A man borrows 4,000 at 8%25 per annum on compound interest. at the end of every year he pays 1,500 as part payment of loan and interest. How much does he still owe to the bank after 3 such annual payments?

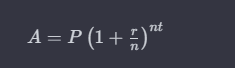

To solve this problem, we can use the compound interest formula:

Where:

- is the amount after years, including interest.

- is the principal amount (initial loan amount).

- is the annual interest rate (as a decimal).

- is the number of times that interest is compounded per year.

- is the time the money is invested or borrowed for, in years.

In this case:

- (principal amount).

- (8% interest rate converted to a decimal).

- (interest is compounded annually).

- (3 years).

The formula becomes:

Calculate the amount after 3 years:

So, after 3 years, the amount owed after the annual payments of $1,500 each would be $5,038.85.

Now, subtract the total amount paid over 3 years (1,500×3=4,500) from this total to find the remaining amount owed:

- Remaining amount owed≈538.85

Therefore, after 3 annual payments of $1,500 each, the man still owes approximately $538.85 to the bank.

CashLoanPH Changed status to publish 10/12/2023