In a nation characterized by its evolving economic landscape and a substantial proportion of underserved individuals in the financial realm, the Philippines stands as a promising ground for the proliferation of fintech solutions. These solutions hold the potential to bridge the gap in financial inclusion and grant citizens broader entry to a spectrum of financial services.

The Fintech Philippines Report 2023 delves into the intricate tapestry of the fintech sector within the Philippines, shedding light on pivotal milestones in regulatory frameworks that are pivotal in nurturing a flourishing digital financial ecosystem throughout the nation.

Notably, this report accentuates the remarkable strides orchestrated by the central financial authority, the Bangko Sentral ng Pilipinas (BSP), in conjunction with vital complementary entities like the Securities and Exchange Commission (SEC) and the collaborative force of FinTech Alliance.ph.

Empowering Financial Inclusion through Fintech

As a nation in developmental ascent, the Philippines grapples with a substantial segment of its population grappling with limited access to conventional banking services. This report underlines the profound role that fintech entities are poised to play in rectifying this disparity. By harnessing technological innovation, fintech companies are harnessing the power of mobile connectivity and digital platforms to serve as conduits for financial inclusion. This metamorphosis in service delivery is propelling the nation towards an era where financial services are no longer a privilege but a fundamental right accessible to all.

Regulatory Dynamics: Navigating the Fintech Landscape

One of the cornerstones of the Philippines’ burgeoning fintech ecosystem is the dynamic regulatory framework that is progressively taking shape. The Fintech Philippines Report 2023 sheds light on the transformative impact of regulatory developments that are fostering an environment conducive to digital financial innovations. The strategic initiatives undertaken by the BSP are at the forefront of this transformation. From pioneering digital payment systems to setting the stage for open banking frameworks, the central bank’s proactive measures are sowing the seeds of a financial revolution.

Bangko Sentral ng Pilipinas (BSP): The Vanguard of Innovation

At the heart of the Philippines’ fintech resurgence stands the Bangko Sentral ng Pilipinas (BSP), an institution that has emerged as the vanguard of financial innovation. The report expounds upon the BSP’s pioneering efforts in championing digital currency exploration, steering the nation toward a cash-lite society. Furthermore, the BSP’s collaborations with an array of stakeholders, from traditional financial institutions to emerging fintech players, underscore its commitment to steering the financial sector toward a cohesive, technologically empowered future.

Symbiotic Collaborations: SEC and FinTech Alliance.ph

The regulatory orchestration extends beyond the realms of the BSP, encapsulating the collaborative endeavors of the Securities and Exchange Commission (SEC) and FinTech Alliance.ph. The Fintech Philippines Report 2023 delineates their roles in shaping the fintech landscape, facilitating innovation, and ensuring regulatory compliance. With a focus on safeguarding consumer interests while propelling innovation, these entities are instrumental in ensuring that the fintech surge remains sustainable and beneficial for all stakeholders.

Navigating the Fintech Terrain: Philippines Fintech Map 2023

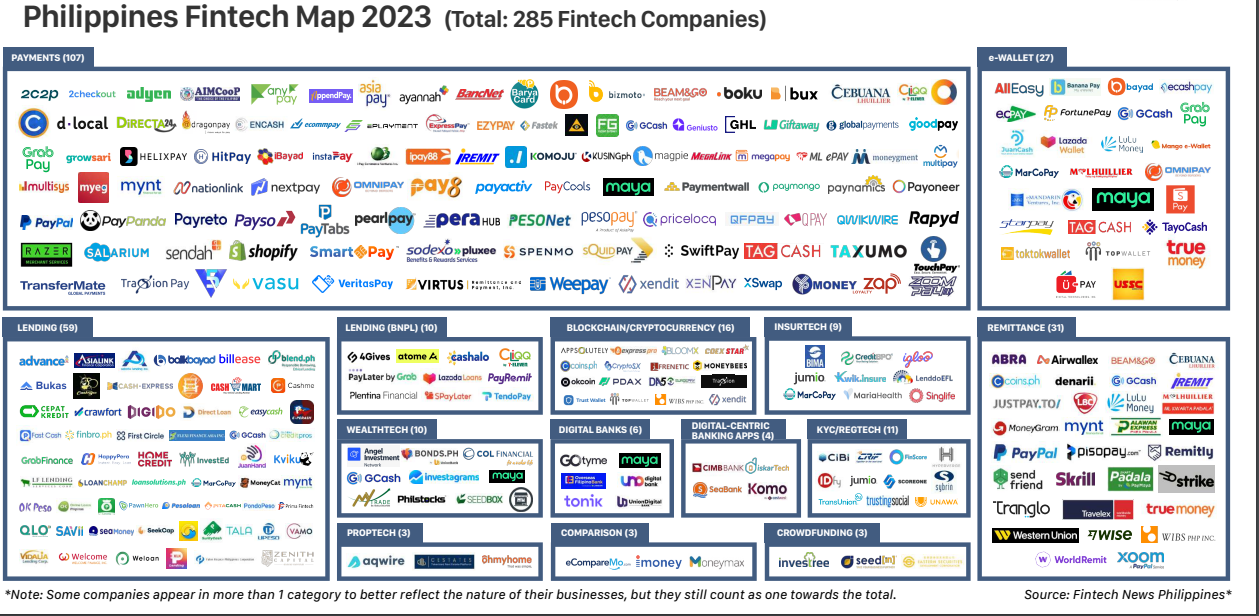

Embarking on an expedition through the Philippine fintech landscape reveals a vivid tapestry woven with diverse players, each contributing uniquely to the sector’s advancement. The Philippines Fintech Map 2023, encompassing a comprehensive ensemble of 285 fintech companies, serves as a testament to the dynamism and vibrancy of the sector. From digital payment platforms to blockchain-driven solutions, the map provides a panoramic view of the transformative journey the nation is undertaking.

Convergence, Expansion, and Beyond

In summation, the Fintech Philippines Report 2023 encapsulates the convergence of regulatory foresight, technological innovation, and collaborative efforts that define the Philippines’ fintech narrative. This report is more than a mere assessment; it is a testament to the nation’s dedication to harnessing fintech as a catalytic force for inclusive economic growth. As the Philippines navigates the financial frontier, propelled by fintech, the report stands as a guiding compass, illuminating the path towards a future where financial services know no bounds and where the unbanked and underbanked are no longer on the margins, but at the heart of a thriving digital economy.

For a more detailed exploration of the Fintech Philippines Report 2023, including insights on individual fintech companies and their transformative contributions, the full report can be accessed and downloaded here.

Further information regarding the Philippines’ fintech landscape, including the Philippines Fintech Map 2023 featuring 285 innovative fintech companies, can be found here.

- Payments (107)

- E-Wallet (27)

- Lending (59)

- Lending (BNPL) (10)

- Blockchain/Cryptocurrency (16)

- Insurtech (9)

- Remittance (31)

- WealthTech (10)

- Digital Banks (6)

- Digital-Centric Banking Apps (4)

- Kyc/Regtech (11)

- Proptech (3)

- Comparison (3)

- Crowdfunding (3)

- Remittance (31)

Source: Fintech News Philippines