FinaGuru, operating under the domain ph.fina.guru, has established itself as a facilitator in the financial landscape, providing users with a curated list of credit products from various financial institutions. It positions itself as an intermediary, connecting clients with potential lenders, and emphasizes that it is not a financial institution or bank. The website mandates users to consent to the processing of personal data and agree to the Public Offer Agreement when engaging in any activity on the platform.

The website’s primary function is to facilitate access to credit products for individuals who meet certain criteria. FinaGuru does not directly provide paid services on credit products but rather acts as a conduit for clients to explore and apply for loans from credit institutions and non-credit financial entities.

FinaGuru Loan product Terms

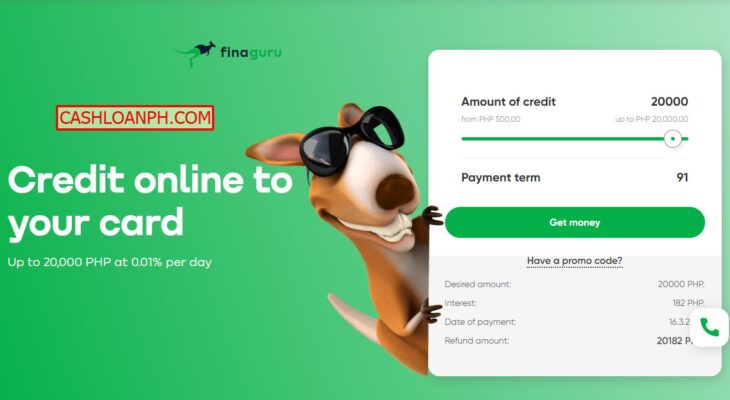

First loan

- Interest rate: The standard rate is 1.99% per day (726.35% per annum). If the Borrower fulfills terms of the agreement and loyalty program, the rate for the first period (from 91 to 365 day, depending on the conditions agreed by the parties) can be reduced to 0.01% per day (3.65% per annum). The actual annual interest rate ranges from 6961.93% to 115757.37% (depending on the fulfillment of the conditions);

- Application review time: Up to 15 minutes

- Loan Term: Loan term from 91 to 365 days (depending on the agreed frequency of interest payments).

- Loan Age: 18 to 70 years old

- Ways to get a loan: Loan processing is carried out online

- Necessary for applying for an online loan: Passport, valid payment card issued in your name, mobile phone

- Advantages: The loan is issued at a reduced interest rate. Registration on the same day.

Repeated loan

- Interest Rate: Standard – 1.99% per day (726.35% per annum). The rate for the first period can be reduced to 0.019% per day (7.5106% per annum) if the consumer is a member of the program loyalty. The real annual interest rate is from 7004.32% to 115757.37% (depending from the conditions of participation in the loyalty program).

- Application review time: Up to 5 minutes

- Loan Term: Loan term from 91 to 365 days (depending on the agreed frequency of interest payments).

- Age of borrower: 18 to 70 years old

- Ways to get a loan: Loan processing is carried out online

- Necessary for applying for an online loan: When applying for a second loan, the provision of documents is not required

- Advantages: When you reapply, you do not need to register. The solution will be known in a few minutes

Loan Conditions and Eligibility

Conditions for the Lender

To be eligible for loans facilitated by FinaGuru, individuals must be citizens of the Philippines, holding a valid passport, and be at least 18 years old. Interestingly, credit history is explicitly mentioned as not being a decisive factor in loan approval. This inclusivity is a noteworthy feature, suggesting that individuals with varying financial backgrounds may have access to financial assistance.

Loan Terms

The loan conditions outlined by FinaGuru include a broad range of interest rates, spanning from 1% to 31% per annum. This flexibility allows users to choose a product that aligns with their financial capabilities and needs. Additionally, penalties are imposed for late payments, amounting to approximately 0.1% of the overdue amount per day. Loan durations range from 91 to 365 days, providing borrowers with options that suit their repayment capabilities.

Total Cost of the Loan and Calculation Example

An insightful breakdown of the total cost of a loan is provided, offering users transparency into the financial implications of borrowing. An example is given, involving a microcredit of PHP 3000 for a period of 100 days, showcasing the interest rate, accrued remuneration, penalties for delayed repayment, and the total amount to be repaid. This level of detail empowers users to make informed decisions about their borrowing.

Why Choose FinaGuru

Convenience

FinaGuru positions itself as a provider of convenient and swift loan processing. The promise to accept and process loan applications within 15 minutes, around the clock and on holidays, speaks to the urgency often associated with financial needs.

