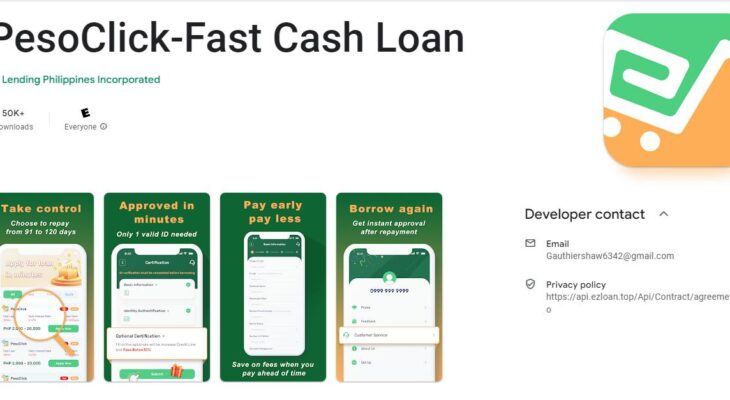

Financial needs can arise unexpectedly, leaving individuals searching for reliable and secure sources of quick cash. PesoClick understands the importance of providing a trustworthy and efficient online loan service to meet these demands in the Philippines.

As a licensed and regulated platform, PesoClick offers a seamless borrowing experience that prioritizes customer satisfaction and financial well-being. In this article, CashLoanPH will delve into the various features, loan information, fees, requirements, application process, repayment options, and essential details about PesoClick.

| Loan App | PesoClick |

| Loan Amount | up to PHP 20,000 |

| Loan Term | max 365 days |

| SEC Registration No. | CS201904471 |

Is PesoClick Loan Legit?

Yes, the PesoClick loan app is legit. PesoClick is registered with the Securities and Exchange Commission (SEC), with Registration No. CS201904471 and Certificate of Authority No. 2916. To verify this information, you may also visit the official SEC website.[

Moreover, PesoClick has a physical location that enforcement authorities can visit if necessary: 9F LENDING PHILIPPINES INC., Unit 2nd floor, Zeta bldg,Unit 2d,91 Sacedo Street, Legaspi Uillage, Makati City, Manila.

PesoClick Features

- Quick Approval Process: Time is of the essence when it comes to obtaining cash loans. PesoClick ensures a swift approval process, allowing borrowers to receive funds within as little as 24 hours. By providing a single valid ID and mobile number, applicants can expedite the loan release, providing a much-needed solution to their financial emergencies.

- Enhanced Security Measures: Protecting personal information is a top priority at PesoClick. The platform incorporates robust security protocols, employing encryption technology to safeguard user data. The “SAFER” system ensures that personal information is used solely for review and certification purposes, providing customers with peace of mind and reassurance about the security of their sensitive data.

- Easy Accessibility: PesoClick aims to simplify the loan acquisition process, ensuring accessibility for all applicants. Through strategic partnerships with ML and RD Pawnshop, PesoClick offers multiple sources for obtaining loans. This convenient approach allows borrowers to secure funds effortlessly, comparable to purchasing a refreshing cola.

- Personalized Assistance: Facing financial difficulties can be overwhelming, but PesoClick stands as a reliable friend ready to assist borrowers during challenging times. The platform boasts a dedicated and proficient team committed to providing personalized support and guidance. Whether borrowers have questions, concerns, or require additional assistance, PesoClick’s support team is available to offer prompt solutions.

PesoClick Loan Information

When considering a loan, it is crucial to be informed about the terms and conditions to make sound financial decisions. PesoClick provides the following loan information:

- Loan Amount: Ranging from PHP 2,000.00 to PHP 20,000.00, PesoClick offers borrowers the flexibility to choose an amount that suits their needs.

- Loan Term: PesoClick’s loan terms range from a minimum of 96 days (including renewal time) to a maximum of 365 days (including renewal time). This flexibility allows borrowers to tailor their repayment schedule to their individual circumstances.

- Maximum APR: The annual percentage rate (APR) represents the total cost of borrowing, including interest and fees. PesoClick maintains a maximum APR of 24%, ensuring transparency and fairness to borrowers.

