Easy Apply for Loan Online Products from BPI: AUTO LOAN · HOUSING LOAN · KA-NEGOSYO BUSINESS LOANS · PERSONAL LOANS with Loan Amount Up To PHP 2,000,000.

| Lending Company | Bank of the Philippine Islands (BPI) |

| Loan Products | Home Loan, Personal Loan, Auto Loan.. |

| Loan Amount | Up to PHP 2 000 000 |

| Loan Term | 36 months, 1 year, 3 years |

About BPI

Founded in 1851, Bank of the Philippine Islands (BPI) is the first bank in the Philippines and in the Southeast Asian region. BPI is a universal bank and together with its subsidiaries and affiliates, it offers a wide range of financial products and solutions that serve both retail and corporate clients.

BPI’s services include consumer banking and lending, asset management, payments, insurance, securities brokerage and distribution, foreign exchange, leasing, and corporate and investment banking.

The bank has a network of over 1,176 branches in the Philippines, Hong Kong, and Europe, and close to 3,000 ATMs and CAMs (cash accept machines).

The establishment of BPI, originally known as El Banco Español Filipino de Isabel II, ushered in the start of the Philippine banking and finance industry. The bank back then performed many functions-from providing credit to the National Treasury to printing and issuing currency-making it in effect, the country’s first Central Bank. Today, BPI proudly carries on this tradition, financing many private and public sector initiatives and enterprises in support of economic growth and nation building.

BPI is acknowledged as a leading provider of financial services in the Philippines.

Types of Loan Products from BPI

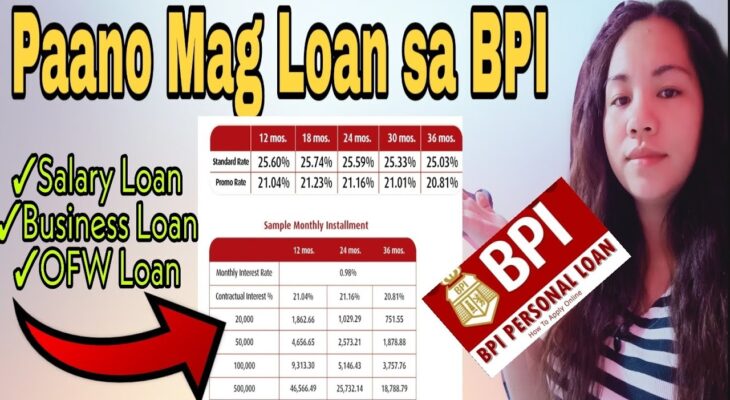

BPI Personal Loans

BPI Personal Loan is an easy way for you to get extra cash to fund your needs. Use it to fund your child’s education, repair your home, or bridge immediate business and other personal needs.

For our regular Personal Loan, you may get as much as 3 times of your gross monthly income, with amounts ranging from PHP 20,000 up to PHP 2,000,000. For our Seafarer Loan, you can get as much as PHP 300,000, subject to approval.

A personal loan application is processed within 5 to 7 working days upon receipt of complete documents.

The proceeds will be credited to your account within 1 to 2 banking days from the date of signing.

Once you book the loan, a minimal one-time processing fee of PHP 1,500 will be deducted from your loan proceeds. For loans above PHP 250,000 or for business purposes, government requires a Documentary Stamps Tax equivalent to PHP 1.50 for every PHP 200 of the loan amount.

For BPI Personal Loan, the monthly add-on rate is 1.2%, while for Seafarer Loan, the monthly add-on rate is 1.5%.

What requirements do I need to submit?

You just need to submit one (1) valid Philippine government-issued ID with photo and signature, duly accomplished, and signed application form, and your income documents.

1. Employed/ Professionals: Payslips for the last 3 months or latest ITR (BIR 2316).

2. Self Employed: Latest Audited Financial Statements or ITR DTI/SEC Business Registration Certificate.

3. OFW:

Agency-based: Latest and unexpired signed POEA contract or employment contract with boarding date

For Direct Hire:

- Latest 3 months Proof of remittance.

- Latest and Unexpired POEA Validated Information Sheet or latest POEA Overseas Employment Certificate (OEC), and latest Employment Contract.

- Consularized COE (If remitter is permanent resident in the country).

4. Allottee (income coming from Remittance)

- Proof of remittance or latest bank statement where remittance is credited

- Latest and unexpired POEA validated information sheet or latest Employment Contract or consularized COE (If remitter is permanent resident in the country)

How do I apply for a BPI Personal Loan?

Apply online by accomplishing the Application Form and send together with the complete requirements to [email protected] or through your nearest branch. Click here for the list of required documents.

BPI Housing Loan

Available for Filipino citizens who are of legal age but not more than 65 years old upon maturity of the loan.

Your housing loan application will be processed within 2 – 5 days upon receipt of complete documentary requirements.

Loan Amount:

- Minimum of P400,000

- Maximum of 70% of appraised value of house and lot

- Maximum of 60% of appraised value of vacant lot or residential condominium

- Up to 80% of appraised value of house & lot not to exceed P5M (provided applicant is employed and purpose is for owner occupancy)

Loan term:

- Maximum of 25 years for house and lot

- Maximum of 10 years for vacant lot, residential condominium, business loan, refinancing,or multi-purpose loans

3 Steps Apply for a BPI Housing Loan:

Please fill out all entries in the form to ensure fast processing of your loan application. Incomplete information will cause a delay in processing.

Standard business hours is from 8:30am to 5:30pm, Monday to Friday. Applications recieved outside the standard business hours will be processed on the next business day.

- Step 1: Property Information

- Step 2: Borrower Information

- Step 3: Submission

BPI Auto Loan

The minimum Loan Amount is PHP 200,000.00. To avail of a loan, the purpose of the vehicle to be acquired should be for personal/business use and not an accommodation.

Your auto loan application will be processed within 1 – 3 days upon receipt of complete documentary requirements.

Eligible to get a BPI Auto Loan:

- You are a Filipino between 21 to 65** years old with a total monthy family income of at least PHP 30,000.00.

- Foreign nationals married to Filipinos, or business entities like corporations and partnerships may also apply for an auto loan.

Requirements for BPI Auto Loan:

- If you are employed, BPI will need a copy of your Certificate of Employment with Compensation and ITR, together with your completely filled-out application form.

- If you are self-employed, BPI would need copies of your business registration papers, articles of incorporation (if applicable), ITR and latest financial statements,a list of trade references including addresses and contact numbers, and your completely filled-out application form.

Contacts BPI

BANK OF THE PHILIPPINE ISLANDS

Tower One, Ayala North Exchange

6796 Ayala Avenue corner Salcedo St.,

Legaspi Village, Makati City 1229

- Phone Banking: (632) 889-10000

- Website: www.bpi.com.ph or www.bpiloans.com

- Facebook: https://www.facebook.com/bpi