Discover the latest 2025 List of BIC or Bank Swift Code in the Philippines. Our comprehensive guide provides the complete list of BIC / SWIFT Code for major banks in the country including BDO, Metrobank, BPI, PNB, Security Bank, Landbank, Union bank, RCBC, and more.

If you frequently transfer or receive money abroad, it’s crucial to connect your local bank account with your international provider accurately. Knowing the correct Swift code of your Philippine-based bank comes in handy to ensure successful crediting of the money you’re transferring. Fret no more as we present the updated bank SWIFT Codes below.

Bank Swift Code in the Philippines Updated List 2025

As of 2025, the SWIFT codes of all major commercial banks in the Philippines can be found below, including BDO, Metrobank, BPI, PNB, Landbank, Security Bank, Union Bank, China Bank, RCBC, Eastwest Bank, and PS Bank. This updated list provides the SWIFT codes for the banks mentioned, which are necessary for international transactions and money transfers.

| BANK | SWIFT Code |

|---|---|

| AL-Amanah Islamic Investment Bank of the Philippines | AIIPPHMM |

| Allbank | ALKBPHM2 |

| AUB (Asia United Bank Corporation) | AUBKPHMM |

| Asian Development Bank | ASDBPHMM |

| ANZ (Australia and New Zealand) Banking Group Limited | ANZBPHMX |

| Bangko Sentral ng Pilipinas | PHCBPHMM |

| Bank of America | BOFAPH2X |

| Bank of China | BKCHPHMM |

| Bank of Commerce | PABIPHMM |

| BDO (BDO Unibank, Inc.) | BNORPHMM |

| BPI (Bank of the Philippine Islands) | BOPIPHMM |

| Cathay United Bank Co. LTD. – Manila Branch | UWCBPHMM |

| Chinabank (China Banking Corporation) | CHBKPHMM |

| CIMB Bank Philippines, Inc. | CIPHPHMM |

| Citibank, N.A. – Makati Branch | CITIPHMX |

| Citibank, N.A. – Manila Branch | CITIPHMXTSU |

| Citibank, N.A. – Cebu Branch | CITIPHMXCBU |

| CTBC Bank (Philippines) Corporation | CTCBPHMM |

| DBP (Development Bank of the Philippines) | DBPHPHMM |

| Deutsche Bank AG | DEUTPHMM |

| Eastwest Bank (East West Banking Corporation) | EWBCPHMM |

| Eastwest Rural Bank, Inc. | EAWRPHM2 |

| First Commercial Bank, Ltd., Manila Branch | FCBKPHMM |

| HSBC (Hongkong and Shanghai Banking Corp. Manila Head Office) | HSBCPHMM |

| HSBC (Hongkong and Shanghai Banking Corp. Cebu Branch) | HSBCPHMMCEB |

| JPMorgan Chase Bank, N.A. | CHASPHMM |

| Land Bank of the Philippines | TLBPPHMM |

| Maybank Philippines, Inc. | MBBEPHMM |

| Metrobank (Metropolitan Bank and Trust Co.) | MBTCPHMM |

| PBCom (Philippine Bank of Communications) | CPHIPHMM |

| Philippine Veterans Bank | PHVBPHMM |

| Philtrust Bank (Philippine Trust Company) | PHTBPHMM |

| PNB (Philippine National Bank) | PNBMPHMM |

| PNB (Philippine National Bank)- Treasury Operations | PNBMPHMMTOD |

| Philippine Business Bank | PPBUPHMM |

| PSBank (Philippine Savings Bank) | PHSBPHMM |

| RCBC (Rizal Commercial Banking Corporation) | RCBCPHMM |

| Robinsons Bank Corp. | ROBPPHMQ |

| Security Bank Corp. | SETCPHMM |

| Standard Chartered Bank | SCBLPHMM |

| Standard Chartered Bank – Custodial Dept. | SCBLPHMMEQI |

| Sterling Bank of Asia, Inc. | STLAPH22 |

| UCPB (United Coconut Planters Bank) | UCPBPHMM |

| Unionbank (Union Bank of the Philippines) | UBPHPHMM |

| United Overseas Bank Limited | UOVBPHMM |

What is SWIFT Code?

SWIFT Code, or Society for Worldwide Interbank Financial Telecommunication, is a system that enables safe and secure financial services worldwide. Through this network, banks can communicate with each other from anywhere in the world to facilitate access, integration, identification, analysis, and regulatory compliance. One of the primary functions of a bank SWIFT code is to ensure that transactions are processed securely, accurately, and efficiently. It does this by establishing and enforcing global standards for financial communication. This helps to ensure that the banks utilizing the system are compliant with regulatory requirements.

