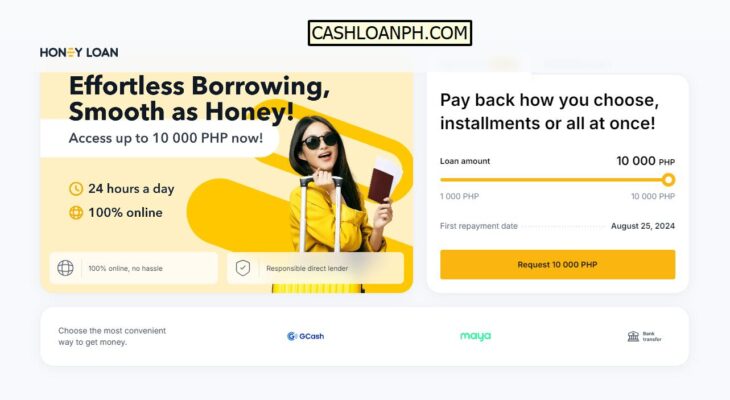

Honey Loan is a trusted online lending platform in the Philippines, dedicated to providing quick and convenient loans to help you manage unexpected expenses. With a focus on simplicity, speed, and convenience, Honey Loan ensures a seamless lending experience for its customers, making it easier than ever to access the funds you need.

Warm Cash Lending Corp.

Unit 10-C, 10th Floor, PDCP Bank Center

V.A. Rufino Corner Leviste Street, Salcedo Village,

Makati City, Philippines

SEC Registration No. 2021030009095-02

Certificate of Authority No. 3472

1. What Does Honey Loan Offer?

Honey Loan offers a range of loan amounts starting from PHP 1,000 up to PHP 30,000, with flexible payment terms extending up to 6 months. Their streamlined online application process allows you to apply for a loan using your smartphone or laptop, receive approval in just minutes, and have the funds transferred directly to your e-wallet or bank account.

2. Why Choose Honey Loan?

Easy Sign-Up Process:

Honey Loan’s platform is accessible from any mobile device or computer. Simply visit HoneyLoan.ph, fill out basic information about yourself, and submit your loan application online. The process is designed to be user-friendly, allowing you to apply for a loan with minimal effort.

Fast and Reliable Service:

Honey Loan understands the urgency of financial needs. They review your application in minutes and transfer the approved funds instantly, ensuring that you receive the money when you need it most.

Convenient Payouts:

With Honey Loan, you can easily withdraw and deposit your money through any of their partner channels nationwide, making the process as hassle-free as possible.

Secure and Confidential:

Your personal information is safeguarded with top-tier security measures. Honey Loan complies with the Data Privacy Act, ensuring that your data is protected at all times.

3. How to Apply for a Loan with Honey Loan

Applying for a loan with Honey Loan is straightforward and user-friendly:

- Create an Account or Sign In:

If you’re a new customer, start by creating an account. Existing customers can simply sign in to their accounts. - Complete the Application Form:

Provide your personal details and submit a valid ID along with a selfie for verification purposes. - Await Loan Application Decision:

You’ll receive an SMS notification regarding your application status. Honey Loan may contact you if additional information is required. - Receive Your Money:

Once approved, the loan amount can be claimed via e-wallet or bank account transfer. Make sure the bank account is registered in your name.

4. How to Repay Your Loan with Honey Loan

Repaying your loan is just as easy as applying for it. Honey Loan offers multiple repayment options:

- Sign In to Your Account:

Access your account by clicking the sign-in button at the top of the page using the mobile number you registered with. - Confirm Your Sign-In:

After proceeding, you’ll receive an SMS with a confirmation code. Enter this code in the required field to access your account. - Select Repayment Method:

Within your Honey Loan account, you can choose either the “Make Full Repayment” or “Make Minimum Payment” option, depending on your financial situation. - Complete the Payment:

Payments can be made via e-wallet, online banking, or over-the-counter at partnered establishments.

