The Securities and Exchange Commission (SEC) of the Philippines has taken a bold step to clean up the financial sector by revoking the licenses and corporate registrations of 56 delinquent lending and financing companies. 📉 This move is a strong message to all financial institutions: follow the rules—or face the consequences.

🏛️ Why the SEC Took This Drastic Step

🔍 The Goal: Enforcing Transparency and Accountability

The SEC is the chief regulator responsible for overseeing corporations, lending companies, and financing institutions in the Philippines. Their job isn’t just paperwork—they are tasked with ensuring that businesses operate fairly, transparently, and within the bounds of the law. 🕵️♀️

To fulfill this mission, the SEC requires regular and accurate reports from registered entities. These reports include:

- 📊 Audited Financial Statements (AFS)

- 📄 General Information Sheets (GIS)

- 💼 Business plans and governance reports

- 💰 Details of directors’ compensation and other corporate disclosures

Failure to submit these documents is not just a technical error—it’s a serious violation that compromises the SEC’s ability to monitor and protect the investing public.

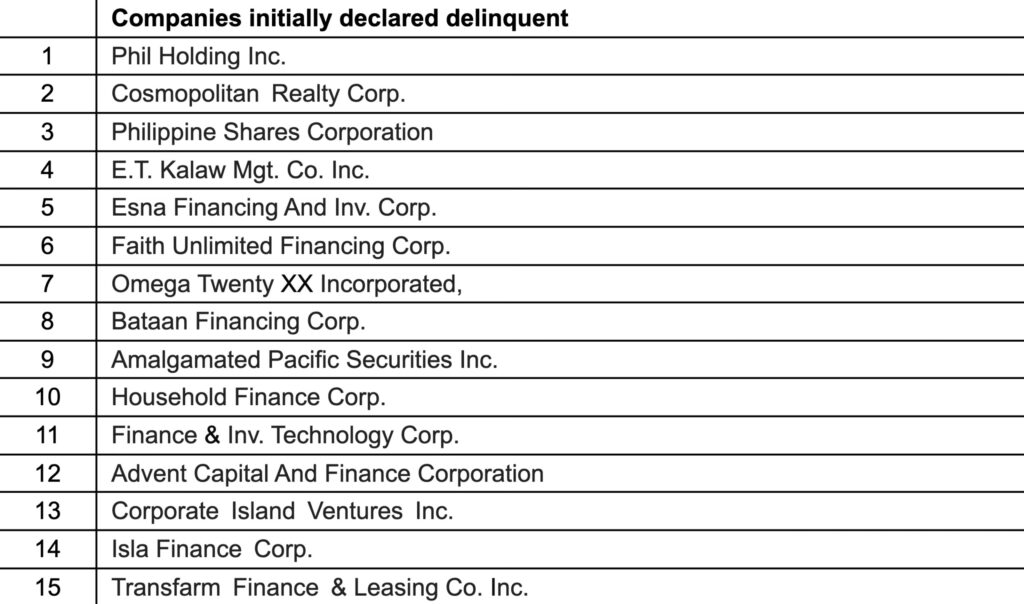

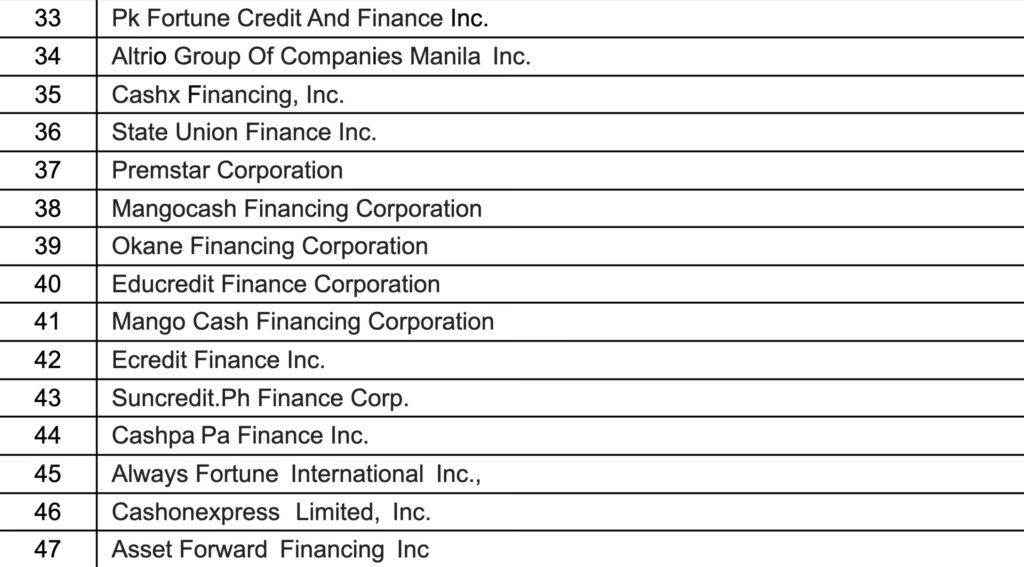

🛑 The Crackdown: 56 Companies Penalized

On May 29, 2025, the SEC’s Financing and Lending Companies Division (FinLenD) announced the cancellation of both primary registrations and secondary licenses (also known as certificates of authority to operate) for 47 companies. These were not isolated incidents—they were repeated offenses.

