See the top trending online loan apps in Philippines. Users easy download, install and apply a loan online from loan apps. Loan amount up to PHP 25000 with low interest rate. 100% online. You will receive the loan application result within 15 – 20 minutes. You can avail an instant personal loan without leaving your home.

What is Online Loan App Philippines?

Online Loan App is a form of allowing quick loans in Philippines through apps installed on the smart phone without collateral. Borrowers only need to create an account on the app and request a loan online, once the loan is approved, the money will be transferred to the bank’s account.

Advantages of Online Loan App:

- Open 24/7 without any holidays or weekends

- Easy loan application process and instantaneous decisions

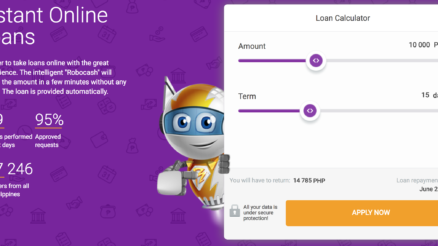

- Online loan calculator to choose the right loan amount and duration

- Loans without any collateral and guarantors

- Multiple Loan Repayment Options – bank transfer, remittance centre, 7-Eleven, offline branches, Dragonpay.

- up to 10 000 ₱ with 0% loans in 15 minutes

- receive money in a bank account or in cash

- service charge of 0 ₱

10+ Best Legit Online Loan Apps in Philippines

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 20,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

728 daysRate ()

365.00% / yearLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Long termFor a period of

4 monthsRate (PSK)

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

61 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 50,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

30 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

30 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

30 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

730 daysRate ()

0.00% / dayLoan amount

PHP 50,000Approval in

15 minutesService Fee

₱500

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

₱ 25,000Approval in

15 minutesFirst loan free

yesTop 40+ Trending Loan Apps Philippines in Google Play

- GCash – Buy Load, Pay Bills, S (Mynt – Globe Fintech Innovations)

- PalawanPay (PPS-PEPP Financial Services Corporation)

- My Home Credit-Loan,Load,Bills (HC CONSUMER FINANCE PHILIPPINES, INC)

- MocaMoca – Safe and fast loan (Copperstone Lending Inc)

- PesoBuffet – fast cash loan (PesoBuffet by Copperstone)

- UnionBank Online (Union Bank of the Philippines)

- Tonik (Tonik Digital Bank)

- BPI Mobile (BANK OF THE PHILIPPINE ISLANDS (BPI))

- OKPeso – Safe Online Loan App (Codeblock Lending Inc)

- JuanHand-online cash loan App (Wefund Lending corp)

- Peralending (U-PESO.PH LENDING CORP)

- Pera Bag – Loan with Integrity (Got-IT Lending Inc)

- PeraMoo-online peso cash (PERAMOO FOR MAGICIAN)

- PesoQ – Reliable Online Loan (U-PESO LENDING INVESTORS CORP)

- Fast Cash-Loans up to P20,000 (FCASH GLOBAL LENDING INC)

- WowPera – Fast & Safe Loan App (TREASURE BOWL FINTECH LENDING CORP)

- PesoCash – Safe Online Loans (MyLoan Lending Investors Inc)

- Cashalo – Cash Loan and Credit (Oriente Express)

- CIMB Bank Philippines (CIMB Bank Philippines, Inc)

- BDO Online (BDO Unibank, Inc)

- COCOPESO (FAST COIN LENDING CORPORATION)

- BDO Pay (BDO Unibank, Inc)

- Pautang Online-Loan Peso Cash (LHL ONLINE LENDING, INC)

- SurityCash (SURITY CASH LENDING INVESTORS CORP)

- Pesoin – Your Safe Online Loan (LINK CREDIT LENDING INVESTORS INC)

- Cashme—Easy loan peso pera (Hupan Lending Techology Inc)

- Support – Online Safe Loan (EXCELLENT ERA LENDING SERVICE CORP)

- MadaLoan easy lend pera peso (IFun Lending Corp)

