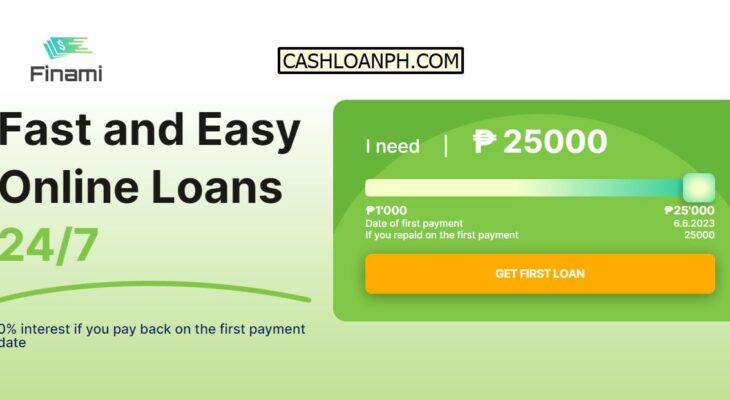

Are you in a financial bind and in need of cash fast? Look no further than Finami PH (Finami.ph) for your hassle-free solution to obtain quick cash. As an online loan platform, Finami PH is your one-stop-shop where all your financial needs can be met in a fast and secure way. With 24/7 availability, Finami PH has revolutionized lending in the Philippines by making it easier and more accessible than ever before.

| Loan Name | Finami PH |

| Loan Amount | up to PHP 25,0000 |

| Loan Term | up to 12 months |

| Operated by | Infinsacom kft |

0% interest if you pay back on the first payment date

About Finami PH

Owned and operated by Infinsacom kft in Estonia and Hungary, Finami PH is a lending platform that provides quick and reliable online loans to Filipinos. The lending company caters to people who need an instant loan to take care of unplanned expenses. It also offers highly competitive interest rates that can easily fit into borrowers’ budgets.

At Finami PH, there are no intermediaries, and the platform connects borrowers directly to lenders, simplifying the lending process.

Finami PH Loan Information

Finami PH is a platform that provides clients with a list of credit product offers from various credit institutions and non-credit financial organizations. Clients can browse the list and choose the perfect credit product that meets their financial needs. It is important to note that Finami PH is not a bank or lender and does not provide any paid services for credit products. The project simply aims to help clients find the best credit product that suits their financial needs.

Moreover, Finami PH is not responsible for the consequences of any concluded loan agreements or any surety taken by a client to any credit institution or financial organization. The platform simply serves as a bridge between the client and the various financial organizations providing credit products.

Clients can apply for a loan by simply filling out a questionnaire on the Finami PH website. By carrying out any actions on the site, clients must provide their Consent to the processing of personal data and Consent to receive advertising materials. The client must also familiarize themselves with and agree to the Public Offer Agreement and the Service Tariffs before proceeding.

Although Finami PH does not provide paid services for credit products, its partners may have a minimum interest rate of 0.01%. Thus, clients can expect to find credit offers with an interest rate that ranges from this minimum to as much as 916% per year. The interest rate offered to clients will be dependent on various factors, such as credit history and the financial institution’s policies.

It is also important to note that the service is intended for persons over 18 years of age only. The calculation in the calculators provided on the site is based on the average interest rate that will be offered to the client by the various financial institutions. Therefore, clients can use the calculators to gauge their loan payment obligations before committing to a credit product.

Advantages of Finami PH Loans

Finami PH offers a range of loans that provide customers with fast, easy, and reliable financial solutions.

The Service Works 24/7

Finami PH understands the unpredictability of emergencies, and as such, it is available for service 24/7. This means that no matter the time of day or night, you can access Finami PH loans. Unlike other loan providers, Finami PH does not close on weekends or holidays, making it easy for you to apply and receive a loan anytime and anywhere.

Personal Offers

Finami PH offers personal loan offers based on the individual’s needs, making it easier for customers to access the funds they need. The personal offers are designed such that they cater to the customer’s specific needs, and the repayment terms are structured such that they do not put additional financial strain on the borrower. Additionally, personal loan offers make it easier for borrowers to budget and plan their finances.

