Kumusta, Kabayan! 👋 As a financial expert who’s seen the online lending landscape in the Philippines evolve dramatically, I can tell you that 2026 marks a pivotal year. The phrase “safe online loans Philippines” is no longer just a wish; it’s becoming more of a reality, thanks to intensified regulatory efforts and a growing commitment from legitimate players to consumer protection.

In the past, the rapid rise of online lending brought incredible convenience but also, unfortunately, a fair share of concerns – from sky-high interest rates to alarming debt collection practices. Many Filipinos hesitated, asking, “Are online loans safe in the Philippines?” or “Which online lending apps are legitimate?” Well, Kabayan, I’m here to tell you that the game has changed!

The Securities and Exchange Commission (SEC), in close coordination with the National Privacy Commission (NPC) and the Bangko Sentral ng Pilipinas (BSP), has significantly tightened its grip on the online lending industry. New rules are in full swing, aiming to weed out the bad actors and protect borrowers like never before. This is exciting news, as it means you can now access fast, convenient financial solutions with greater peace of mind. But even with these positive changes, being informed and vigilant remains your best defense.

Let’s dive into what “safe online loans Philippines 2026” truly means for you, the Filipino borrower, and how you can confidently navigate this new digital frontier!

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 20,000Approval in

5 minutesFirst loan free

no

Loan type

Long termFor a period of

4 monthsRate (PSK)

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 50,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

noThe Evolving Landscape: Why Online Loans Are Safer Than Ever in 2026 🌟

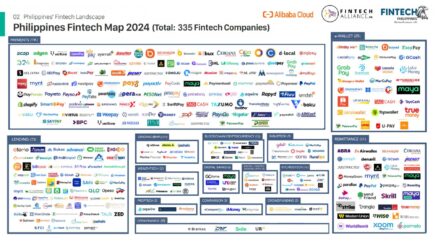

The Philippine online lending market is projected to exceed US$1 billion in the second half of 2026, a clear indicator of its vital role in our economy. This growth is being met with robust regulatory frameworks designed for your protection:

- Stricter SEC Oversight (Post-Moratorium): The SEC has lifted its moratorium on new online lending platforms (OLPs) but with significantly tougher requirements. This includes higher paid-up capital (₱10M for OLPs), rigorous “fit-and-proper” screening for directors, and even mandatory cyber-resilience audits. This means only financially stable and ethically committed companies can now operate.

- Zero Tolerance for Data Harvesting & Harassment: This is a huge win for borrowers! Following NPC Circular 2022-01 and SEC MC 3-2024, online lenders are strictly prohibited from accessing your phone contacts, photos, or call logs without your explicit, limited consent. They can only contact you and two nominated “guarantors” you provide. Abusive collection practices like public shaming, doxxing, and threatening are now met with severe penalties (up to ₱5M fine or 3% of gross revenue for first offense!). Collections are also limited to specific hours (08:00-18:00 weekdays, maximum 1 call/day).

- Interest Rate Caps Enforced: The BSP’s caps on interest rates for short-term, non-collateralized loans (≤ 6% nominal monthly interest; fees+penalties ≤ 15% of principal) are actively enforced by the SEC. This protects you from predatory, exorbitant rates.

- Mandatory CIC Reporting (Since Jan 2025): Every single legitimate online loan you take out and repay (or don’t repay) is now reported to the Credit Information Corporation (CIC). This transparency works both ways: it builds your credit score Philippines when you pay on time, and it helps the industry track problematic borrowers, making it safer for compliant lenders.

- Clear Complaint Channels: Regulators (SEC, NPC, BSP) have streamlined their complaint processes. If you encounter violations, you have clear avenues to seek redress, including administrative fines, license revocation for lenders, and even civil/criminal action.

These changes make choosing safe online loans in the Philippines much less daunting than before.

How to Spot a Legitimate vs. a Risky Online Loan Provider in 2026 🔍

Even with improved regulations, your vigilance is your strongest shield. Here’s a pro’s guide to identifying safe online lenders:

1. Always Verify SEC Registration – Your Absolute MUST! ✅

This is paramount. Before you even download an app or fill out any form, do this:

- Check the SEC Website: Go to the official SEC website (sec.gov.ph) and look for their “List of Registered Online Lending Platforms” and “List of Lending and Financing Companies with Certificate of Authority.”

