Peer-to-Peer (P2P) lending has become a popular financial service in the Philippines. With the growth of online platforms, borrowers and investors can connect and transact with ease. In this article, we will delve into the world of P2P lending online Philippines. We will cover its definition, how it works, benefits, and risks. We will also provide tips for borrowers and investors, as well as how P2P lending is regulated in the Philippines.

What is P2P lending?

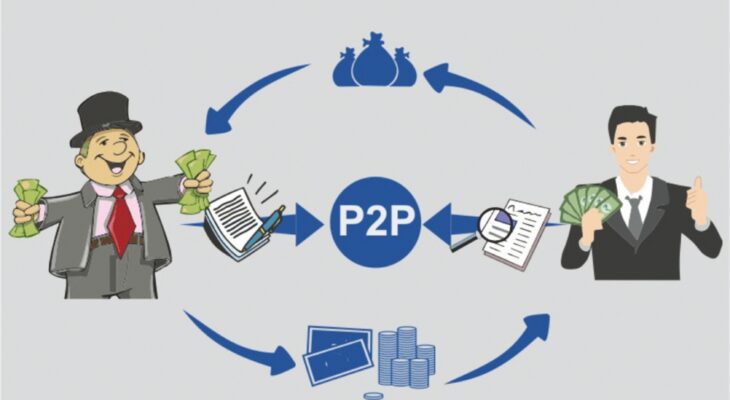

P2P lending is a type of financial service that connects borrowers directly to investors through an online platform. The platform acts as an intermediary, facilitating the transaction, and earns a fee for its services. P2P lending eliminates the need for traditional banks or financial institutions, making it more accessible and affordable to borrowers.

How does P2P lending work?

In P2P lending, borrowers apply for loans through an online platform. The platform assesses the borrower’s creditworthiness and assigns a risk rating. Investors then review the borrower’s profile and can choose to fund a portion or the full amount of the loan. Once the loan is fully funded, the borrower receives the funds and begins making repayments with interest. The platform collects the repayments and distributes them to the investors.

Benefits of P2P lending

P2P lending has several benefits for both borrowers and investors. For borrowers, P2P lending offers lower interest rates than traditional bank loans. It also has a faster application process and a higher chance of approval. For investors, P2P lending provides higher returns than traditional savings accounts or time deposits. It also diversifies their investment portfolio and reduces their risk.

Risks of P2P lending

Like any financial service, P2P lending has risks. For borrowers, defaulting on the loan can negatively affect their credit score and financial standing. For investors, the risk of default is higher than traditional investments. The platform may also face regulatory issues, which could affect the borrower’s repayments and the investor’s returns.

Tips for borrowers and investors

For borrowers, it is essential to understand their financial capabilities and only borrow what they can afford to repay. They should also compare online loan offers from different platforms and read the terms and conditions carefully. For investors, it is crucial to diversify their investment portfolio and spread their investments across different loans and platforms. They should also review the borrower’s profile and risk rating before investing.

Regulation of P2P lending in the Philippines

The Securities and Exchange Commission (SEC) regulates P2P lending in the Philippines. Platforms must register with the SEC and comply with its rules and regulations. This ensures that the platform operates transparently and protects the interests of both borrowers and investors.

Pros and Cons of P2P Lending

Like any financial product, P2P lending has its advantages and disadvantages. Here are some of the key pros and cons to consider when evaluating whether P2P lending is right for you:

Pros:

- Higher returns – P2P lending typically offers higher returns than traditional savings accounts and other low-risk investments. This is because investors are directly lending money to borrowers, with the platform acting as a facilitator.

- Diversification – P2P lending allows investors to diversify their portfolios and spread their investments across multiple loans, borrowers, and platforms.

- Accessibility – P2P lending is a relatively accessible investment option, with low minimum investment amounts and easy-to-use online platforms.

- Flexibility – P2P lending offers flexibility in terms of loan terms, interest rates, and repayment schedules, allowing borrowers and investors to tailor their investments to their specific needs.

Cons:

- Default risk – P2P lending carries a risk of default, with borrowers potentially failing to repay their loans. This can result in losses for investors.

- Lack of regulation – P2P lending is not currently regulated by the central bank in the Philippines, which can create uncertainty for investors and borrowers.

- Platform risk – P2P lending platforms can be subject to risks such as fraud or bankruptcy, which can result in losses for investors.

- Liquidity risk – P2P lending investments are not always readily available for withdrawal, and early withdrawal or selling of investments may be subject to fees and restrictions.

Overall, P2P lending can be a viable investment option for those willing to take on some risk and do their due diligence. Investors should carefully evaluate the pros and cons and assess their risk tolerance before investing in P2P lending.

Top 5+ P2P Lending Online Philippines

- Blend.ph – Blend.ph is a leading P2P lending platform in the Philippines that offers personal and business loans. Its interest rates range from 1.5% to 6% per month, with loan terms of 3 to 12 months.

- FundKo – FundKo is another popular P2P lending platform that offers personal loans with interest rates ranging from 1.99% to 3.99% per month. It also has a borrower insurance program to protect borrowers and investors.

- Uploan – Uploan provides personal and salary loans with interest rates ranging from 1.3% to 3.5% per month. It has a fast and easy application process and offers flexible repayment terms.

- MoneyMatch – MoneyMatch is a P2P lending platform that offers personal loans with interest rates ranging from 1.95% to 4.95% per month. It has a user-friendly platform and a transparent fee structure.

- Acudeen – Acudeen is a P2P lending platform that specializes in invoice financing for small and medium-sized enterprises. Its interest rates range from 2% to 3% per month, and it offers fast and hassle-free funding solutions.

- Kiva.org – Kiva is a global P2P lending platform that connects borrowers in need with lenders around the world. It offers microloans to small businesses and individuals, with loan terms ranging from 1 to 36 months.

Notes on P2P Lending

While P2P lending offers many benefits to borrowers and investors, it is important to note that there are also risks involved. Here are some things to keep in mind when considering P2P lending:

- Credit risk – As with any type of lending, there is a risk that borrowers will default on their loans. P2P lending platforms typically have their own credit assessment processes, but investors should still diversify their investments and carefully evaluate the creditworthiness of borrowers.

- Liquidity risk – Unlike traditional savings accounts, P2P lending investments are not always readily available for withdrawal. Investors should be aware of the platform’s policies on early withdrawal or selling of investments.

- Regulation – P2P lending is a relatively new industry in the Philippines and is currently not regulated by the central bank. However, the government is currently working on implementing regulations to protect both borrowers and investors.

- Platform risk – P2P lending platforms can also be subject to risks such as fraud or bankruptcy. Investors should choose platforms that are reputable and have a track record of successful operations.

- Fees – P2P lending platforms typically charge fees for their services, such as loan origination fees or investment management fees. Investors should be aware of these fees and factor them into their investment returns.

By keeping these factors in mind and doing thorough research, borrowers and investors can make informed decisions about P2P lending and minimize their risks.

Conclusion

P2P lending online Philippines is a fast-growing industry that offers several benefits to borrowers and investors. It has lower interest rates, faster application processes, and higher returns than traditional financial services. However, it also has risks that borrowers and investors should be aware of.

By following our tips and understanding the regulations, borrowers and investors can make informed decisions and benefit from P2P lending.

![10 Fast Cash Loan Apps Philippines in 15 Minutes [Latest Update] 10 Fast Cash Loan Apps Philippines in 15 Minutes [Latest Update]](https://cashloanph.com/wp-content/uploads/2023/05/fast-cash-loan-apps-philippines-cashloanph-438x246.jpg)