Processing of the Request Almost Immediately

Finami PH loans understand the urgency of financial emergencies. As such, the loan processing period is almost immediate, with a few minutes between the loan application and approval. Thus, you can get the funds you need quickly and without having to jump through many hoops.

They Don’t Care About Your Credit History

Finami PH loans disburse funds to anyone, irrespective of their credit history. This means that even if you have a poor credit history, you can still access Finami PH loans. This is unlike traditional loan providers that require you to have a good credit history before you can access their loans.

All You Need is Internet, ID, and a Bank Account

Another significant advantage of Finami PH loans is that you do not require much to apply, and you can do so from anywhere in the Philippines. All you need are a smartphone, an internet connection, and a bank account. The loan application process is also straightforward and can be completed in a matter of minutes.

Online Service Available Anywhere in Philippines

Finami PH offers an online loan application platform accessible from anywhere in the Philippines. With this platform, you can apply, review, and monitor the status of your loan application, making it more convenient for borrowers to apply for loans.

Basic requirements for borrowers

To be eligible for a loan, borrowers must meet the basic requirements of being at least 18 years old and holding Philippine citizenship, evidenced by a valid passport. The interest rate for the loan ranges from 4 to 916 percent per year. Credit history is not a factor in the loan application process.

However, in the event of late payments, a commission of 0.1% of the amount owed will be charged. For instance, if a loan of 1000 PHP is taken with a duration of 3 months and an annual interest rate of 48%, the total payment due at the end will be 1120 PHP.

3 Easy Steps to Get a Cash Loan from Finami PH

Managing finances can be challenging, especially when unforeseen circumstances arise. It can be a relief to get a cash loan in such situations, and Finami PH offers a quick and easy solution. In just three simple steps, you can apply for, get approval, and receive your loan.

Step 1: Apply for Loan: Complete the Application Process in 3 Minutes

The first step to getting a cash loan from Finami PH is to apply. The application process is straightforward and quick, taking only three minutes to complete.

You can begin the loan application by visiting the Finami PH website. Once you have provided all the required information, including personal and financial details, you can submit your application by pressing ‘Apply.’

After submitting the application, you will receive an email confirming that the loan application is being reviewed.

Step 2: Wait for Approval: In a Few Minutes, You Will Receive Our Decision Thru SMS or Call

The second step in the process is waiting for approval. Once you have submitted your loan application, the team at Finami PH will review it and make a decision regarding your loan.

The loan approval process takes only a few minutes. You will be notified of the decision through SMS or call. If your loan application is approved, you will be provided with the loan amount and repayment terms. If your loan application is rejected, you will be informed of the reasons why and provided with other options.

The Finami PH team understands the urgency of your loan application and ensures that the approval process is done swiftly, sparing you the stress and agony of waiting for long periods.

Step 3: Get Money: You’ll Receive Your Cash in Less Than 5 Minutes (Using InstaPay)

The final step after approval is getting your loan. Once your loan is approved, Finami PH will send you the cash within five minutes using InstaPay.

InstaPay is an electronic fund transfer system that allows for safe and immediate interbank transactions. This means that once your loan is approved, you will receive the money in your account instantly. You can use the money to address your financial emergency immediately.

Referral Program

Finami PH also offers a referral program where existing customers can earn by referring other people to the platform. When a referred person completes their loan application and receives approval, the referrer receives a commission. The referral program is an excellent way for existing customers to earn extra income while providing financial loans to their friends and family.

Conclusion

In summary, Finami PH fills a gap in the lending industry by providing a quick and straightforward online lending platform. The company is licensed, and personal information is kept confidential, ensuring that it is a safe platform for borrowing money. The ability to tailor loans to an individual’s repayment history and borrowing capacity makes it a reliable choice. The referral program is an excellent way to help those in need of money while also earning extra income.

With Finami PH, borrowers can get the loans they need in a matter of minutes, making it an excellent choice for individuals and small businesses in need of funding.

Note: Finami PH (Finami.ph) is not a bank or lender, does not belong to financial institutions and is not responsible for the consequences of any concluded loan agreements or surety to him.