- UnaCash – Buy Now Pay Later (Digido Finance Corp)

- LoanAlley (Leapgen Lending INC)

- Loanmoto – Secure Loan (U-PESO.PH LENDING CORP)

- SeaBank (SeaBank Philippines, Inc. (A Rural Bank))

- Suki loan (fincredit)

- CashBee Ph – Online Peso Loan (Cashbee)

- Paghiram-Loans Up To PHP20,000 (PaghiramDeveloper)

- Security Bank Online (SECURITY BANK CORPORATION)

- Online Loan App Philippines Low Interest (uKredit)

- Zada Cash (Easy Borrow)

- zukì (SB FINANCE COMPANY, INC)

- Big Loan (Big Loan)

- MoneyCat PH (Moneycat Financing Inc)

- GoLoan – Online Loan Fast Appr (Digital Solutions PH)

- Fast Cash Loan Philippines (TheQGames)

Top 40+ Trending Loan Apps Philippines in Apple Store

- GCash (Globe Fintech Innovations, Inc)

- PalawanPay (Palawan Pawnshop)

- BPI Mobile (Bank of the Philippine Islands)

- UnionBank (Online UnionBank of the Philippines)

- CIMB Bank Philippines (CIMB Bank Philippines, Inc)

- BDO Digital Banking (BDO Unibank, Inc)

- BillEase – Buy Now, Pay Later (First Digital Finance Corporation)

- BDO Online (BDO Unibank, Inc)

- PesoQ (U-PESO LENDING INVESTORS CORP)

- HappyPera 2 – Easy Cash Loan (Royal Yohoo Lending Investors Corp)

- PeraUp – Mobile Cash Loan (Megawow Finance Inc)

- PinoyLend- Peso Cash Loan APP (Philippine Consumer Lending Corp)

- Cashalo – Cash Loan and Credit (Oriente Express Techsystem Corporation)

- MadaLoan-cash online loans app (Quark financing corp)

- SukiLoan Loan Philippine (ORIGIN LENDING CORP)

- Cashme -madaling utang sa pera (Hupan Lending Technology Inc)

- Digido Philippines online loan (Digido Finance Corp)

- Security Bank Online (Security Bank Corporation)

- JuanHand-Fast cash loan (WeFund Lending Corp)

- Citibank PH (Citibank NA Philippines)

- Prima Cash Loan App Philippine (PRIMA FINTECH (PHILIPPINES) LENDING CORPORATION)

- Paghiram (MYCASH LENDING INVESTORS INC)

- OPESO (OKLIK LENDING COMPANY INC)

- Pautang Cash- Peso Online Loan (PRIMA FINTECH (PHILIPPINES) LENDING CORPORATION)

- tonik (Tonik Digital Bank)

- Loan App Philippines PH (MSB FINANS)

- Flip Cash- Peso Online Loan PH (PRIMA FINTECH (PHILIPPINES) LENDING CORPORATION)

- PesoOnline (MYCASH LENDING INVESTORS INC)

- Security Bank Mobile (Security Bank Corporation)

- zukì (SBFinance)

- 24h peso (WECASH FINANCE, INC)

- Fast Cash (Fcash Global Lending Inc)

- Advance – Salary on-demand (Advance Tech Lending Inc)

- Fast Cash VIP (Fcash Global Lending Inc)

- ACOM – Fast Cash Loan. Simple. (ACF)

- PCash (PROWEALTH LENDING CORPORATION)

- lendpinoy (AND Financing Corporation)

- Kusog Pera (KUSOG PERA LENDING INC)

- VCash – Make life easier (Masaganang Buhay Finance Philippines Corporation)

- PesoHaus (Leapgen Lending INC)

- CashNow-Safe Loan App (Quantix Technology Projects L.L.C)

- Pesoloan (Masaganang Buhay Finance Philippines Corporation)

- RapidCash (FLYING BEAR LENDING GORP)

- Cash Mart Philippines (Cashmart)

- FT Cash – Fast Cash Loan App (FT CORP)

Are Online Loan Apps Legit?

