Are you in need of an urgent loan? Do you need extra cash to cover up some of your unexpected expenses? Worry no more! Cashwagon Philippines is here to help you with their fast and convenient loan services.

| Online Loan App | CashWagon PH |

| Loan Amount | up to 40,000PHP |

| Loan Term | up to 180days |

| SEC Reg. No. | CS201718196 |

Cashwagon provides quick online cash loans of up to PHP 40,000 for all your needs. With Cashwagon, you can apply for a loan on the go at any time and from anywhere in the Philippines. Their financial services are specifically tailored to fulfill the everyday financial needs of Filipinos in an innovative way.

Is Cashwagon PH legit?

Yes, Cashwagon Philippines (Cashwagon PH) is a legitimate online loan app that operates in the Philippines. It is registered with the Securities and Exchange Commission (SEC) and is under the supervision of the Bangko Sentral ng Pilipinas (BSP).

Cashwagon aims to provide Filipinos with quick cash loans through a secure and transparent lending process. It also follows strict data privacy policies, ensuring that personal and sensitive information of clients are kept confidential as required by law.

However, it is still essential to read and understand the loan terms and conditions before applying to make informed decisions regarding loan applications.

Why Choose Cashwagon?

Cashwagon offers numerous advantages to its customers, making it the most preferred loan provider in the Philippines.

Easy Application Process

The cash loan application process with Cashwagon is easy and simple. To apply, all you need to do is download and install the Cashwagon app on your smartphone or tablet. Complete the application form by filling in your personal details and submit the required documents. Once done, your application will undergo review.

Fast Approval

Cashwagon’s review process takes only 20 minutes or less, and you will receive an SMS on your loan status. Upon approval, the loan amount will be credited to your bank account on the same day.

High Loan Limits

With Cashwagon, you can apply for loans up to PHP 40,000. This high loan limit makes it an ideal option if you need to cover up some emergencies or require funds for significant expenses.

Flexible Repayment Terms

Cashwagon provides flexibility in loan repayment through its extended loan tenure of up to 6 months (180 days), thus making it more convenient for borrowers.

Competitive Interest Rates

Cashwagon offers lower interest rates compared to traditional financial institutions. They offer an interest rate of 12% per month, with a maximum annual percentage rate (APR) of 144%, which is much lower than that offered by banks and other financial institutions.

Transparency in Fees and Interest Rates

Cashwagon does not hide additional fees or charges from its customers. Their fees and interest rates are entirely transparent, and you can get them by downloading its app.

Cashwagon’s Loan Calculator

Cashwagon offers a loan calculator feature that enables borrowers to determine the total interest and monthly repayments depending on the loan amount and the repayment tenure. You can utilize this tool to evaluate what you owe, how feasible it is to repay, considering your earnings and expenses.

Special Promotions

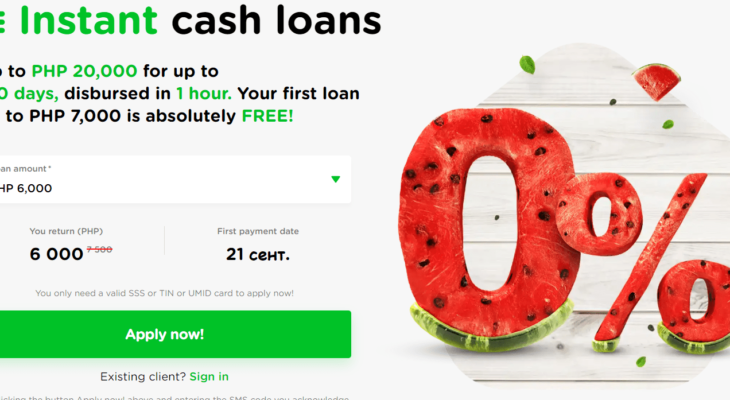

Cashwagon also offers exclusive deals and discounts, such as 0% interest and 0% service fee for first-time borrowers. Through these offers, you can save a substantial amount of money while repaying your loan.

High-security Standards

Cashwagon ensures the security of your personal information and your loan application. They employ SSL (Secure Sockets Layer) encryption and 24/7 monitoring to ensure that your data and activity remain secure.

Cashwagon: Your Best Option for Fast and Hassle-free Loans

Cashwagon is an innovative platform that provides fast, easy, and secure online loans to customers in the Philippines. With fast approval and disbursement times, transparent fees, and competitive interest rates, Cashwagon is the ideal option for borrowers looking to fulfill their financing needs instantly.

The best part is, Cashwagon’s financial services are designed to cater to your financial emergency needs in the most user-friendly, expedient manner possible. Anyone can apply for their fast online cash loan or credit cash with the Cashwagon app. The primary requirements are a valid ID-card (SSS or TIN or UMID), to be a Filipino national, aged between 20-60 years, and an active bank account.

How to apply for a Cashwagon loan?

Applying for a Cashwagon loan is simple and straightforward. Here are the steps you need to follow:

- Download the Cashwagon app on Google PlayStore

- Create an account, and fill out personal information such as name, address, contact details, and employment information.

- Choose the loan amount and repayment terms that suit your financial capacity, and upload the required documents such as ID, payslip, or proof of billing.

- Wait for the application approval, and once approved, you will receive the funds in your bank account or through cash pick-up.

Tips on managing your Cashwagon loan

While it could be tempting to take out a loan, it is essential to make sure that you can repay it on time to avoid additional charges and penalties. Here are some tips on managing your Cashwagon loan:

- Set a realistic repayment schedule and stick to it

- Do not borrow more than you can afford to repay

- Avoid taking out multiple loans at the same time

- Keep track of your loan repayment status through the Cashwagon app

- If you experience any difficulties in repaying the loan, it is best to contact Cashwagon’s customer support team to seek guidance and discuss a possible repayment plan.

Conclusion

Cashwagon is among the fastest and most convenient loan providers in the Philippines. They offer competitive interest rates, high loan limits, flexible repayment terms, and expedition reviews on your application.

Cashwagon has set itself apart from traditional financial institutions by providing fast and easy access to online loans with transparent fees and competitive interest rates. Their services are trustworthy, user-friendly, and secured, providing an excellent experience for first-time borrowers or anyone in need of an immediate cash loan. With Cashwagon, you can solve your financial emergencies on the spot, helping you get back on track in no time.