The financial world is rapidly evolving, and with it comes a plethora of options for obtaining personal loans online. CashExpress PH stands out in this landscape, offering a range of convenient and accessible personal loan options. As we adapt to the new normal, where digital solutions are more important than ever, CashExpress PH provides a platform where individuals can explore loan offers, compare terms, and make informed financial decisions.

This article delves into the top 7 online personal loan offers available through CashExpress PH, shedding light on their features, eligibility criteria, and borrowing costs.

Top 7 Best Personal Loan Offers in CashExpress PH

Navigating the world of personal loans can be overwhelming, but CashExpress PH aims to simplify the process by presenting a diverse range of loan offers, each catering to different financial needs. Let’s dive into the details of these offerings:

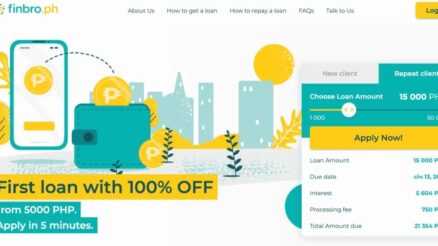

FINBRO.PH: Bridging Short-Term Gaps

For those in need of short-term financial assistance, FINBRO.PH offers a loan term of up to 12 months. With a maximum loan amount of 50,000 PHP and an interest rate of 6% per month, it caters to various financial needs. Eligibility criteria include citizenship in the Philippines, an age range of 20 to 65 years, and a stable income. To put this in perspective, borrowing 10,000 PHP for one month incurs an interest of 6% or 600 PHP, with a total payment of 11,500 PHP.

VAMO: Quick Solutions for Immediate Needs

VAMO presents a shorter loan term of up to 3 months, with a maximum loan amount of 30,000 PHP. The unique aspect here is the interest rate, which is 1.3% per day. This is a favorable option for those seeking immediate financial solutions. Similar to other offerings, eligibility requires citizenship within the Philippines and an age range of 20 to 65 years. Borrowing 10,000 PHP for a month would lead to an interest of 130 PHP per day and a total payment of 14,000 PHP.

DIGIDO: Balancing Mid-Term Financial Goals

DIGIDO offers a loan term of up to 6 months, with a maximum loan amount of 25,000 PHP. The interest rate is 11.9% per month, making it suitable for mid-term financial goals. Eligibility criteria encompass citizens aged 21 to 75 years with a stable income. For instance, borrowing 1,000 PHP for a month would result in a total payment of 1,119 PHP.

SOSCREDIT: Flexible Options for Diverse Needs

SOSCREDIT provides flexibility in loan terms, ranging from 3 to 12 months, and a maximum loan amount of 25,000 PHP. The interest rate, at 2.17% per day, caters to those who prefer shorter repayment periods. Citizens aged 20 to 65 years with a stable income are eligible. A loan of 10,000 PHP for 20 days would lead to a total payment of 14,340 PHP.

CASH-EXPRESS: Convenience and Accessibility

Cash-Express introduces a loan term of up to 3 months, with a maximum loan amount of 20,000 PHP. The interest rate, at 1% per day of the loan amount, suits those who prioritize convenience. Eligibility requires citizenship within the Philippines, an age range of 23 to 50 years old, and a stable income. Borrowing 1,000 PHP for 7 days results in an interest of 10 PHP per day and a total payment of 1,070 PHP.

PesoRedee: Tailored Solutions for Varied Situations

PesoRedee’s loan terms range from 3 to 12 months, with a maximum loan amount of 20,000 PHP. What sets this offering apart is its unique interest structure: the first loan is interest-free, while subsequent loans start at 0.15% per day. Eligibility encompasses citizens aged 22 to 70 years old with a stable income or current employment. Borrowing 1,000 PHP for a month incurs an interest of 4.5% or 45 PHP, leading to a total payment of 1,045 PHP.

MoneyCat: Holistic Solutions for Financial Needs

MoneyCat offers loans ranging from 500 to 20,000 PHP, with an interest rate of 11.9% per month. Loan terms vary from 3 to 6 months. This option caters to citizens aged 22 years and above with Philippine nationality, stable income, or current employment. Borrowing 1,000 PHP for a month incurs an interest of 119 PHP, resulting in a total payment of 1,119 PHP.

Streamlined Application Process in 3 Steps

Securing a personal loan through CashExpress PH is a user-friendly and efficient process that can be broken down into three simple steps:

Step 1: Compare and Select

In this step, prospective borrowers are encouraged to explore different lenders and meticulously compare the available loan options. By selecting a loan that aligns with their financial situation, applicants increase their chances of approval.

