In the ever-evolving financial world, obtaining a loan can often resemble a herculean task, fraught with extensive prerequisites and a labyrinthine trail of paperwork. Nevertheless, a glimmer of hope exists for Filipinos in search of expedited financial assistance: no-requirement loans. In this comprehensive exploration, we will delve into the realm of no-requirement loans available in the Philippines, with a special focus on Digido Loan.

With this review, CashLoanPH will encompass an analysis of the eligibility criteria, the myriad advantages and disadvantages, where to unearth these financial lifelines, how to heighten the likelihood of approval, and additional insights to empower borrowers in making informed decisions.

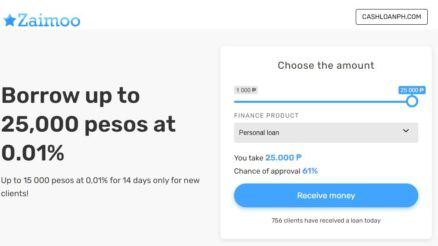

GET ONLINE LOANS IN THE PHILIPPINES UP TO PHP 25,000

Select online loans that come with the best terms and conditions, ensuring a card without any rejections. Numerous companies provide an initial loan at 0% interest and ensure swift money transfers, making them perfect for urgent financial needs.

| Lender | Loan Product Detail |

|---|---|

|

Finbro PH |

Hot - 0% first loan

|

|

LoanOnline |

Popular - 0% first loan

|

|

Honey Loan |

Hot Offer - 0% first loan

|

|

Cash-Express |

Express Loan - 0% first loan

|

|

Kviku |

New - 0% first loan

|

|

MoneyCat |

Fast Approve - 0% first loan

|

Eligibility for a Digido Loan

Before we embark on our journey into the intricacies of no-requirement loans, it is paramount to grasp the fundamental question of who can access these financial lifelines. To qualify for a Digido Loan, potential borrowers must satisfy the following criteria:

- Age and Citizenship: Applicants should fall within the age bracket of 21 to 70 years and be Filipino citizens, a testament to the inclusive nature of these loans.

- Valid Government ID: A crucial component of the eligibility criteria is the provision of a valid government-issued identification document, which plays a pivotal role in the verification process.

Understanding No-Requirement Loans

In the Philippines, traditional loans are often encumbered by a multitude of prerequisites, including an impeccable credit score, irrefutable proof of income, and adherence to specific age constraints. Nevertheless, a beacon of financial hope emerges in the form of no-requirement loans, which, as the nomenclature suggests, necessitate minimal documentation and qualifications. These loans are designed to streamline the application process, rendering them an attractive option for borrowers who may not meet the stringent prerequisites demanded by traditional lenders.

Pros and Cons of No-Requirement Loans

Advantages:

- Access for All: No-requirement loans extend a lifeline to individuals with low credit scores or those without collateral. They grant access to much-needed funds without the hindrance of a credit check, rendering them an inclusive financial solution.

- Streamlined Application: The application process is characterized by its swiftness and simplicity. Whether online or in-person, borrowers can complete their applications in a matter of minutes, reducing the wait time for access to funds.

- Opportunity for Those with Bad Credit: These loans present a unique chance for individuals with either no credit history or a tarnished one to secure financing. This can be particularly crucial for those in the process of rebuilding their credit.

- Minimal Documentation: Applicants are generally only required to furnish basic documentation, such as proof of income and identification, making the process far less cumbersome compared to traditional loans.

- Speedy Approval: With minimal documentation requirements, no-requirement loans often boast swift approval processes. Borrowers are quickly informed whether their loan applications have been approved, enabling them to proceed with their financial plans.

- Versatility: No-requirement loans can be utilized for a multitude of purposes, ranging from debt consolidation to covering unexpected expenses and tuition fees, underscoring their flexibility and adaptability.

Disadvantages:

- Higher Interest Rates: One of the trade-offs associated with no-requirement loans is the often higher interest rates compared to their traditional counterparts. Borrowers must exercise caution and conduct thorough research when selecting a lender.

