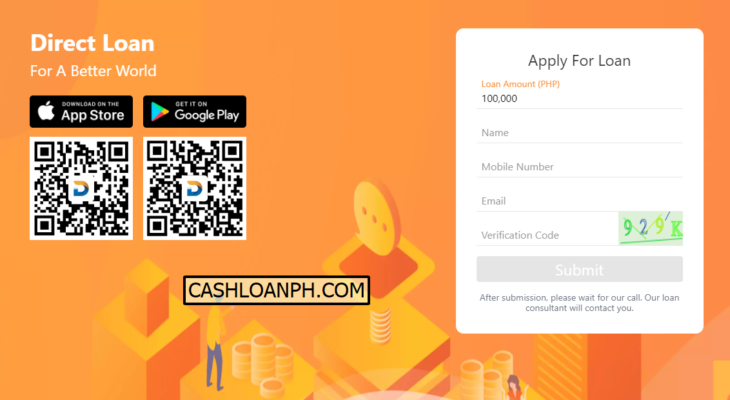

DirectLoan PH is a peso loan app for Filipinos by iDIRECT FINANCE COMPANY, INC. This loan app is your partner for a cash loan online up to PHP 100,000. DirectLoan PH provides convenient and friendly credit loan service to Filipinos. Easy loan application, get funding in pesos, and make your family life better in the Philippines.

| Loan Name | DirectLoan App PH |

| Loan Company | iDIRECT FINANCE COMPANY, INC |

| SEC REG NO. | 2021080023709-02 |

| Loan Amount | up to PHP 100,000 |

Sa mga Pilipinong naghahanap ng mapapautang lalo na kung emergency o anumang pangangailangang pinansyal, huwag mag-alala dahil nandito ang DirectLoan PH na handang tumulong sa iyo.

MAG-LOAN SA WEBSITE DIRECTLOAN PH

About DirectLoan PH

DirectLoan PH provides safe and secure loan service to Filipinos based on mobile internet security technology and big-data analysis innovation. Easy loan online application, get funding in pesos, and make your family life better in the Philippines.

Why choose DirectLoan PH

DirectLoan PH is a convenient peso online loan App in Filipino, that offers all the basic features available in any other loan app:

- Simple, Easy and Fast process: Receive your loan for as fast as 3 minutes after approval.

- Easy Approval and fast lending.

- Low Interest Rates on loans.

- High Loan Amount: Loan up to ₱ 100,000.

- Long-term Payment Options: Repayment term of up to 12 months with 12 installment payments.

- Repayment by Installments.

DirectLoan PH’s Product Introduction

- Loan Amount: ₱ 5,000.00 – ₱ 100,000.00

- Loan Term: 91 days (shortest, including renewal time) – 365 days (longest, including renewal time)

- Maximum APR : 30% per year

- Disbursement Fee: 0

- Other Fees: we will charge one time Processing Fee, Guarantee Fee (per month), Service Fee (per month). Minimum 0%, Maximum 5%

Example Fee:

- 180-day loan with interest rate of 12%, and principal amount is 20000

- Interest: 20000*12%= ₱ 2400

- Processing Fee: 0.2% 20000*0.2% = ₱ 40

- Service fee: 0.2% per month, 10000*0.2%*6 = ₱ 240

- Guarantee Fee: 0.2% per month, 10000*0.2%*6 = ₱ 240

- Total payment is ₱ 22920 (20000*12%/12*6 + 20000*0.2% + 10000*0.2%*6 + 10000*0.2%*6 )

Conditions for applying for a DirectLoan PH

DirectLoan PH is one of the online loan app for Filipinos. DirectLoan PH requirements:

- You are over 18 years old;

- You are a resident of the Philippines;

- You have a valid mobile phone number;

- Work With Stable Income;

- You have 2 Valid ID.

- You must have an active bank account.

DirectLoan PH will increase the limit and loan period based on your credit score! The more data you provide, the higher your credit score.

