Pautang Peso Loan is an esteemed online lending platform that aims to provide quick and convenient financial assistance to individuals in need. With a commitment to transparency and user satisfaction, Pautang Peso Loan has gained a reputation for its reliable services.

CashLoanPH will delve into the platform’s features, benefits, and legitimacy. If you’re considering applying for a loan through Pautang Peso Loan, read on to determine if it aligns with your financial needs and goals.

VISIT PAUTANG PESO LOAN WEBSITE

What is Pautang Peso Loan?

Pautang Peso Loan is an innovative online lending platform that strives to simplify the borrowing process. The platform offers personal loans to eligible individuals, catering to a diverse range of financial requirements. Whether you need funds for emergencies, education, medical expenses, or debt consolidation, Pautang Peso Loan aims to provide a solution.

How Pautang Peso Loan Works

- Streamlined Loan Application Process: Pautang Peso Loan ensures a user-friendly experience by offering a straightforward application process. To begin, prospective borrowers need to visit the Pautang Peso Loan website and create an account. Once registered, applicants can proceed to fill out the loan application form, providing accurate and essential personal and financial information. This step helps Pautang Peso Loan evaluate the applicant’s eligibility and assess their loan requirements effectively.

- Eligibility Criteria and Documentation: To qualify for a loan from Pautang Peso Loan, applicants generally need to meet specific eligibility criteria. These criteria typically include being of legal age, having a stable source of income, and possessing the necessary identification and proof of income documents. It is crucial to review and understand the specific eligibility requirements outlined by Pautang Peso Loan before initiating the application process.

User Experiences and Reviews

Customer feedback plays a vital role in evaluating the reliability and efficiency of any lending platform. Pautang Peso Loan has received positive reviews from many satisfied customers. Users appreciate the user-friendly interface, quick loan approval process, and convenient online application system. Additionally, borrowers highlight the responsive customer support team as a valuable asset of the platform.

One common aspect praised by users is the transparency of Pautang Peso Loan. Borrowers appreciate the platform’s clear communication regarding interest rates, fees, and repayment terms. This transparency allows borrowers to make informed decisions and better manage their finances. Furthermore, borrowers express satisfaction with the prompt disbursement of loan funds, enabling them to address their financial needs promptly.

Legitimacy of Pautang Peso Loan

Ensuring the legitimacy of any lending platform is crucial to avoid scams and fraudulent activities. Pautang Peso Loan is a registered and licensed lending platform, ensuring compliance with relevant regulations and industry standards. By adhering to responsible lending practices, Pautang Peso Loan provides a secure environment for users to conduct their financial transactions.

To verify the legitimacy of Pautang Peso Loan, potential borrowers can review the platform’s licenses and certifications, which are typically displayed prominently on the website. These credentials serve as proof of the platform’s commitment to providing reliable and trustworthy lending services.

Pros and Cons of Pautang Peso Loan

As with any lending platform, Pautang Peso Loan has its advantages and disadvantages. Understanding these aspects can help borrowers make an informed decision before committing to a loan. Here are some of the pros and cons of Pautang Peso Loan:

Pros:

- Quick and Simple Application Process: Pautang Peso Loan offers a streamlined application process, saving borrowers time and effort.

- Competitive Interest Rates: The platform provides competitive interest rates, ensuring borrowers can access funds at affordable terms.

- Flexible Repayment Terms: Pautang Peso Loan offers borrowers the flexibility to choose repayment durations that suit their financial situations.

- No Collateral Required: Borrowers can access funds without the need for collateral, making it an attractive option for many individuals.

Cons:

- Specific Eligibility Criteria: Pautang Peso Loan may have certain eligibility requirements that not everyone can meet. It is essential to review these criteria before applying.

- Potential Additional Fees or Penalties: Late or missed payments may result in additional fees or penalties, impacting borrowers’ credit scores and financial standing.

- Terms and Conditions: It is crucial to carefully review and understand the terms and conditions of the loan before accepting the offer from Pautang Peso Loan.

How to Apply for a Loan with Pautang Peso Loan

To apply for a loan with Pautang Peso Loan, follow these step-by-step instructions:

- Visit the official Pautang Peso Loan website.

- Choose an online leader and fill out the loan application form accurately, providing all the required personal and financial information.

- Submit the necessary documents, such as identification and proof of income, to support your loan application.

- Wait for the platform to evaluate your application and notify you of the loan approval status.

- If approved, carefully review the loan offer and terms before accepting it.

- Once you have accepted the offer, the loan funds will be disbursed to your designated bank account.