- No SEC Registration = No Deal: If the company or app is NOT on this list, it is operating illegally. Close the app/website immediately and do not proceed. This is non-negotiable. The SEC is aggressively shutting down unregistered platforms, as seen with recent actions against “Zada Cash” and “Bloom Cash.”

2. Transparency in Terms and Conditions (Especially APR!) 📊

Legitimate lenders are crystal clear about their terms.

- Annual Percentage Rate (APR): They will clearly disclose the APR – the total cost of the loan (including all interest and fees) expressed as an annual rate. Compare APRs, not just daily interest rates.

- No Hidden Fees: All processing fees, service charges, and late payment penalties should be explicitly stated upfront. If anything feels vague or you suspect hidden charges, move on.

- Clear Loan Disclosure Statement: You should receive and fully understand a loan disclosure statement before you accept the loan.

3. Respect for Data Privacy and Ethical Collection Practices 🔒

This is a major distinguishing factor in 2026.

- Limited App Permissions: A legitimate app will only ask for permissions relevant to your loan application (e.g., camera for ID verification). If it asks for access to your contacts (beyond nominated guarantors), photos, or call logs without a clear, legitimate reason, it’s a predatory lender. Uninstall it immediately and report it to the NPC.

- Fair Collection: They will contact you through appropriate channels (phone, SMS, email) during designated hours (08:00-18:00 weekdays). They will never resort to threats, public shaming, or contacting your entire contact list.

4. Responsive and Accessible Customer Service 🤝

A trustworthy lender will have clearly stated contact information (including a landline, as now required by SEC) and a readily available customer support team to answer your questions and address concerns.

Applying for a Safe Online Loan: Your 2026 Checklist 📝

Once you’ve found a legitimate and transparent lender, the application process is generally streamlined:

- Download the Official App: Only from official app stores (Google Play Store, Apple App Store). Double-check the developer name.

- Accurate Information: Fill out the application form truthfully. Any discrepancies can delay approval or lead to rejection.

- Prepare Documents: Have clear photos of your valid government ID (PhilID, UMID, Driver’s License, Passport, etc.) and proof of income (payslips, COE, bank statements) ready.

- Nominate Contacts (Carefully!): If the app asks for emergency contacts or guarantors, provide only those whom you have informed and who are willing to be contacted. Remember, legitimate lenders won’t harass them.

- Review Loan Offer: Carefully read the loan agreement, including the total amount to repay, the due date, and all associated fees. Don’t sign anything you don’t understand.

- Receive Funds: Once approved and accepted, funds are typically disbursed directly to your bank account or e-wallet (e.g., GCash, PayMaya).

Responsible Borrowing in the New Era of Online Lending 🧠

While safe online loans Philippines are more accessible than ever, responsible borrowing remains paramount.

- Borrow Only What You Need & Can Repay: This is the golden rule. Don’t borrow impulsively. Calculate your ability to repay by the due date based on your income and expenses.

- Prioritize Repayment: Make your loan repayments on time, every time. This not only avoids late fees but, more importantly, builds a positive record with the CIC, improving your credit score Philippines.

- Avoid “Loan Stacking”: Never take out a new loan to pay an old one. This is a quick route to a debt spiral. If you’re struggling, seek help through credit counseling Philippines or reach out to the lender to discuss options before defaulting.

- Leverage Financial Literacy: Utilize the growing number of financial literacy initiatives. The BSP, DBM, and even digital payment platforms like GCash (with “Pera Talks”) are expanding programs to help Filipinos with budgeting, debt management, and understanding financial products.

Your Partner in Smart Financial Choices: CashLoanPH.com 🤝

Here at cashloanph.com, we are committed to being your most reliable and up-to-date resource for navigating the exciting, yet sometimes complex, world of online finance in the Philippines. We champion financial literacy and consumer protection, especially as the industry moves towards greater transparency and accountability in 2026.

The landscape for online loans in the Philippines is safer and more regulated than ever before. By being informed, vigilant, and disciplined in your borrowing habits, you can confidently leverage these powerful financial tools to meet your needs and build a stronger financial future. Stay smart, stay safe, Kabayan! Maraming salamat! 🙏🇵🇭