Step 2: Sign Up

Once a suitable loan has been identified, applicants can initiate the application process by clicking the “apply” button on the lender’s website. This step involves providing essential personal and financial information.

Step 3: Await Response

After the application is submitted, borrowers can expect a response from the lender. Communication typically occurs through the phone number provided during registration. This straightforward process minimizes delays and ensures quick access to funds.

The CashExpress PH Advantage

CashExpress PH distinguishes itself as a premier brokerage in insurance and financial services, with a commitment to offering the best products and promotions to customers. Their user-friendly tools empower borrowers to compare various products, aiding in making informed financial decisions that align with their goals.

Frequently Asked Questions

A well-rounded review covers not only the offerings but also addresses common queries potential borrowers might have:

Borrowing Money Online

This section elucidates the concept of online borrowing, emphasizing that creditworthiness is the linchpin for approval. The integration of technology has streamlined the lending process, allowing for quick approvals and disbursements on the same day.

Finding the Best Loan

For individuals unsure about where to secure a loan or those who have faced previous denials, CashExpress PH’s lender comparison tool provides a solution. By selecting lenders with high approval rates and submitting relevant information, borrowers can receive tailored consultations.

Loan Approval Speed

Loan approval timelines are contingent on individual lender policies and document readiness. CashExpress PH plays a pivotal role in clarifying the approval process and providing around-the-clock consultation to address any concerns.

The CashExpress Loan Package

A thorough understanding of CashExpress PH’s loan package reveals an accessible option for borrowers. With loan amounts ranging from 1,000 to 20,000 PHP and an interest rate of 1% per day, it caters to diverse financial needs. The eligibility criteria encompass an age range of 23 to 50, specific identification documents based on employment status, and stable income.

The Digido Loan Package

The Digido offering caters to those seeking loans from 1,000 to 25,000 PHP, with an interest rate of 11.9% per month. The eligibility criteria target individuals aged 21 to 70, necessitating the submission of identification and proof of income.

The FinBro Loan Package

FinBro, an online lending platform, facilitates swift cash access with loans ranging from 1,000 to 50,000 PHP and an interest rate of 6% per month. Loan terms extend up to 12 months, and eligibility hinges on an age range of 20 to 65, submission of valid identification, and proof of income.

The MoneyCat Loan Package

MoneyCat’s offering spans loans from 500 to 20,000 PHP, featuring an interest rate of 11.9% per month. The loan terms vary from 3 to 6 months, targeting citizens aged 22 and above with Philippine nationality, stable income, or current employment.

The PesoRedee Loan Package

PesoRedee caters to various needs with loan terms ranging from 3 to 12 months and a maximum loan amount of 20,000 PHP. The unique aspect is the interest structure, where the first loan carries no interest, and subsequent loans start at 0.15% per day. Eligibility criteria encompass an age range of 22 to 70, with stable income and employment.

The Soscredit Loan Package

Soscredit, an independent broker, provides small loans up to 25,000 PHP with an interest rate of 2.17% per day. Loan terms extend up to 6 months, and eligibility requires an age range of 22 to 65, valid identification, a phone number, and a bank account.

The Vamo Loan Package

Vamo Lending Inc., operating under VIA SMS Group, offers loans ranging from 1,000 to 30,000 PHP with an interest rate of 1.3% per day. Loan terms extend up to 3 months, targeting individuals aged 20 to 65 with valid identification and proof of income.

Application Timing

The beauty of CashExpress PH’s service lies in its 24/7 operation, enabling borrowers to apply for loans at any time that suits them.

Applying for Multiple Loans

While borrowers have the flexibility to apply for multiple loans within lender limits, a responsible borrowing approach is advocated to maintain manageable debt levels.

Dealing with Loan Denial

This section provides invaluable advice for borrowers facing loan denials. It encourages resubmission with detailed personal information to enhance the likelihood of approval.

Conclusion: Empowering Financial Decisions

In a rapidly changing financial landscape, CashExpress PH emerges as a beacon of convenience and accessibility. Through a variety of well-structured loan offerings, this platform caters to a range of financial needs. By facilitating informed decisions through user-friendly tools and addressing common concerns in their FAQ section, CashExpress PH is poised to empower individuals in navigating the world of online personal loans. Whether for short-term gaps, immediate needs, or mid-term goals, CashExpress PH offers a gateway to financial empowerment in the digital age.