To enhance your chances of loan approval, ensure that you meet the eligibility criteria and provide all the necessary documents accurately. While a good credit history is helpful, Pautang Peso Loan considers applications from individuals with less-than-perfect credit scores as well.

Interest Rates and Repayment Terms

Pautang Peso Loan offers competitive interest rates based on factors such as creditworthiness, loan amount, and repayment term. During the loan application process, the platform clearly discloses these interest rates, empowering borrowers to make well-informed decisions.

Repayment terms with Pautang Peso Loan are flexible, allowing borrowers to select a duration that aligns with their financial situation. However, it is vital to note that late or missed payments can result in additional fees or penalties, potentially affecting credit scores and future loan applications. Timely repayments according to the agreed-upon schedule are crucial to maintaining a positive financial standing.

Pautang Peso Loan vs. Other Lending Platforms

When comparing Pautang Peso Loan to other lending platforms, it is essential to consider the unique features and benefits it offers. Pautang Peso Loan distinguishes itself with its user-friendly interface, efficient loan approval process, competitive interest rates, and commitment to customer satisfaction and transparency. These factors contribute to a positive borrowing experience for users.

However, it is always recommended to research and compare multiple lending platforms to find the one that best suits specific needs and requirements. Factors to consider in this evaluation include interest rates, loan terms, customer reviews, and overall reputation.

Safety and Security Measures

Pautang Peso Loan prioritizes the safety and security of its users’ information. The platform employs robust security measures to protect personal and financial data from unauthorized access. Furthermore, Pautang Peso Loan adheres to data protection regulations and privacy policies, ensuring the confidentiality of user information.

While Pautang Peso Loan maintains a secure online environment, it is essential for borrowers to exercise caution and follow best practices to safeguard their personal information. This includes being vigilant against phishing attempts or fraudulent activities and ensuring that all financial transactions are conducted through the official Pautang Peso Loan website.

Frequently Asked Questions (FAQs)

- Can I apply for a loan with Pautang Peso Loan if I have a bad credit score? Pautang Peso Loan considers applications from individuals with various credit histories, including those with less-than-perfect credit scores. Meeting the other eligibility criteria and providing accurate information are crucial factors in the loan approval process.

- How long does it take to receive the loan funds from Pautang Peso Loan? Once your loan application is approved, and you have accepted the loan offer, the funds are typically disbursed to your designated bank account within a few business days.

- Are there any hidden fees or charges with Pautang Peso Loan? Pautang Peso Loan maintains transparency in its fee structure, and any applicable fees or charges are disclosed during the loan application process. It is crucial to review the terms and conditions carefully to understand the associated costs.

- Can I repay my loan early without incurring any penalties? Pautang Peso Loan generally allows borrowers to repay their loans early without penalties. However, it is recommended to review the specific terms and conditions related to loan prepayment to ensure clarity.

- What happens if I miss a payment or make a late payment with Pautang Peso Loan? Late or missed payments with Pautang Peso Loan can result in additional fees or penalties. Timely repayments are crucial to avoiding any adverse consequences, such as a negative impact on credit scores.

Conclusion

Pautang Peso Loan offers a convenient and reliable lending platform for individuals seeking financial assistance. With its user-friendly interface, competitive interest rates, and flexible repayment terms, it has garnered positive reviews from borrowers. The platform’s legitimacy, adherence to responsible lending practices, and commitment to user satisfaction provide assurance to potential users.

Before applying for a loan with Pautang Peso Loan, it is crucial to carefully review the eligibility criteria, interest rates, and repayment terms. Understanding the associated costs and obligations is vital for making informed decisions. By using the platform responsibly, Pautang Peso Loan can serve as a valuable resource for meeting financial needs.

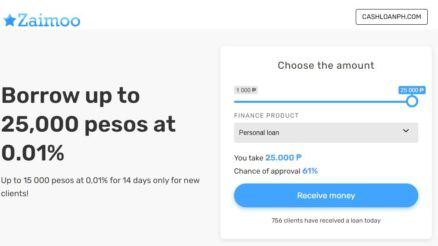

GET ONLINE LOANS IN THE PHILIPPINES UP TO PHP 25,000

Select online loans that come with the best terms and conditions, ensuring a card without any rejections. Numerous companies provide an initial loan at 0% interest and ensure swift money transfers, making them perfect for urgent financial needs.

| Lender | Loan Product Detail |

|---|---|

|

Finbro PH |

Hot - 0% first loan

|

|

LoanOnline |

Popular - 0% first loan

|

|

Honey Loan |

Hot Offer - 0% first loan

|

|

Cash-Express |

Express Loan - 0% first loan

|

|

Kviku |

New - 0% first loan

|

|

MoneyCat |

Fast Approve - 0% first loan

|