Not all online loan apps in Philippines are legit. All most online loan apps owned by online lending companies that operate legally have to register its existence under SEC. They should have a physical office set up within the Philippines so that the enforcement authorities can track them down in case of any untoward incidents.

Still, several illegal lenders operate only in the online world. They do not follow the regulation and loot the customers through various unethical practices.

For a borrower who seeks instant loans online, differentiating such lenders from legally operating ones is a bit difficult task. While applying for an instant money loan online, always ensure that the lender is legit by checking the details on the website: https://www.sec.gov.ph/.

FAQs About The Top Loan Apps in Philippines

Is online loan app legal?

“Considering that the online lending operators are not incorporated entities or have no Certificate of Authority to Operate as Lending Companies or Financing Companies, the lending activities and transaction are illegal and have to be stopped immediately by this Commission,” the cease and desist order read.

Which is the most used loan app in Philippines?

GLoan by Gcash is the most used loan app in Philippines. GCash Loan gives you pre-approved access to up to Php 50,000 cash loans instantly. No collateral needed and get the freedom to choose your payment terms.

Which app gives you loan instantly in Philippines?

Digido and Credify PH is one of the quick loan apps available in Philippines for short-term personal loans. The app is quite user-friendly with guided steps for the application process. Based on your needs you can apply for loans ranging from 1000 ₱ to 25 000 ₱.

What are the top 5 most popular online loan apps in Philippines?

The top 5 most popular online loan apps in Philippines are:

- Gcash Loan PH

- MoneyCat PH

- Crezu PH

- Credify PH

- Digido PH

How to apply a loan online?

- Fill-up the application online in just 5 minutes and confirm using the OTP code sent through SMS.

- Answer our call to verify the information, terms & conditions.

- Receive the money in your account within 24 hours!

How can I get a loan online immediately?

Just follow 5 easy steps below:

- Sign in your account: Authenticate Yourself – Instant KYC and with OTP SMS.

- Choose Loan Offer: Set your loan amount and Term. Setup Repayment- setup your monthly installment.

- Upload documents requirements

- Sign Electronically: Sign the loan agreement.

- Get loan disbursal: Wait approval and get money in your bank account.

How do I Utang online?

- Step 1: Apply – Fill in the form application. You fill out an online application and send it to us.

- Step 2: Wait 5 – 15 minutes. Lender review your application and make a decision.

- Step 3: Get money – You are guaranteed to receive money for a bank card.

Why use Online Loan App?

- FAST – Only 5 minutes to complete the application!

- SIMPLE – Just provide 1 valid ID and apply in 3 simple steps!

- SAFE – Personal information is kept confidential according to the Company’s Privacy Policy.

- CONVENIENT – Download the app on your phone and apply from ANYWHERE in the Philippines!

Who is eligible to get a loan app Philippines?

- From 18 years old.

- Filipinos currently living in the Philippines

How to I get online cash loan application approved faster in the Philippines?

- Know what type of loan you need

- Build a good credit rating

- Choose the right Lender

- Borrow for the right reasons

What are the interest rates?

Interest rates will vary depending on your particular lender and circumstances. The quickest way to figure out interest rates is to request a quote for a loan – it only takes a few minutes!

What will happen if I doesn’t pay online loan apps?

You get a losing credit score. Your credit score is what lenders look into first before deciding if your application is either havey or waley. Non-payment of loans simply equals to lower credit scores, which will eventually disqualify you from making any secured loans in the future.

Note about Online Loan Apps

Online loan Apps are dangerous in cases where the lender turns out to be a scammer. Therefore, it is necessary to be extremely careful when applying to a microfinance organization.

Let to adhere to the following rules:

- Carefully check the lender you are going to apply to.

- Never pay a fee for reviewing an application.

- Please note the application deadlines

- Read the terms of the contract carefully. The document must indicate the amount, loan terms, interest rate, possible fines, and penalties.