Hello, Kaibigan! 👋 As a financial advisor deeply immersed in the evolving financial landscape of the Philippines, I often hear the urgent plea: “I need a cash advance in the Philippines, and I need it now!” Whether it’s to cover an unexpected bill bills 🧾, make an urgent purchase 🛍️, or simply tide you over until your next payday, the demand for quick access to funds is constant. And let’s be real, in our fast-paced lives, waiting around for days for loan approvals just isn’t an option sometimes.

The good news is, the digital revolution has brought forth a multitude of options for a fast cash advance Philippines. Gone are the days when your only recourse was a traditional bank loan with its lengthy application process or a less-than-ideal informal lender. Today, online platforms and mobile apps offer unparalleled speed and convenience. However, this ease of access comes with a critical caveat: not all cash advance providers are created equal. In fact, with stricter SEC monitoring in 2026, it’s more important than ever to know how to spot the legitimate players from the predatory ones.

So, how do you navigate this landscape to secure funds safely and efficiently? I’m here to share my expert insights, ensuring you make informed decisions and protect your financial well-being. Let’s get you that cash advance, the smart way!

The Rise of Digital Cash Advance: Why It’s the Modern Solution 📈

The Philippines has embraced digitalization like few other nations. Our high smartphone penetration and digital literacy have created a fertile ground for online financial services. Here’s why digital cash advance Philippines options are booming:

- Speed and Accessibility: This is the primary driver. Most legitimate platforms offer near-instant approval and disbursement directly to your bank account or e-wallet (like GCash or PayMaya). You can apply from anywhere, at any time, eliminating travel and waiting times. 🚀

- Simplified Requirements: Compared to traditional loans, online cash advances often have fewer documentary requirements. Typically, a valid government ID and proof of income are sufficient, making them accessible to a broader range of Filipinos, including freelancers and those with less formal employment.

- Convenience for Urgent Needs: When emergencies strike, or you simply have a temporary cash flow gap, the ability to get funds quickly without a lengthy bureaucratic process is a significant relief.

- Financial Inclusion: These platforms are extending financial services to segments of the population that might be underserved by traditional banks, contributing to greater financial inclusion across the archipelago.

However, the rapid growth also means you, the borrower, need to be extra vigilant. The SEC is actively cracking down on unregistered and abusive lenders, which is a positive step, but it also means your diligence is paramount.

How to Get a Cash Advance Safely: My Pro Tips for 2026 🔑

Securing a cash advance in the Philippines is easier than ever, but doing it safely requires a methodical approach. Here’s my updated guide for 2026:

1. Always, Always Check for SEC Registration – Your First Line of Defense! 🛡️

This cannot be stressed enough. Before you download any app or provide any personal information, verify that the lending company is officially registered with the Securities and Exchange Commission (SEC) Philippines.

- Action Step: Visit the official SEC website (sec.gov.ph). Look for their “List of Registered Online Lending Platforms” and the “List of Lending and Financing Companies with Certificate of Authority.” If the company or the specific app you’re looking at isn’t on these lists, DO NOT PROCEED. This is the most crucial step to avoid loan sharks and scammers. The SEC is becoming stricter, even requiring landline details from registered companies, making it harder for illegitimate players to operate.

- Red Flag: Be wary of apps or companies that lack clear SEC registration details on their website, app store description, or splash screen. By 2025, it’s a mandatory disclosure.

2. Deep Dive into the Loan Terms: Transparency is Key! 📊

Once you’ve identified SEC-registered options, scrutinize their terms and conditions. This is where you understand the true cost of borrowing.

- Annual Percentage Rate (APR): Don’t just look at daily or monthly interest rates. Demand to know the full APR, which includes all interest, processing fees, and other charges over a year. This provides a clear, comparable cost across different lenders. The BSP also continues to cap interest rates for short-term, non-collateralized loans, so be aware of these limits (e.g., ≤ 6% nominal monthly interest).

- All Fees and Charges: Get a complete breakdown. Are there processing fees, service fees, late payment fees, or other hidden deductions? A reputable lender will be completely transparent about these upfront.

- Repayment Schedule: Understand the exact due date(s) and the total amount you need to repay. Many cash advances have short repayment terms (e.g., 7-30 days), so ensure you can meet the deadline comfortably.

3. Protect Your Data Privacy – No Contact Harvesting! 🔒

This is a huge area of focus for the SEC and NPC (National Privacy Commission) in 2025. Predatory lenders illegally access your phone’s contacts and use them for harassment if you default.

- App Permissions: When installing an app, carefully review the permissions it requests. A legitimate lending app should NOT ask for access to your contacts, photos, call logs, or location data unnecessarily. If it does, immediately uninstall it and report it. The NPC has imposed significant penalties on lenders violating data privacy rules.

