Sa mga araw na ito, hindi na kailangang tumakbo sa pinakamalapit na bangko, pawnshop o impormal na nagpapahiram kapag ang isang tao ay kailangang humiram ng pera o gumawa ng isang cash loan.

Maaari mong hayaan ang iyong mga daliri na maglakad dahil ang kailangan mo lamang ay magsimula ka.

Madali ng humiram ng pera! Online cash loan ba ang hanap mo? Click below and apply online.

4+ Pinaka Da Best na Lending App online sa Pilipinas

#1. Online Loans Pilipinas

So far, ito ang pinaka-mabilis mag-approved sa lahat ng mga online loans! Sa loob ng ilang minuto o oras, pwedeng niyo na makuha o ma-withdraw ang inutang na pera. Pwede sa GCash! APPLY NOW!

#2. DigiDo

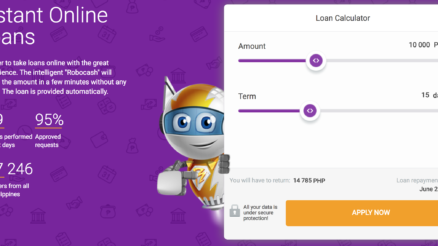

0% sa una niyong utang sa Robocash! Magandang offer ito kapag ikaw ay nasa emergency at may paparating naman na fund, kaso gipit lang sa kasalukuyan. Pwede sa GCash! APPLY NOW!

#3. MoneyCat

Kapag meron kayong bank account, maganda din utangan ang MoneyCat. Kaso wala itong option para sa cash pick-up or e-wallets like GCash. APPLY NOW!

#4. SoSCredit

Soscredit offers its customers attractive terms and conditions for borrowing services. You also get the opportunity to get a loan 24 hours a day, 7 days a week without going to a credit institution. APPLY NOW!

#5. Crezu

Crezu Philippines – it is an international online loan broker. With the help of one, you can apply to the different loan services. Loan limit from 1,000 – 20,000 PHP. APPLY NOW!

=> Read more: https://t.me/s/loanph

Who can APPLY the LOAN?

- Any Filipinos in the Philippines and 18+ years old.

- At least 1 valid ID and a phone number.

- Acceptable Valid IDs: Philhealth ID/ UMID/ SSS/ Pass Port/ PRC ID/ GSIS ID/ Voter’s ID/ Postal ID/ Driver License etc. ( You can choose one of the above id types.)

Reasons For Loan Interruption

Many people believe the following reasons prevent them from getting their credits online:

- Poor credit history

- Unemployment

- Inadequate salary level

- Inexperience in getting a loan

- And more…

Loan Rates and Fees

Low Interest Rates & Longer loan periods We have the right loan product for your needs.

- Loan Amounts: Up to ₱1,000.00 – ₱30,000.00

- EFFECTIVE APR: 34.68%

- Late fee: Base on outstanding amount due

- Tax (DST & GRT): 1.5%

- Minimum repayment period offered = 91 days

- Maximum repayment period offered = 120 days

For example, if you choose a 90-day loan limit of ₱10,000, your loan detail is as follows:

- Principal ₱10,000

- Processing Fee ₱0.00

- Service Fee ₱0.00

- NET PROCEEDS OF LOAN ₱10,000

- Interest due on maturity ₱855 (₱1,0000*90*0.095%=₱855)

- Total amount repayable on maturity ₱10,855(₱10,000*34.68%*(90/365) +₱10,000=₱10,855)

- EFFECTIVE DAILY INTEREST RATE(Interest and Other Charges include) :0.095%

- EFFECTIVE APR (Interest and Other Charges include) :34.68%

How to REPAY THE LOAN?

Visit any branch of the following:

- 7-Eleven

- G-Cash

- SM / Robinsons Department Store and Supermarket

- M Lhuillier

You can pay the loan in full or in part at any time before the due date.

* Easy loan-repayment plans enable you to pay in time.

What happens to unpaid online loans?

Non-payment of loans simply equals to lower credit scores, which will eventually disqualify you from making any secured loans in the future.

If your loans reach a default, expect to get really bad credit scores that will also disqualify you of any financial assistance when you most need it.

Isang salita ng pag-iingat sa mga cash loan apps

Ang modernong-araw na teknolohiya ay inilagay ang halos lahat ng maabot, ngunit hindi ito nangangahulugang dapat makuha mo ito.

Personal, pinapayagan ko lamang ang aking sarili sa isang araw sa isang linggo upang mag-browse sa mga online na tindahan, at kung gusto ko ang anumang bagay, inilalagay ko ito sa cart at maghintay hanggang sa susunod na linggo upang muling makita ito at magpasya kung i-click ang pagbili.

Ang pagiging isang digital na estranghero sa mga site ng pamimili ay nagpapanatili ng malusog ang aking account sa bangko.

Pagdating sa mga pautang, palaging suriin kung magkano ang kabuuang interes na babayaran mo. Habang ang mga emerhensiyang pera ay inilalagay sa amin sa mahirap na mga sitwasyon, huwag hayaan ang sinuman na samantalahin ang iyong pagkabagabag o magkakaroon ka ng isang mas mahirap na oras upang mag-crawl out sa credit hole na iyon.

![USD to PHP Exchange Rate Today [Latest Update] USD to PHP Exchange Rate Today [Latest Update]](https://cashloanph.com/wp-content/uploads/2023/05/usd-to-php-exchange-rate-today-cashloanph-438x246.jpg)