- Shorter Repayment Terms: While these loans offer flexibility in terms of repayment, they frequently necessitate shorter repayment periods compared to traditional loans.

- Limited Loan Amounts: No-requirement loans may offer smaller loan amounts, which may not suffice for borrowers with substantial financial needs.

- Risk of Predatory Lending: Borrowers must remain vigilant and discerning when selecting a lender. There is a real risk of encountering unscrupulous lenders who impose exorbitant interest rates, hidden fees, and unfavorable terms. It is imperative to engage exclusively with lenders who possess SEC certification and a commendable reputation.

Where to Find No-Requirement Loans in the Philippines

Selecting the right lender is of paramount importance when seeking a no-requirement loan in the Philippines. With a plethora of options at one’s disposal, making an informed choice becomes pivotal. Here are some lending entities offering no-requirement loans, along with a comparative overview:

Comparison of No-Requirement Loans

| Lender | Loan Amount PHP | Loan Term | Interest Rate | Approval Time |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | 7-180 days | 0% per day for 7 days | Within 4 minutes |

| UnaCash | 2,000 – 50,000 | Up to 6 months | 0% to 6% | Within 5 minutes |

| MoneyCat | 1,000 – 20,000 | Up to 180 days | First loan free | In 5 minutes |

| Finbro.ph | 1,000 – 50,000 | 1 to 12 months | 1.25 – 15% p.m. | Up to 12 hours |

| OnlineLoans Pilipinas | 2,000 – 10,000 | 10-30 days | New clients 0% | In minutes |

| Tala | 1,000 – 25,000 | Up to 61 days | 15% (p.a.) | In minutes |

Note: Rates and terms are subject to change, so borrowers are strongly advised to contact their chosen lender directly for the most current information.

Benefits of Digido Personal Loans

Digido emerges as a noteworthy online lender in the Philippines, offering an array of benefits:

- Certified and Reputable: Digido boasts certification from the SEC, providing borrowers with an assurance of trustworthiness and reliability.

- 24/7 Availability: Borrowers can access Digido’s services at any time and from any location in the Philippines, underscoring its accessibility.

- 0% Interest on First Loan: New borrowers can benefit from zero interest on their initial loan, providing an attractive incentive for first-time users.

- Effortless Application: The entire application process is conducted online, obviating the need to leave one’s home. Applicants need only possess a single valid ID.

- No Hidden Charges: Digido places a premium on transparency, ensuring that borrowers are not subjected to hidden fees or concealed commissions.

- No Collateral or Guarantors: The absence of stringent collateral or guarantor requirements simplifies the borrowing process.

- High Approval Rate: Digido enjoys a commendable approval rate, with over 95% of loan applications being granted.

- Multiple Repayment Options: Borrowers are afforded a range of repayment alternatives, including bank transfers, remittance centers, DragonPay, offline branches, and even 7-Eleven outlets, enhancing convenience.

Why Choose Digido?

Digido’s prominence in the world of online lending is bolstered by several compelling factors:

- Fast and Convenient: With Digido, borrowers can apply for loans from the comfort of their homes. The application process is swift, and funds can be disbursed within as little as 30 minutes, mitigating the waiting period.

- Flexible Repayment: Borrowers are offered a degree of flexibility, with the option to select weekly or monthly installments. Furthermore, borrowers are not penalized for early repayment, ensuring autonomy in managing their loans.

- Transparent: Transparency is a cornerstone of Digido’s operations. There are no concealed fees or unexpected charges; all costs are made explicit to borrowers prior to application.

Eligibility for No-Requirement Loans in the Philippines

To access a personal loan with no requirements in the Philippines, borrowers generally need to meet these general criteria:

- Age: Borrowers should fall within the age range of 18 to 65 years old.

- Stable Income: Proof of income that is sufficient to cover monthly loan payments is a fundamental prerequisite.

