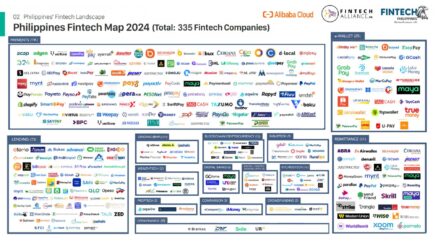

Gone are the days when obtaining a loan meant having to visit a bank or financial institution in person. With the advent of technology and the internet, online loans have become a popular alternative for many people looking to secure financing. In the Philippines, the online loan industry has grown significantly in recent years, offering quick and convenient access to funds for those in need.

However, as with any type of financial product, there are pros and cons to consider before applying for an online loan in the Philippines. In this article, we’ll take a closer look at the benefits and drawbacks of this type of lending so that you can make an informed decision about whether it’s the right choice for you.

The Advantages of Online Loans in the Philippines

One of the biggest benefits of taking out an online loan in the Philippines is the speed and ease with which you can obtain funds. Unlike traditional loan processes, which can take several days or even weeks to complete, online loans can often be approved and funded within a matter of hours. This is because the application and approval process is typically much simpler and quicker than with a traditional loan.

Another advantage of online loans is the increased accessibility they offer. Because you can apply for an online loan from the comfort of your own home, you don’t have to worry about traveling to a bank or financial institution during business hours. This is especially beneficial for those who live in rural areas or who have difficulty leaving their home due to health or mobility issues.

Online loans are also generally more affordable than traditional loans, with lower interest rates and fees. This is due in part to the increased competition in the online lending market, as well as the reduced overhead costs associated with digital lending.

The Disadvantages of Online Loans in the Philippines

While there are many benefits to taking out an online loan, there are also some potential drawbacks to consider. One of the biggest concerns with online lending is the risk of fraud and scams. With so many digital lenders operating in the Philippines, it’s important to be cautious and only work with reputable lenders who are fully licensed and regulated.

Another drawback of online loans is that they may come with higher interest rates than traditional loans. This is due to the higher risk associated with digital lending, as well as the lack of collateral and security measures.

Additionally, online loans may not be the best option for those with poor credit, as many digital lenders have strict credit requirements and may not approve applicants with low scores.

How to Choose the Right Online Loan for You

If you’re considering taking out an online loan in the Philippines, it’s important to do your research and carefully consider your options. Start by comparing the interest rates, fees, and repayment terms offered by different lenders to find the best deal for your needs.

It’s also a good idea to read reviews from other borrowers and to check the lender’s reputation and licensing status. You can do this by visiting the website of the Philippine Securities and Exchange Commission (SEC) and checking their list of registered lenders.

Finally, make sure you fully understand the terms and conditions of the loan before you sign any agreement. This includes the interest rate, repayment terms, and any fees or penalties associated with the loan.

You can apply for a loan 24 hours a day, seven days a week in the Philippines. Loans online with Digido are fast and reliable to meet some needs. Download App. Apply Online. Highlights: App Available, Providing Fully Automated Service.

Conclusion

Online loans are a quick and convenient option for those looking to secure financing in the Philippines. However, as with any type of loan, it’s important to consider the pros and cons and to do your research before making a decision. By following the tips and advice outlined above, you can find the right online loan for your needs and avoid potential drawbacks.

It’s important to remember that taking out an online loan should never be taken lightly. This type of financing should only be used as a last resort, and you should always make sure that you can repay the loan on time and in full. By doing your due diligence and being responsible with your finances, you can take advantage of the benefits of online loans while minimizing the risks.

In conclusion, online loans can be a useful and convenient option for those in need of quick financing in the Philippines. However, it’s crucial to do your research, compare your options, and fully understand the terms and conditions of the loan before making a decision. By taking these steps, you can find the right online loan that meets your needs and helps you achieve your financial goals.