DirectLoan app PH provides instant personal loan help for your urgent cash needs.Our fast cash loan has the automation function online, only 2 Valid ID is needed, which offers you loan in as fast as 3 minutes after approval. DirectLoan PH provides you a quick loan approval and strive to be the best loan app.

Easy Steps to Apply for Loan At DirectLoan PH

- Step 1: Download Direct Loan app (Go to Googleplay or Appstore, download Direct Loan App or DOWLOAD HERE), register an account and login.

- Step 2: Type in your complete and relevant information.

- Step 3: Select loan amount and payment term.

- Step 4: Wait for approval and loan disbursement.

FAQ About DirectLoan PH

What is an OFW loan in Philippines?

As an OFW (Overseas Filipino Worker) in the Philippines, if you take out a loan online, it’s important to ensure that you have a solid plan in place to repay it. Just like for any other borrower, if you fail to repay your loan, the lender may take several actions to collect the debt, including sending reminders, reporting the default to credit bureaus, hiring a collection agency, or taking legal action.

It’s also important to be aware of the potential risks of borrowing from unscrupulous lenders, especially if you’re abroad. Before taking out a loan, make sure to thoroughly research the lender and understand the terms and conditions of the loan agreement. If you’re in any doubt, it’s best to seek the advice of a financial expert.

Is DirectLoan App PH legit or not?

If you are asking is DirectLoan PH legit, you can be sure that the company is operating legally. DirectLoan App PH is SEC registered and is certified for this purpose. Its SEC Company Name: iDIRECT FINANCE COMPANY, INC; Its SEC Registration number is 2021080023709-02 and its Certificate of Authority number is F-21-0010-64. (Check SEC)

Legal ba ang online loan sa Pilipinas?

Ang mga online lending company sa Pilipinas ay dapat na nakarehistro at may lisensya ng Securities and Exchange Commission (SEC) sa halip na Bangko Sentral ng Pilipinas (BSP). Kinakailangan silang kumuha ng Certificate of Authority (CoA) bago sila makapag-alok ng mga pautang.

| 46 | iDIRECT Finance Company Inc | 2021080023709-02 | F-21-0010-64 | Direct Loan |

How much can I borrow?

DirectLoan PH offer loans online up to PHP 100,000. New borrower can loan at least PHP 5,000, repeat borrowers in good credit are automatically approved and have the opportunity to increase your credit limit up to PHP 100,000. Please repay on time and keep your good credit to get higher amount, longer duration and lower intrest.

How to Repay DirectLoan PH?

- Step 1: Find your DirectLoan PH’s repayment order.

- Step 2: Enter the repayment amount and choose to repay in Philippines or elsewhere.

- Step 3: Select a payment method,repay with your Skywallet/P-wallet balance, or repay with the QRCode in 7-11, FamilyMart, OKMart,Hilife, or repay with the contract NO. at M Lhuillier, RD, or repay in Gach and Bank account.

What happens if I don’t pay my online loan in Philippines?

If you fail to pay your online loan in the Philippines, the lender may take several actions to collect the outstanding amount. These may include:

- Sending reminders or notifications through phone, email, or mail

- Reporting the loan default to credit bureaus, which can negatively impact your credit score

- Hiring a collection agency to recover the debt

- Taking legal action, such as filing a lawsuit or wage garnishment

It’s important to communicate with the lender and try to come to a mutually agreeable solution, as failing to repay a loan can have serious consequences for your financial standing.

Contacts DirectLoan PH

You can contact the customer service of the iDirect Finance Company, Inc at

- Office Address: 26th Floor The Podium West Tower ADB Ave Ortigas Center Mandaluyong City.

- Tel: (+63) 926-623-8333 PH or (+886) 958-074-148 TW

- Email: [email protected]

- Website: www.directloan.ph

- Facebook: facebook.com/iDirectFinance