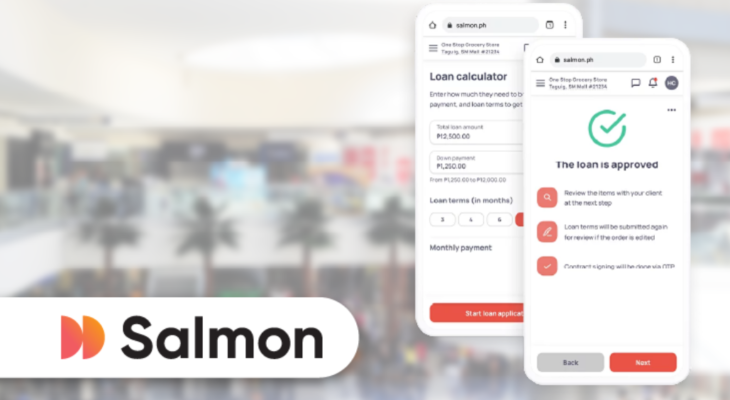

In the dynamic world of consumer finance, Salmon Installment emerges as a pioneering point-of-sale (POS) lending service, empowering Filipinos to defer payment and effortlessly spread the cost of their purchases over several monthly installments.

Launched in 2022 by distinguished banking and IT veterans Pavel Fedorov, George Chesakov, and Raffy Montemayor, Salmon Installment swiftly gained prominence as a reliable and customer-centric financing platform.

In this article, CashLoanPH will provide an in-depth exploration of Salmon Installment, encompassing its origins, modus operandi, eligibility requirements, benefits, and additional insights.

Unveiling Salmon Installment

Salmon Installment operates as a subsidiary of Fintech Holdings Ltd., a renowned entity fostering seamless access to financial products through its registered partners with the Securities and Exchange Commission (SEC). Among its esteemed partners are Sunprime Finance Inc., an online lending platform registered under SEC Reg. No. CS201916698, C.A. No. 1241, and FHL Financing Company, Inc., a service app registered under SEC Reg. No. 2022100071291-07, C.A. F-22-0038-29.

Meeting Eligibility Requirements

To avail a loan from Salmon Installment, applicants must fulfill the following criteria:

- Age: Be at least 18 years old, ensuring legal capacity for financial transactions.

- Identification: Possess a valid identification document, enhancing transparency and security.

- Employment: Be gainfully employed or self-employed, substantiating the capacity to meet repayment obligations.

- Credit Score: Maintain a commendable credit score, reflecting responsible financial behavior.

Embracing the Benefits of Salmon Installment

Salmon Installment presents a host of advantages for Filipinos seeking convenient and flexible financing options:

- Streamlined Application Process: Through the user-friendly Salmon website or mobile app, customers can effortlessly apply for a loan. The application process is efficient, allowing most applicants to receive a loan decision within a mere 10-15 minutes.

- Instant Funding: Once a loan is approved, customers swiftly receive the funds, facilitating prompt payment for desired purchases.

- Tailored Repayment Terms: Salmon Installment extends loan terms of 3, 6, or 12 months, empowering borrowers to choose a repayment duration that aligns with their financial capabilities and preferences.

- Competitive Interest Rates: Salmon Installment prides itself on offering competitive interest rates, tailored to each customer’s credit score and chosen loan term.

- Convenient Online and Mobile App Management: The intuitive online portal and mobile app streamline loan management, enabling borrowers to easily track payments, make timely repayments, and access reliable customer support.

Unveiling Additional Insights

- Salmon Installment Headquarters: Salmon Installment operates from its headquarters located in the vibrant city of Manila, Philippines, enhancing local accessibility.

- Expansive Merchant Partnerships: Salmon Installment has cultivated strategic alliances with over 30 reputable merchants, fostering collaborations with esteemed brands such as SM Store, Lazada, and Shopee, among others.

- Demonstrating Success: Since its inception, Salmon Installment has facilitated over 10,000 loans, attesting to its robust presence and extensive customer base.

- Loan Amount Limit: Salmon Installment accommodates a maximum loan amount of PHP 50,000, offering financial flexibility within reasonable bounds.

- Processing Fee: In alignment with industry standards, Salmon Installment levies a processing fee equating to 3% of the loan amount, ensuring seamless operational efficiency.

- Timely Repayments and Late Fees: Salmon Installment mandates monthly payments, with the exact amount contingent upon the loan amount, interest rate, and chosen loan term. Failure to adhere to repayment schedules will result in a nominal late fee of PHP 500, emphasizing the importance of responsible financial conduct.

Contacts

Fintech Holdings Ltd.

- Address: 2475-2476ResCo-work09, 24, Al Sila Tower, Adgm Square, Al Maryah Island, Abu Dhabi, , United Arab Emirates

- Email: [email protected]

- Facebook: https://www.facebook.com/salmonphilippines

- Instagram: https://instagram.com/salmon_philippines

Conclusion

Salmon Installment emerges as an ideal financial partner for Filipinos seeking a convenient and affordable solution to finance their purchases. With its streamlined application process, prompt funding, flexible repayment terms, competitive interest rates, and seamless online and mobile app management, Salmon Installment embodies the pinnacle of customer-centricity. As prudent financial decision-making entails understanding the intricacies of loan agreements, it is advisable for interested individuals to peruse and comprehend the terms and conditions presented by Salmon’s esteemed partner lenders.

To embark on an enriching journey with Salmon Installment, visit their comprehensive website or download their user-friendly mobile app. By embracing Salmon Installment, Filipinos can unlock the door to a world of accessible and convenient financial solutions tailored to their unique needs and aspirations.