- Employment: Borrowers must demonstrate stable employment, typically for a minimum of six months, or they can opt for self-employed status.

- Documentation: A valid government ID is mandatory, with acceptable forms including TIN, Passport, PRC, UMID, SSS, Driver’s License, or Postal Identification Card. Additionally, some lenders may require proof of income, such as Income Tax Return (ITR), pay slips, or salary slips.

Tips for Increasing Loan Approval Chances

Borrowers seeking to enhance their likelihood of loan approval should consider these pragmatic tips:

- Compare Offers: A prudent approach involves evaluating loans offered by different providers. Factors to assess include loan amount, interest rate, repayment period, and the overall ease of the loan application process.

- Document Preparation: Ensuring that all documents are up-to-date and accurately reflect one’s financial capacity is pivotal.

- Valid IDs: Furnishing valid and current identification documents is a non-negotiable requirement.

- Accurate Application: Completing the loan application form with precision is essential to expedite the process and minimize errors.

- Borrow Realistically: Prudent borrowing entails only acquiring what can be comfortably repaid, safeguarding one’s financial well-being.

- Income Proof: Providing compelling evidence of financial capacity is critical. For self-employed individuals, furnishing a copy of their Income Tax Return (ITR) is often a requisite.

- Communication: Proactive engagement with lenders can signify commitment and reliability. Being open to dialogue and inquiry can positively impact the approval process.

Factors to Consider When Choosing a Lender

Beyond the rudimentary factors such as interest rates and fees, borrowers should contemplate additional factors when selecting a lender. Each borrower possesses unique objectives and financial circumstances, which can necessitate specific considerations:

- Flexibility: The ability of a lender to accommodate individual needs and circumstances is of paramount importance. A lender that is compassionate and willing to work with borrowers to meet their requirements is a valuable asset.

- Customer Support: A responsive and empathetic customer support team can make a significant difference in the borrower’s experience. Effective communication can alleviate concerns and facilitate a smoother borrowing process.

- Reputation and Reliability: A lender’s reputation is indicative of their trustworthiness. Conducting due diligence to ascertain a lender’s standing in the industry is a prudent step.

- Transparency: The lender’s website should offer comprehensive information, including SEC registration, physical office locations, and other essential details. Digido, for instance, readily provides this information, enhancing transparency and trust.

Beware of Scammers

While the accessibility of online loans surpasses that of traditional bank loans, borrowers must exercise vigilance and discernment. Legitimate lenders will conduct verification processes to confirm the borrower’s identity and qualifications. Consequently, borrowers should be cautious of any lender claiming to offer loans without any requirements, as such assertions may be indicative of fraudulent activity. Instead, individuals should prioritize improving their credit history by collaborating with reputable companies and vigilantly avoiding defaults.

Conclusion

In periods of financial urgency and exigency, no-requirement loans emerge as a beacon of hope, offering rapid access to funds for diverse needs. Digido Loan, as a certified and trustworthy lender, stands out as an exemplary choice in the Philippines. It distinguishes itself with a streamlined application process, transparent terms, and a commendable approval rate. However, it is imperative to underscore the importance of responsible borrowing, as financial prudence remains the linchpin of long-term fiscal well-being.

12. FAQ

- Are loans without requirements legal? Yes, loans without requirements are legal when offered by duly registered and licensed lenders, overseen by the Securities and Exchange Commission (SEC) to ensure lawful and equitable operations.

- What is the most important requirement in a loan application? Proof of income and a valid government ID are fundamental prerequisites for most no-requirement loan applications.

- How do I know if my online lending is legit? Borrowers can verify the legitimacy of a lender by contacting the Securities and Exchange Commission (SEC) for confirmation.

- Should I trust online lenders? Online lenders can be trusted, provided they are legitimate and possess a reputable track record. Their loans are as safe as those offered by established banks.

- What happens if you don’t pay back the loan? Defaulting on a personal loan can result in penalties and can negatively impact one’s credit history, making responsible repayment essential for financial stability.