If you’re looking for a quick-loan option in the Philippines and have come across PeraMuning, here’s a detailed and up-to-date guide that cuts through the jargon – covering how it works, what you should watch out for, and how to navigate it safely.

Understanding PeraMuning: What is it exactly?

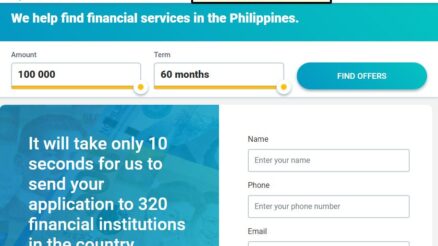

PeraMuning is not a direct lender, but a loan-comparison platform that connects you with partner lenders. You submit your information, they match you to available lenders, and you choose the offer that suits your needs best. Their process is known to be fast – typically taking only a few minutes to complete.

Key aspects:

- Borrowing range: usually ₱500 up to ₱20,000 or even ₱25,000, depending on the lender and your profile.

- Repayment term: mostly short-term loans, typically up to 6 months for smaller amounts.

- Interest rate: can vary widely, depending on the lender’s terms and your creditworthiness. Some may offer promotional rates for first-time borrowers.

- Requirements: Filipino citizen aged 18 years or older, valid government-issued ID, active bank account or e-wallet, and a stable source of income.

Essentially, PeraMuning lets you compare multiple loan options in one place, helping you find the most suitable one without having to apply to each lender individually.

Why some Filipinos turn to quick loans like PeraMuning 🙋♂️🙋♀️

Fast access

When emergencies strike – from hospital bills to urgent home repairs – a quick-loan service can be a lifesaver. PeraMuning’s partner lenders often release funds within hours of approval.

Minimal paperwork

Most online loan platforms skip the long queues and heavy document requirements. Usually, an ID and proof of income are enough to get started.

Convenience

You can apply anytime, anywhere using your smartphone – no need to visit a physical branch.

Flexible credit acceptance

Some partner lenders may accept borrowers with limited or poor credit history, giving them a chance to rebuild trust through smaller, short-term loans.

Important caveats & what to be careful about ⚠️

Higher borrowing costs

Quick loans are fast but can be expensive. Their convenience often comes with higher interest rates and service fees compared to traditional bank loans. Always check the total repayment amount before confirming any offer.

Short repayment periods

While banks might give you years to repay, quick-loan offers from platforms like PeraMuning usually require repayment within a few weeks or months. This can be tough if you don’t have a stable cash flow.

The fine print matters

Since PeraMuning works with various lenders, the actual loan agreement comes from the lender you choose. Read all terms carefully – including interest rate computation, late payment penalties, and hidden charges – before signing.

Beware of predatory lending

Some unregistered lenders may disguise themselves as legitimate partners. Always ensure your chosen lender is registered with the Bangko Sentral ng Pilipinas (BSP) or the Securities and Exchange Commission (SEC).

Borrow only what you can repay

Even if you’re offered ₱20,000 or more, take only what you truly need. Quick loans can become a debt trap if repayment is not well-planned.

Step-by-step: How to apply using PeraMuning

- Determine your needs – Know exactly how much you need and how long you’ll need it.

- Prepare your requirements – Have your ID, bank or e-wallet account, and income proof ready.

- Visit the PeraMuning website – Choose the amount and fill in the online application form.

- Compare offers – You’ll receive a list of lenders with various terms and interest rates. Compare carefully before proceeding.

- Select a lender and submit – Once you choose an offer, you’ll be redirected to that lender’s platform to finalize your application.

- Receive your funds – After approval, funds are usually sent directly to your account or e-wallet.

- Repay responsibly – Track your due dates and pay on time to avoid penalties and maintain a good credit record.

Tips to make the most of your loan 💡

- Borrow only what you absolutely need.

- Pick a repayment term that matches your income cycle.

- Set reminders for your due dates to avoid late fees.

- Always keep copies of your loan agreement and receipts.

- Avoid juggling multiple quick loans – this increases your financial risk.

- If you expect repayment trouble, contact the lender early to explore options instead of ignoring calls or messages.

Latest updates & trends in quick loans (2024-2026) 🚀

The Philippine online-lending landscape is rapidly evolving. Here are some notable trends and updates relevant to borrowers:

- Tighter regulation: The SEC continues to crack down on illegal and unregistered online lenders. Legitimate apps and platforms must display their registration details and provide transparent loan terms.

- More digital options: There’s an increasing number of online-only lenders offering instant approval through apps or websites. These services cater to the growing population of smartphone-savvy Filipinos.

- Integration with e-wallets: Quick-loan disbursement through GCash, Maya, and other wallets is becoming the norm, improving convenience and reducing transfer delays.

- Higher awareness campaigns: The government and private groups are promoting financial literacy to help Filipinos understand interest rates, avoid harassment, and manage repayments responsibly.

- Rise of comparison platforms: Just like PeraMuning, several other aggregators are emerging, helping users compare multiple lenders at once – a big help in finding better loan terms and avoiding scammers.

Is PeraMuning the right choice for you?

Let’s look at both sides of the equation:

👍 Pros

- Quick access to funds for emergencies.

- Fast, paperless application process.

- Lets you compare multiple offers before choosing.

- Suitable even for borrowers with limited credit history.

👎 Cons

- Can have high interest rates and processing fees.

- Short repayment terms increase repayment pressure.

- Some offers may come from smaller or lesser-known lenders.

- Not ideal for large or long-term financial goals.

If your need is urgent and short-term – for example, paying bills or covering a one-time emergency – PeraMuning may be a convenient choice. However, if you’re looking for a longer-term, lower-interest loan (e.g., for education or business expansion), a bank or cooperative loan might be more practical.

Better alternatives to consider 💬

While quick loans are helpful for emergencies, here are other safer and cheaper financing options:

- Personal loans from banks – Lower interest rates and longer repayment periods, but with stricter requirements.

- Credit card cash advance – Easy access if you already have a credit card, but comes with higher charges and interest.

- Cooperative or government loans – Organizations like Pag-IBIG or GSIS offer salary and emergency loans at low interest.

- Borrowing from family or trusted peers – Can be interest-free, but should still have clear repayment terms.

- Side gigs or freelance work – Increasing income can be a smarter long-term solution than constant borrowing.

Final thoughts: Borrow smart, not fast 🧠💰

Platforms like PeraMuning can be incredibly helpful when you’re facing a short-term cash crunch. But remember – convenience should not replace caution.

Before borrowing, ask yourself:

- Do I really need this loan right now?

- Can I comfortably repay it on time?

- Have I read and understood the full loan terms?

Taking a loan should be a strategic decision, not an impulse. With the right mindset, a quick-loan platform can be a stepping stone toward better financial flexibility – but without proper discipline, it can also become a burden.

Borrow responsibly, stay informed, and always put your long-term financial health first. 🌱