Kumusta, Kabayan! 👋 As a financial expert who’s seen the ins and outs of the Philippine money landscape, I understand the urgent need many of us face when unexpected expenses hit. Whether it’s a medical emergency, a sudden home repair, or simply needing to bridge the gap until your next paycheck, the quest for instant cash in the Philippines is real. And let’s be honest, in today’s fast-paced world, who has time for long queues, mountains of paperwork, and endless waiting?

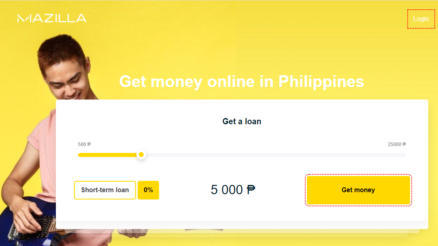

That’s where online loans in the Philippines have become a true game-changer. Forget the days of begging relatives or resorting to informal lenders with exorbitant rates. Technology has revolutionized how we access credit, putting quick financial solutions right at our fingertips. But with so many options popping up, how do you know which one is right for you? And more importantly, how do you ensure you’re making a smart, safe choice? 🤔

Why Online Loans Are King in the Philippines Right Now 👑

Think about it: the Philippines is a nation of smartphone users. We’re connected, tech-savvy, and always looking for convenience. This widespread digital adoption has naturally paved the way for online lending to flourish. Here’s why it’s dominating the scene:

- Speed and Convenience: This is the undisputed champion. You can apply for a loan from your phone 📱, anywhere, anytime. No need to take a leave from work, no travel expenses, no long lines. For those moments when you need money fast, this is invaluable.

- Minimal Requirements: Unlike traditional banks that often demand extensive documentation, many online lenders have streamlined their process. Often, you’ll only need a valid ID, proof of income, and sometimes a utility bill. This accessibility is a huge relief for many Filipinos who might not have a formal employment history or extensive credit records.

- Accessibility for All: Online loans have opened doors for individuals who were previously underserved by traditional financial institutions. This includes freelancers, small business owners, and those with irregular income. It’s about financial inclusion, truly.

- Transparency (When You Choose Wisely!): Reputable online lenders clearly outline their interest rates, fees, and repayment terms upfront. This transparency helps you make informed decisions and avoids hidden charges that can plague less scrupulous lenders.

But here’s the kicker, and this is where my expert hat comes on: While the benefits are undeniable, the online lending world also has its sharks. You need to be street-smart and know how to differentiate the good from the bad.

Navigating the World of Fast Loan Apps: What to Look For 🔍

The term “fast loan app Philippines” is one of the most searched phrases these days, and for good reason! These apps promise quick disbursements, sometimes in minutes. But how do you pick a trustworthy one? Here’s my advice:

1. Always Check for SEC Registration! ✅

This is non-negotiable! Before you even think about downloading an app or filling out an application, make sure the lending company is registered with the Securities and Exchange Commission (SEC) in the Philippines. The SEC website has a list of registered and licensed online lending companies. If they’re not on that list, run! 🏃♀️💨 This registration is your primary safeguard against predatory lenders and scams.

2. Read the Reviews, But Be Critical! ⭐

App store reviews can be a mixed bag. Look for consistent themes. Are people complaining about harassment during collection? Or are they praising the fast process and clear terms? Pay attention to reviews mentioning hidden fees or aggressive collection practices. Also, be wary of apps with only five-star reviews – some might be fake! Look for a balanced perspective.

3. Understand the Interest Rates and Fees (APR is Key!) 📊

This is where many people get tripped up. Don’t just look at the daily interest rate. Ask for the Annual Percentage Rate (APR). This gives you the true cost of borrowing over a year, including all fees. Some apps might seem to have a low daily rate, but when you factor in processing fees, service charges, and other deductions, the APR can be shockingly high. Always compare APRs across different lenders. A reputable lender will be upfront about this.

4. Data Privacy is Paramount! 🔒

When you apply for an online loan, you’re sharing sensitive personal information. Make sure the app has a clear privacy policy and that they emphasize data security. Are they asking for access to your contacts or photos unnecessarily? That’s a red flag! A legitimate lender will only ask for information relevant to your loan application and credit assessment.

Understanding Your Personal Credit Score: Your Financial DNA 🧬

While many online loan apps in the Philippines cater to those with limited credit history, understanding your personal credit score is crucial for long-term financial health. Think of it as your financial DNA – it tells lenders how responsible you are with borrowed money.

- Why it Matters: A good credit score can unlock better loan terms, lower interest rates, and higher loan amounts in the future. It’s not just about loans; it can also affect things like getting postpaid plans or even renting an apartment.

- How to Build It (Even with Online Loans!): The good news is, using online loans responsibly can actually help build your credit score!

- Pay on Time, Every Time: This is the golden rule. Timely payments are the biggest contributor to a good credit score.

- Don’t Over-Borrow: Only borrow what you can comfortably repay. Taking on too much debt can lead to missed payments, which harms your score.

- Avoid Multiple Applications Simultaneously: Applying for too many loans at once can signal to lenders that you’re in financial distress, which can negatively impact your score.

- Where to Check It: The Credit Information Corporation (CIC) is the central credit registry in the Philippines. You can request your credit report from them to see your credit standing. It’s an eye-opener and a great step towards responsible personal finance Philippines.

Financial Solutions for Low-Income Individuals: Hope on the Horizon! 🌅

A common concern I hear is: “What about financial solutions for low-income individuals Philippines?” It’s true that traditional banks often have strict income requirements. However, the online lending space, when used wisely, offers opportunities.

- Micro-Lending Platforms: Many online lenders focus on micro-loans, which are smaller amounts designed to help individuals cover immediate needs. These are often more accessible for those with lower or irregular incomes.

- Government Initiatives & Cooperatives: While not strictly online, it’s worth exploring government programs or local cooperatives that offer financial assistance or livelihood loans specifically tailored for low-income sectors. Sometimes, these have online application components or information available digitally.

- Financial Literacy is Power! 💪 No matter your income level, understanding basic financial literacy principles is key. This includes budgeting, saving, and understanding the true cost of borrowing. Many resources are available online and through NGOs to help you manage your money better.

My Expert Take: Borrow Smart, Not Hard! 🧠

As someone deeply immersed in the financial world, my top advice for Filipinos considering online loans is this: Be empowered, be informed, and be responsible.

Online loans are a powerful tool, a modern solution to age-old financial challenges. They offer speed, convenience, and accessibility that was once unimaginable. However, with great power comes great responsibility.

Before you click “apply,” ask yourself:

- Do I truly need this loan? Is it for an essential expense or a frivolous one?

- Can I realistically repay this on time, without straining my finances? Calculate your income and expenses to ensure you have enough buffer.

- Have I checked the lender’s SEC registration and read their terms and conditions thoroughly? No shortcuts here!

Remember, cashloanph.com is here to be your trusted resource, guiding you through the landscape of online financial solutions in the Philippines. We aim to empower you with the knowledge to make wise choices, protect yourself from pitfalls, and ultimately achieve greater financial stability.

So, the next time you’re searching for “instant cash Philippines” or exploring “fast loan apps,” remember the tips shared here. Your financial future is in your hands, and with the right knowledge, you can navigate it successfully. Stay smart, Kabayan! Maraming salamat! 🙏🇵🇭