Financial emergencies can strike at the most unexpected times-medical bills, sudden home repairs, school fees, or even an opportunity you can’t afford to miss. In moments like these, having a trusted and efficient lending partner can make all the difference. HoneyLoan has become a go-to choice for many Filipinos looking for quick and hassle-free access to funds, offering loan amounts from ₱1,000 to ₱30,000 with repayment terms of up to six months.

Unlike traditional banks that often require long application processes and heaps of paperwork, HoneyLoan streamlines the lending experience-making it faster, more convenient, and accessible even for those applying for the first time. 💡

About HoneyLoan 🏦

HoneyLoan is a licensed online lending platform in the Philippines under Warm Cash Lending Corp, a SEC-registered company with complete authorization to operate legally. They are part of EcoFinance, an international financial technology company that has successfully issued over €350 million in loans and served more than 4 million customers across Europe and Southeast Asia.

Business Information:

- SEC Registration Number: 2021030009095-02

- Certificate of Authority Number: 3472

- Address: 20th Floor, The W Fifth Avenue Building, 5th Street, Bonifacio Global City, Taguig City 1634

- Contact Number: 02-8876-1972 (9:00 AM to 6:00 PM)

- Email: [email protected]

With a focus on speed, transparency, and customer satisfaction, HoneyLoan continues to gain the trust of Filipino borrowers who value both convenience and security.

What HoneyLoan Offers 🎯

HoneyLoan provides short-term personal loans designed to meet different financial needs, such as:

- Emergency expenses

- Tuition fees

- Small business funding

- Home repairs

- Medical bills

Loan Features:

- Loan Amount: ₱1,000 – ₱30,000

- Repayment Term: Up to 6 months (180 days)

- Interest Rate: 0.5% daily, equivalent to 182% APR

- Payout Method: Bank transfer or e-wallet

- Approval Time: Within minutes for qualified applicants

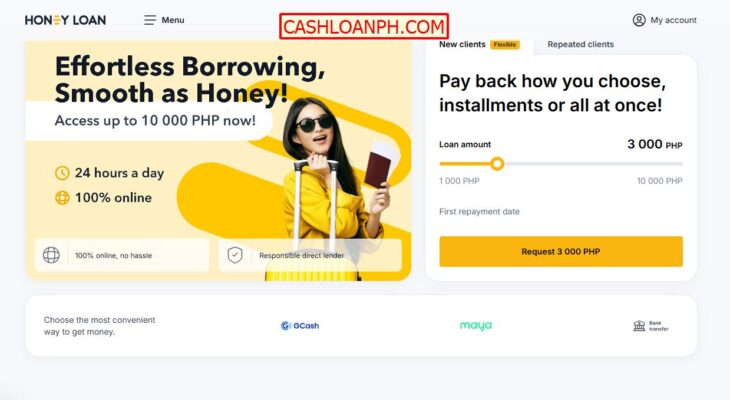

First-time borrowers can apply for up to ₱10,000, while returning customers with good repayment history can access up to ₱30,000.

Why Choose HoneyLoan? 🌟

Choosing a loan provider is an important decision, especially when financial stability is at stake. Here’s why HoneyLoan stands out:

Quick and Simple Application 📝

Borrowers can apply entirely online using a smartphone, tablet, or laptop. The form takes less than 7 minutes to complete, and only basic personal details are required.

Lightning-Fast Approval ⏱

Loan applications are reviewed within 2-3 minutes. Once approved, the funds are transferred instantly to the borrower’s chosen payout channel.

Multiple Payout Options 💳

Borrowers can choose from various bank and e-wallet partners nationwide, ensuring they get their money quickly and securely.

Data Privacy Protection 🔒

HoneyLoan complies with the Data Privacy Act of 2012 (RA 10173) and uses advanced encryption technology to safeguard all personal and financial information.

How to Apply for a HoneyLoan 📌

Applying for a loan with HoneyLoan is straightforward. Just follow these steps:

- Meet the Requirements:

- Filipino citizen aged 21-70 years

- Valid government-issued ID

- Active and working mobile number

- Stable source of income

- Submit Your Application:

- Visit honeyloan.ph

- Fill out the online form (around 7 minutes to complete)

- Upload your valid ID and other necessary documents

- Get Approved:

- Wait for confirmation (2-3 minutes for most cases)

- In rare instances, approval may take up to 24 hours

- Receive Your Funds:

- Choose your preferred payout channel

- Receive funds instantly

Loan Repayment Options 💰

Repaying your HoneyLoan is easy. Borrowers can pay via:

- Gcash

- DragonPay

- Bank transfer through online or over-the-counter banking

Borrowers are encouraged to pay on time to maintain a good credit record and increase their future loan limits. Missing payments may result in late fees and could negatively impact credit scores.

What Borrowers Say ❤️

Real customer feedback reflects the trust and satisfaction many have with HoneyLoan:

- Angela: “It’s not the first time I’ve applied here. Very helpful when I need money, all good.”

- Perlah: “Service at every stage was impeccable, and terms were transparent. I will apply again!”

- Kristine: “Consultants are great, money came quickly, I’m satisfied.”

- Carmelita: “Great company, pleasant employees, never had a problem. Thanks for your help!”

Frequently Asked Questions (FAQs) ❓

Is HoneyLoan a legitimate company?

Yes. HoneyLoan is operated by Warm Cash Lending Corp, which is registered and licensed by the Securities and Exchange Commission.

Is HoneyLoan part of a global company?

Yes. They are part of EcoFinance, a fintech leader in Europe and Southeast Asia.

How much can a borrower apply for?

First-time borrowers: ₱1,000 – ₱10,000

Returning borrowers: Up to ₱30,000

How long is the loan term?

Up to 6 months (182 days) with the option to repay early.

Is there a processing fee?

No. HoneyLoan does not charge a processing fee for loan applications.

What IDs are accepted?

UMID, PhilSys ID, Passport, SSS ID, TIN ID.

What happens if a borrower misses a payment?

Late fees will be applied, and the borrower’s credit score may be affected. HoneyLoan encourages contacting customer service in advance if payment delays are anticipated.

How to increase the loan limit?

Repaying loans on time and maintaining a good credit history can help qualify for higher loan amounts in future applications.

Why HoneyLoan is a Reliable Partner for Filipinos 🇵🇭

HoneyLoan combines technology-driven convenience with the security of regulated lending, making it an excellent choice for Filipinos seeking quick financial assistance. With their customer-first approach, transparent terms, and commitment to data privacy, borrowers can be confident they are dealing with a reputable company.

Whether it’s covering an emergency expense or funding a small project, HoneyLoan ensures that the loan process is fast, simple, and stress-free-giving borrowers more time to focus on what truly matters. 🌈