrowers can apply through Blend PH’s partner lenders, benefitting from a high approval rate. This loan type allows borrowers to retain possession of their vehicles while using their car registration documents as collateral for personal or business loans. The application process is quick and hassle-free, facilitated through Blend PH’s online loan calculator and an online application portal.

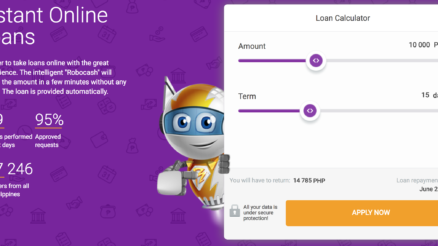

- Digido: Digido is another provider of bad credit loans in the Philippines, offering short-term loans of up to ₱10,000 with no credit checks and minimal formalities. Applicants can apply online through Digido’s online loan management portal or download the official app from the Google Play Store. Approval is swift, and borrowers receive their funds instantly. First-time borrowers can secure up to ₱10,000 with a seven-day repayment period at no interest. Subsequently, borrowers can apply for loans of up to ₱25,000 with repayment terms of up to 30 days.

- AEON Personal Loan: While AEON Credit Service is renowned for its appliance and furniture loans, it also extends its services to personal loans for cash needs. AEON offers competitive interest rates, exclusive VIP deals, promotions, and loyalty rewards to repeat customers. To apply, individuals need only two valid IDs, proof of billing, and proof of income. The application process can be completed at any AEON office, and applicants are notified of their loan status via text or phone call. Loan amounts vary based on credit evaluation, with an interest rate of 2.25% and a ₱1,000 processing fee. Approval typically occurs within 24 to 48 hours, and payment terms extend to six or 12 months.

- Finbro Loan: For individuals seeking bad credit loan options that require no credit check, Finbro provides a convenient solution. Loan amounts range from ₱2,000 to ₱20,000, with interest rates starting at 3.5%. The application process is streamlined through the Finbro mobile app, available for download on the Google Play Store. Once approved, borrowers can receive their funds in as little as 24 hours. Payment terms extend up to three months, allowing borrowers flexibility in repaying the loan.

Alternatives to Bad Credit Loans

While bad credit loans offer a lifeline to individuals facing financial difficulties, it’s important to explore alternative options before committing to a loan. Here are some alternative strategies for managing financial challenges without resorting to borrowing:

- Emergency Fund: Building an emergency fund is a proactive approach to financial management. Setting aside a portion of your income regularly can help you accumulate savings that can be used to cover unexpected expenses without resorting to loans.

- Debt Consolidation: For those struggling with multiple debts, consolidating them into a single loan with a lower interest rate can make repayment more manageable. This approach can help reduce monthly payments and simplify your financial situation.

- Negotiating with Creditors: If you have outstanding debts, consider reaching out to your creditors to negotiate better terms. Some creditors may be willing to reduce interest rates or offer more flexible repayment plans if you communicate your financial difficulties.

- Budgeting: Creating and adhering to a budget is an effective way to manage your finances and avoid unnecessary debt. By tracking your income and expenses, you can identify areas where you can cut back on spending and allocate more funds to savings and debt repayment.

- Financial Counseling: Seeking the guidance of a financial counselor or advisor can provide valuable insights into managing your finances, improving your credit score, and making informed financial decisions.

- Side Jobs or Freelancing: Exploring opportunities for part-time work or freelancing can provide additional income to help you meet your financial goals and cover expenses.

- Credit-Building: If your primary concern is a poor credit history, focus on rebuilding your credit. This can be achieved by making on-time payments, reducing outstanding debts, and being responsible with your finances.

Conclusion

In the ever-evolving landscape of personal finance, bad credit loans in the Philippines offer a ray of hope to individuals grappling with financial difficulties. While they come with both benefits and risks, these loans provide a lifeline for those with poor credit histories or no credit at all. With a plethora of options available, borrowers can carefully evaluate their financial needs, risk tolerance, and repayment capabilities to choose the most suitable bad credit loan provider.

It is essential to exercise caution, conduct thorough research, and explore alternative financial strategies to ensure long-term financial stability. Additionally, responsible borrowing practices, diligent financial management, and a commitment to rebuilding one’s credit can contribute to a brighter financial future.

Remember that while bad credit loans can provide immediate relief, the journey to financial security requires a holistic approach that encompasses saving, budgeting, and smart financial decision-making.

![PNB Exchange Rate Today [Latest Update] (February 2026) PNB Exchange Rate Today [Latest Update] (February 2026)](https://cashloanph.com/wp-content/uploads/2023/04/pnb-exchange-rate-today-cashloanph-438x246.jpg)