- Privacy Policy: Read their privacy policy. It should clearly state what data they collect, how it’s used, and how it’s protected.

4. Assess Your Repayment Capability: Don’t Overburden Yourself! ⚖️

A cash advance Philippines is designed for short-term needs. Never borrow more than you can realistically repay by the due date.

- Budgeting: Before applying, create a quick personal budget. Know your income, essential expenses, and how much disposable income you have available for repayment.

- “Loan Stacking” is a Trap: Avoid taking out a new loan to pay off an existing one. This is a common path to a severe debt spiral. If you’re struggling, seek credit counseling Philippines instead.

The Application Process for a Fast Cash Advance App 📲

Once you’ve done your due diligence and chosen a legitimate, SEC-registered provider, the actual application is typically quick:

- Download the Official App: Use only official app stores (Google Play Store, Apple App Store).

- Registration: Create an account using your mobile number and email.

- Fill Out Form: Provide accurate personal details, employment information, and income sources.

- Upload Documents: Typically a valid government ID (Passport, UMID, Driver’s License, SSS ID) and proof of income (payslip, bank statement, Certificate of Employment). Some require a selfie for verification.

- Bank/E-wallet Details: Input your preferred disbursement channel (bank account, GCash, PayMaya). Ensure details are correct to avoid delays.

- Review and Accept: Carefully read the loan agreement or promissory note, which outlines all terms, fees, and repayment schedules.

- Receive Funds: Upon approval, funds are usually disbursed within minutes to hours.

Beware of “Red Flags” in 2026! 🚩

The SEC’s intensified monitoring aims to clean up the online lending space, but you still need to be aware of the persistent red flags:

- Requests for Upfront Fees: If a lender asks for any payment (e.g., “processing fee,” “insurance fee,” “membership fee”) before disbursing the loan, it’s a scam. Legitimate lenders deduct fees from the loan amount or include them in your repayment.

- Unsolicited Offers & Aggressive Marketing: Be cautious of random SMS or social media messages offering “easy money.”

- Threatening or Abusive Collection Practices: Legitimate lenders follow fair debt collection practices. Any threats, shaming, doxxing, or contacting non-designated third parties (friends, family, employers) is illegal and should be reported to the SEC and NPC. The law now hands regulators powerful tools, including fines and imprisonment, to stamp out abusive actors.

- Vague or Non-Existent Physical Address: Reputable companies have a verifiable physical office.

- Overly High Interest Rates that Exceed BSP Caps: While online loans can be higher than bank loans due to speed and accessibility, extreme rates (e.g., more than 6% nominal monthly) are a warning sign.

Building a Strong Financial Foundation: Beyond Cash Advances 🏗️

While cash advance Philippines serves as a vital short-term solution, my ultimate advice as a financial expert is to work towards building a solid financial foundation that minimizes your reliance on them.

- Emergency Fund: Aim to build a dedicated emergency fund, even if it’s just a small amount initially. This can be your first line of defense against unexpected expenses.

- Budgeting and Spending Tracker: Use budgeting apps or simply a notebook to track your income and expenses. Understanding where your money goes is the first step to better money management. Keywords like “best budgeting apps” and “money management apps” are popular for a reason!

- Improve Your Credit Score: Paying your cash advances on time contributes positively to your credit score Philippines (now reported to CIC by all online lenders as of January 2026!). A good credit score can unlock better loan terms and more favorable financial products in the future.

- Financial Literacy: Continuously educate yourself on personal finance. There are many free resources available online (like cashloanph.com!) to help you make smarter money decisions.

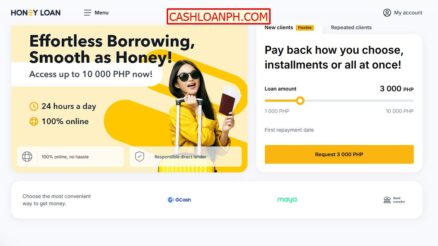

Your Trusted Resource: CashLoanPH.com 🤝

Here at cashloanph.com, we are committed to being your reliable source of information for all things related to online loans and personal finance in the Philippines. We understand the urgency that comes with needing a cash advance, and we are dedicated to helping you find legitimate, safe, and transparent solutions.

Remember, financial stability is a journey, not a destination. By being informed, vigilant, and responsible, you can leverage the power of online cash advances to meet your immediate needs while steadily building a more secure financial future. Stay smart, stay safe, Kabayan! Maraming salamat! 🙏🇵🇭

![Security Bank Exchange Rate Today [Latest Update] February 2026 Security Bank Exchange Rate Today [Latest Update] February 2026](https://cashloanph.com/wp-content/uploads/2023/05/security-bank-exchange-rate-today-cashloanph-438x246.jpg)