Confidentiality

Emphasis is placed on the confidentiality and reliable protection of personal data. In an era where data security is paramount, this assurance is likely to resonate positively with potential users concerned about privacy.

Any Bank Crediting

FinaGuru promotes flexibility by stating that money can be credited to any bank card, expanding accessibility for users regardless of their banking affiliations.

Borrowing Process with FinaGuru

The process of borrowing money from FinaGuru is delineated into three key steps:

Fill Out an Application

Users are encouraged to choose the desired loan amount and specify the loan period. This initial step sets the stage for a user-friendly and straightforward application process.

Wait for a Decision

Upon application submission, users are instructed to register and await a decision on their application. The promise of a quick decision aligns with the overall theme of convenience and efficiency.

Get Money

Successful applicants are directed to sign agreements using an SMS code, enabling them to immediately receive the borrowed funds on their card. This streamlined disbursement process contributes to the overall user-friendly experience.

Client Feedback

User testimonials are showcased to provide prospective clients with insights into the experiences of others. Positive feedback highlights the efficiency and effectiveness of FinaGuru’s services, reinforcing the brand’s reliability and customer-centric approach.

| Client | Date | Location | Feedback |

|---|---|---|---|

| Natalia Conroy | 06.10.2022 | Quezon City | Exemplary customer service! Unprecedented attitude towards customers. Remarkably quick and efficient processes. Sharing my positive experience; this company stands out from the norm. |

| Jared Auer | 11.10.2022 | Manila | Applied for a credit card from the comfort of my home when I was unwell and needed funds urgently. Grateful for the seamless process. |

| Prudence VonRueden | 02.12.2022 | Davao City | Second time applying for a loan here. Pleased with the service; application completed swiftly, and funds deposited promptly. Key takeaway: timely repayments are crucial. |

Partnerships

FinaGuru lists several reputable partners, including Credit Info, Security Bank, Visa, Mastercard, and others. This collaborative network adds credibility to FinaGuru’s platform, assuring users that they are engaging with trusted entities in the financial sector.

Frequently Asked Questions (FAQ) about FinaGuru

How FinaGuru Works

FinaGuru is a contemporary and user-friendly online service designed to assist users in swiftly identifying the best credit card providers. The primary objective is to streamline the loan acquisition process, ensuring transparency, simplicity, and speed, while offering customers a convenient financial service.

How to Receive the Money?

One of the key advantages of FinaGuru is its straightforward design, making online loans accessible to almost everyone. To be eligible for a loan, clients must meet the following criteria:

- Age range: 18 to 70 years

- Philippine citizenship

- Residency in the country with a registered address

- Internet access

- Valid mobile phone

It is crucial to provide accurate information in the application form, as any inaccuracies or errors may result in the refusal of cooperation.

Guarantors and Proof of Income

FinaGuru does not require guarantors or proof of income for loan approval. The recommended companies do not mandate these additional documents.

Loans for Pensioners and Students

Yes, FinaGuru provides loans to pensioners and students, given that the applicant is currently employed (even unofficially) or falls under the companies recommended by them.

Existing Loans

Having an existing loan is not a problem when applying for a loan through FinaGuru.

Repayment Options

Users can manage their loan repayment in various ways:

- Personal Account: Use a bank card for the most convenient and fastest payment, with funds credited within 5 minutes.

- Online Banking: Repay through online banking using provided details.

- Payment Terminal: Make payments through a payment terminal with the specified details.

- Bank’s Cash Desk: Visit any branch of the bank’s cash desk and provide details to repay the loan. Note that such payments may take 3-5 business days to be credited.

Loan Application Considerations

After submitting the application, users will receive an SMS and/or email notification regarding the approval or rejection. Check the personal account for the status. Inaccurate or invalid data are common reasons for rejection, emphasizing the importance of providing reliable information.

Troubleshooting SMS Issues

If users encounter issues receiving SMS messages, check the network signal and ensure that the sender’s alpha name or number is not blocked. If problems persist, reach out to the online chat on the website for assistance.

Contact Information

FinaGuru provides comprehensive contact details, including phone numbers, email addresses, and a physical address, enhancing accessibility for users seeking additional information or support.

FinaGuru emerges as a comprehensive and user-focused online lending platform. Its commitment to transparency, convenience, and user satisfaction is evident throughout the website, supported by positive client testimonials. The detailed breakdown of loan conditions and the informative FAQ section contribute to an overall impression of a trustworthy and reliable financial service provider. As FinaGuru continues to evolve in the dynamic landscape of online lending, its emphasis on user experience and financial inclusivity positions it as a noteworthy player in the industry.