Known by different names like Business Identifier Code, BIC, SWIFT-BIC, or SWIFT ID, a SWIFT code typically consists of 8 to 11 characters of alphanumeric code. It usually begins with four letters to identify the bank, followed by two letters for the country code, and then two to three letters or digits for the branch code.

How to Use SWIFT Code?

If you’re an OFW, freelancer, professional, or anyone who needs to wire transfer money abroad to a local bank account, knowing how to use SWIFT code is essential. SWIFT code plays a critical role in ensuring that your money transfer is processed securely and efficiently.

To use SWIFT code, you need to have the recipient’s bank name, account name, account number, SWIFT code, and the amount being transferred. The bank name is the name of the bank where the recipient maintains their account. The account name is the name of the account holder in whose name the account is held, and the account number is the unique number assigned to the recipient’s account by their bank.

Once you have these five pieces of information, you can initiate the wire transfer. The transfer is then processed within the SWIFT network, and the SWIFT code ensures that the transfer is routed correctly to the recipient’s bank. This network is incredibly reliable, thanks to the strict standards and security measures that SWIFT has set in place.

It’s worth noting that some banks may have multiple SWIFT codes, depending on their location or the specific services they offer. It’s important to ensure that you have the right SWIFT code for the specific bank branch where the recipient holds their account to avoid any delays or errors in processing the transfer.

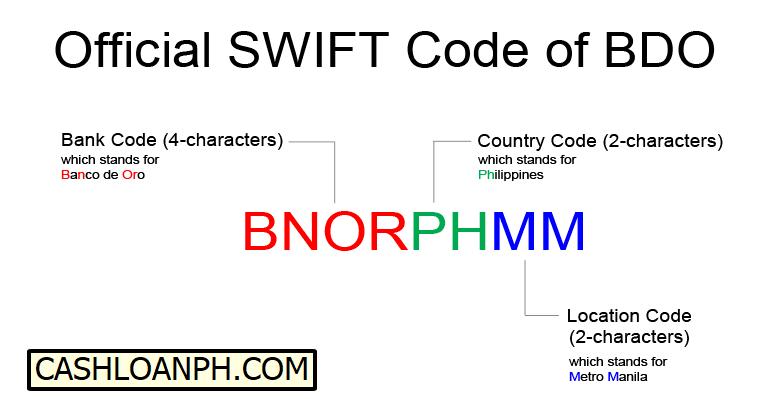

Bank SWIFT Code follow the following format

If you’re not familiar with SWIFT code or are new to using it, it’s useful to understand the structure of the code and what it represents. In essence, the SWIFT code follows a specific format, as you can see in the example given of BDO’s SWIFT code: BNORPHMM.

- The first four letters of the SWIFT code represent the bank code. This code identifies the specific bank that the code corresponds to. The bank code for BDO is BNOW, and the four letters BNOR in their SWIFT code represents the bank code.

- The next two letters of the code represent the country code, which indicates the country where the bank is located. In the case of BDO, PH indicates the country code for the Philippines.

- The following two letters or two digits indicate the location code, which identifies the exact location of the bank branch. In BDO’s SWIFT code, the location code MM refers to the bank’s location in the Makati Central Business District.

- Finally, the last three letters of the code represent the branch code, which identifies the specific branch of the bank. In BDO’s case, the last three characters are simply MM, which does not correspond to a specific branch code.

By understanding the different components of a SWIFT code, you can easily identify the specific bank, location, and branch that a code corresponds to. This can be useful in ensuring that you have the correct SWIFT code for the bank transaction you’re conducting.

What to Do If You Entered the Wrong SWIFT Code?

Having entered an incorrect bank Swift Code, one might face the potential of getting charged additional fees. Despite the fact that the funds may not be transferred to the wrong recipient, it is imperative that you inform your money sender at the earliest possible opportunity to prevent more dire issues from arising.

Ensuring that you have the correct BIC or bank Swift code prior to sending the money to the designated account receiver or local bank account is crucial to avoid any form of penalties or failed fund transfer.

These measures can help safeguard your financial interests while ensuring you don’t encounter any unnecessary obstacles along the way.

![List of Bank Swift Code in the Philippines [Latest Update] 2025 List of Bank Swift Code in the Philippines [Latest Update] 2025](https://cashloanph.com/wp-content/uploads/2023/05/bank-swift-code-philippines-cashloanph-730x400.png)

![Philtrust Bank Exchange Rate Today [Latest Update] Philtrust Bank Exchange Rate Today [Latest Update]](https://cashloanph.com/wp-content/uploads/2023/05/philtrust-bank-exchange-rate-today-cashloanph-438x246.jpg)