5. Frequently Asked Questions (FAQ) About Honey Loan

5.1. Is Honey Loan a Registered Company?

Yes, Honey Loan operates under Warm Cash Lending Corp., a SEC-registered entity with the necessary licenses to offer lending services in the Philippines. Their transactions are safe and regulated by relevant authorities, providing peace of mind to their customers.

5.2. Is Honey Loan an International Company?

Honey Loan is part of EcoFinance, an international financial technology company. EcoFinance has issued over 350 million EUR in loans and has served more than 4 million customers across Europe and Southeast Asia.

5.3. How Does Honey Loan Protect My Personal Information?

Honey Loan uses cutting-edge technology to protect your personal and financial information. They adhere strictly to privacy policies and regulations, including internal policies designed to keep your data secure around the clock.

5.4. Is My Data Shared with Third Parties?

Honey Loan is committed to protecting your privacy and personal data. They comply with Republic Act No. 10173, also known as the Data Privacy Act of 2012, as well as its implementing rules and regulations. For more details, you can review their Privacy Policy.

5.5. How Do I Contact Customer Service?

You can reach Honey Loan’s customer service team by calling their support center at (02) 8876-1972 during working hours (8:00 AM to 5:00 PM). Alternatively, you can email them at [email protected] 24/7 for assistance.

5.6. What is the Loan Interest Rate?

Interest rates at Honey Loan vary based on the loan amount and term. To receive a personalized offer, you’ll need to complete the loan application form on their website.

5.7. How Much Can I Borrow?

Eligible borrowers can be approved for loan amounts ranging from PHP 1,000 to PHP 30,000, depending on their financial profile. First-time customers can borrow between PHP 1,000 and PHP 10,000, while repeat customers can access up to PHP 30,000.

5.8. What is the Loan Term?

Honey Loan offers a flexible repayment schedule that caters to various borrower needs. Loans can be repaid over a term of up to 6 months (182 days), with the option to repay earlier if desired.

5.9. How Do I Repay My Loan?

Loan repayments can be made using Dragon Pay, GCash, or bank transfers through your preferred online banking solution.

5.10. What Happens If I Miss a Payment?

Missing a payment will result in a late fee and could negatively impact your credit score. Honey Loan encourages borrowers to contact their customer service team in advance to discuss potential solutions.

5.11. How Can I Get a Higher Loan Amount?

The amount approved for your loan depends on various factors, including your income and repayment history. By making timely payments on current loans, you may qualify for higher loan amounts in the future.

5.12. What is the Loan Application Process?

The application process is simple:

- Visit the Honey Loan website at honeyloan.ph.

- Complete the online application form with your personal and financial information.

- Submit the required documents.

- Wait for approval, which usually takes just a few minutes.

5.13. How Long Does It Take to Get Approved for a Loan?

Loan approval typically takes just a few minutes after you’ve submitted all the necessary information. In rare cases, it may take up to 24 hours.

5.14. Can I Apply for a Repeat Loan?

Yes. Once you’ve successfully repaid your first loan, you can apply for a new loan the same day. Repeat customers may also qualify for an increased loan limit of up to PHP 30,000, with the application process taking only a few seconds.

5.15. Can My Application Be Rejected?

Honey Loan follows responsible lending practices. Each application is carefully evaluated according to their internal standards and required regulations to ensure customers receive the funds they need and can repay the loan on time without negatively impacting their finances.

5.16. Is There a Loan Application Processing Fee?

No, Honey Loan does not charge a fee for processing your loan application.

5.17. Who is Qualified for a Loan?

Filipino citizens aged 22 to 60 with a valid ID and a stable source of income are eligible to apply for a loan with Honey Loan.

5.18. What IDs Are Valid for Loan Applications?

You can apply for a loan with Honey Loan using any of the following valid IDs: UMID, PhilSys ID, Passport, SSS ID, or TIN ID. Ensure your ID is valid before starting the application process.

5.19. What Types of Loans Are Offered?

Honey Loan offers flexible loans to cater to various financial needs, whether personal, business-related, or for emergencies. The repayment schedule can be customized based on your preferences and financial situation.