📉 Why Were These Companies Penalized?

According to Republic Act No. 11232, also known as the Revised Corporation Code (RCC), corporations that fail to submit mandatory reports three times within a five-year period—whether consecutive or not—can be declared delinquent. 📚

Many of these 47 companies failed to file critical documents multiple times, including:

- Audited Financial Statements (AFS)

- General Information Sheets (GIS)

- Reports on directors’ or trustees’ compensation

- Appraisal reports for capital assets

Despite repeated reminders and formal notices, these firms chose not to comply.

🗓️ Additional Enforcement on May 19, 2025

Separately, on May 19, 2025, the Commission also issued revocation orders against 9 more companies. These cases were slightly different but equally serious.

📩 Violations of SEC Memorandum Circular No. 28 (Series of 2020)

Two companies failed to submit their:

- Official email addresses

- Mobile phone numbers

These contact details are required under SEC Memorandum Circular No. 28 to ensure that companies can be easily reached for formal communications. 📧📱

📝 Violations of SEC Memorandum Circular No. 3 (Series of 2022)

The remaining seven companies failed to submit business plans—a requirement tied to the implementation of Bangko Sentral ng Pilipinas Circular No. 1133 (Series of 2021). This BSP circular aims to:

- Regulate interest rate ceilings 🧮

- Set limits on other fees and charges 💳

- Monitor the operations of online lending platforms (OLPs) 🌐

⚠️ SEC’s Warning Was Ignored

What’s particularly troubling is that many of these firms were given multiple chances to comply. The SEC had already sent:

- Show cause letters

- Notices of deficiencies

- Final warnings

Yet, these companies ignored the Commission’s efforts and continued to operate without providing the necessary disclosures. 😤

By revoking their licenses and corporate registrations, the SEC is sending a clear signal: non-compliance will not be tolerated.

📜 Full List of Revoked Companies

If you’re curious about whether a specific lending or financing company is included in this list, you can view the complete document released by the SEC here:

📎 View the full list of revoked companies

🧠 What This Means for Borrowers and Investors

🤝 For Borrowers: Stay Vigilant

This news is especially important if you’re planning to borrow money from online lending platforms or financing companies. Always make sure that the company you’re dealing with is:

- SEC-registered

- Has a valid Certificate of Authority

- Willing to provide transparent terms and documentation

If a company cannot or will not show proof of SEC compliance, that’s a red flag 🚩.

📈 For Investors: Do Your Due Diligence

If you’re an investor or a stakeholder in any financing-related company, this crackdown is a reminder to:

- Review the compliance status of your portfolio companies

- Ask for regular reports and documentation

- Avoid investing in firms with a history of regulatory problems

Non-compliance isn’t just unethical—it can lead to a total shutdown of the business, as we’ve seen in this case.

🧩 Background: SEC’s Larger Regulatory Push

This isn’t the first time the SEC has gone after delinquent or non-compliant financial firms. In recent years, the rise of online lending apps and fintech startups has made the lending space more complex—and more risky.

The SEC has ramped up its efforts by:

- Implementing stricter registration processes 📋

- Increasing the frequency of audits and inspections 🔍

- Partnering with law enforcement agencies to tackle illegal operations 🚔

This aggressive push is part of a larger campaign to sanitize the financial ecosystem and protect Filipino consumers and investors from fraudulent or irresponsible entities.

💡 How to Check a Financing Company’s Legal Status

Before engaging with any lender, it’s essential to verify its legitimacy. Here’s how:

✅ Use the SEC’s Online Systems

You can visit the SEC’s official website and use their search tools to verify:

- Company Registration Number

- Certificate of Authority

- Status of compliance

📞 Contact the SEC Directly

If in doubt, reach out to the SEC via phone or email to request verification. It’s better to take a few extra minutes than risk your money—or your credit reputation.

🔮 What’s Next for the Financial Sector?

The SEC’s revocation of 56 companies is just the beginning. With tighter enforcement measures and new technology for real-time reporting, the Commission is aiming to:

- Strengthen trust in the financial ecosystem

- Protect consumers from predatory lending

- Encourage compliance and good corporate governance

📢 Companies that want to survive and thrive in the future must treat regulatory compliance not as a burden—but as a foundation of ethical business.

📌 Final Thoughts

The SEC’s decision to revoke the permits of 56 delinquent lending and financing companies is a major step toward a safer, more transparent financial environment in the Philippines. 🇵🇭

This enforcement action should serve as a wake-up call for all industry players: if you want to stay in business, you need to follow the rules, respect the law, and prioritize transparency. 🧾💼

For borrowers and investors, this is a timely reminder to stay cautious, do your research, and only deal with reputable and compliant entities. ✅