Fees

Understanding the fees associated with a loan is essential for borrowers to make informed decisions. PesoClick incorporates a clear fee structure, including the following components:

- Service Fee: PesoClick charges a service fee ranging from a minimum of 10% to a maximum of 20%. This fee covers the administrative costs and services provided by the platform.

- Channel Fee: Certain repayment channels involve third-party providers who charge additional fees. Borrowers should be aware of these charges and consider them when selecting a repayment option.

- Transaction Fee: PesoClick does not impose any transaction fees, further enhancing the affordability and accessibility of the loan service.

PesoClick Example Calculation

To illustrate the cost breakdown, consider the following scenario: a borrower takes out a 360-day (12 months) loan with an interest rate of 24% and a principal amount of PHP 5,000.

- Total Interest Fee: PHP 5,000 * 24% = PHP 1,200

- Service Fee (10%): PHP 5,000 * 10% = PHP 500

- Total Repayment: PHP 1,200 + PHP 500 + PHP 5,000 = PHP 6,700

- Monthly Repayment: PHP 6,700 / 12 = PHP 558.34

PesoClick Requirements

To be eligible for a PesoClick loan, borrowers must meet the following requirements:

- Active Phone Number: Applicants should possess a working phone number for communication purposes.

- Valid Government ID: A valid government-issued identification card is necessary to verify the borrower’s identity and ensure legal compliance.

- Stable Income: Demonstrating a stable source of income assures PesoClick of the borrower’s ability to repay the loan.

- Age Between 18-49 Years Old: PesoClick caters to individuals aged between 18 and 49, aligning with legal requirements and responsible lending practices.

PesoClick Loan Application Process

PesoClick prioritizes a user-friendly loan application process, streamlining the steps to provide convenience and efficiency. The following steps outline the application process:

- Install PesoClick: Download the PesoClick app from your preferred app store and proceed with the installation.

- Registration: Register on the app using your own phone number, ensuring accuracy and easy communication throughout the loan process.

- Application Form: Fill out the peso loan application form, providing the necessary personal and financial information required for loan assessment.

- Loan Approval: After submitting the application, wait for PesoClick’s loan approval decision. Notifications will be sent through the app to keep borrowers informed.

- Loan Disbursement: Once the loan is approved, borrowers can claim their personal loan directly through the app, ensuring a quick and convenient disbursement process.

PesoClick Repayment Options

PesoClick offers multiple repayment options, allowing borrowers to select the most suitable method based on their preferences and convenience. The following options are available:

- M Lhuillier: Visit any M Lhuillier branch and complete the repayment form to settle the loan.

- 7-Eleven: Borrowers can conveniently repay their loan at any 7-Eleven store using the CLiQQ machine or CLiQQ app.

- GCash, Coins: Open the GCash or Coins app, click on “Pay Bills,” and choose the “Loans” option to initiate the repayment process.

- Bank Deposit: Borrowers can deposit the repayment amount directly into PesoClick’s corporate bank account, the details of which are provided within the app.

About PesoClick

PesoClick is operated by 9F LENDING PHILIPPINES INC., a trusted financial institution dedicated to providing secure and reliable lending services.

The company is registered under the Corporate Name 9F LENDING PHILIPPINES INC. with the Company Registration No. CS201904471.

Trading under the name PesoClick, the platform operates under the Certificate of Authority No. 2916. The company’s physical address is Unit 2nd floor, Zeta Building, Unit 2d, 91 Sacedo Street, Legaspi Village, Makati City, Manila. For further inquiries or assistance, PesoClick can be contacted via email at [email protected].

Conclusion

PesoClick stands as a reputable and secure online loan service, committed to providing a reliable borrowing experience in the Philippines. With its quick approval process, enhanced security measures, ease of accessibility, personalized assistance, and transparent fee structure, PesoClick ensures customer satisfaction and financial well-being.

By adhering to the provided loan information, understanding the associated fees, meeting the requirements, and following the straightforward application and repayment processes, borrowers can confidently fulfill their financial needs through PesoClick. Contact PesoClick today and experience the convenience, reliability, and efficiency of our online loan service.