The Securities and Exchange Commission (SEC) in the Philippines plays a crucial role as a government agency responsible for regulating and supervising various entities, including lending companies and financing companies. One of the key areas they focus on is monitoring and regulating the activities of lending platforms to safeguard consumers and prevent illegal lending practices.

TOP 10+ SEC Registered Loan Apps [Most Apply Loan Online] 2026

To ensure the safety and reliability of loan apps, it is essential to verify their registration status with the SEC. While the following list includes 10+ Most Apply Online Loan Apps Registered with the SEC, it is not exhaustive, and there may be other registered apps not mentioned:

1. Online Loans Pilipinas

| 🔰 Company | Online Loans Pilipinas Financing inc. |

| 🔰 SEC Registration No. | CS201726430 |

| 🔰 Certificate of Authority No. | 1181 |

| 🔰 Maximum amount | ₱ 30 000 |

| 🔰 Loan term | 90 – 720 days |

VISIT ONLINE LOANS PILIPINAS APP

Online Loans Pilipinas is a lending platform that provides loans to Filipinos. According to their website, more than 1,500,000 Filipinos trust Online Loans Pilipinas. They offer loans with a better offer for repeaters, where borrowers can get up to P20,000 on their next loans and other benefits if they repay their loan on time. The website also features testimonials from satisfied customers who have used the loans to buy medicine, pay bills, and other expenses. Some customers have expressed gratitude for the help they received from Online Loans Pilipinas, saying that they were the only online loan provider that approved their loan application.

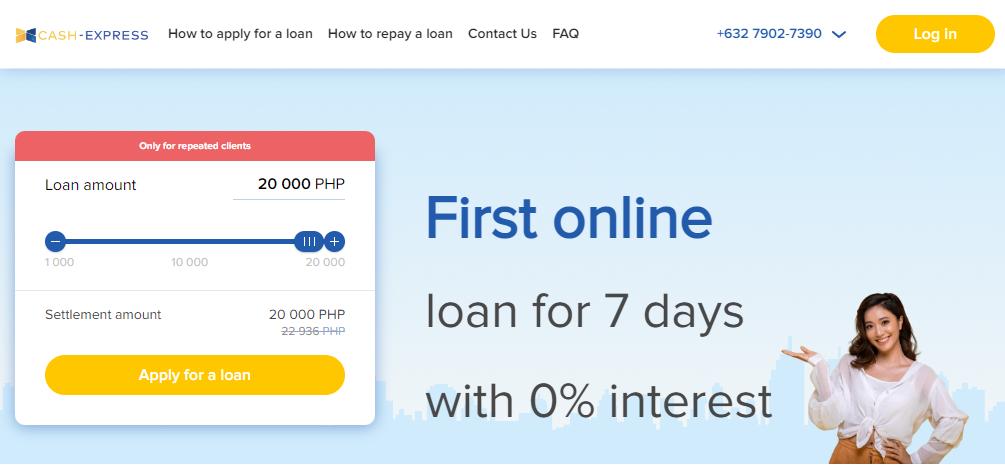

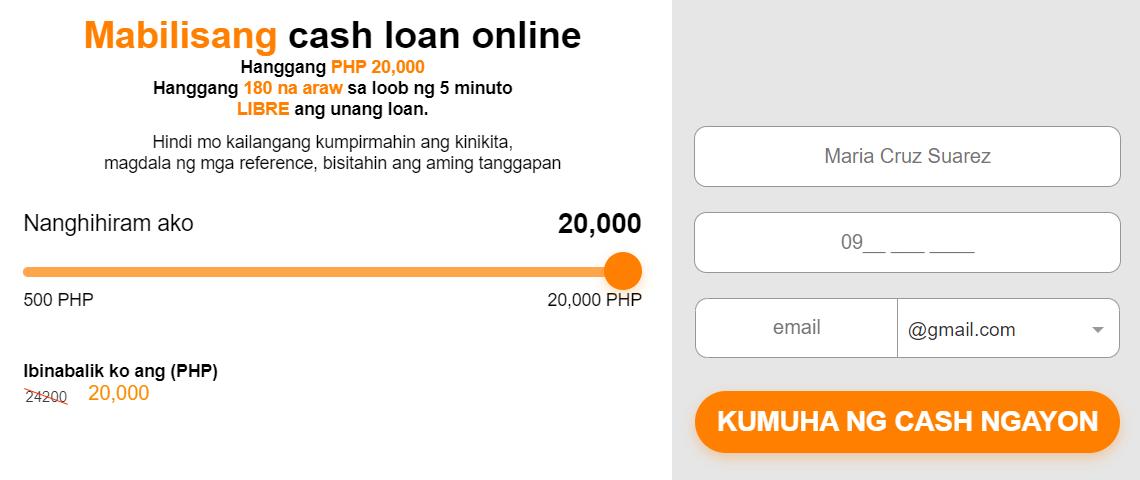

2. Cash-Express

| 🔰 Company | Cash-Express Philippines Financing Inc. |

| 🔰 SEC Registration No. | CS201951088 |

| 🔰 Certificate of Authority No. | 2918 |

| 🔰 Maximum amount | ₱ 30 000 |

| 🔰 Loan term | 30 days |

Cash-Express is an online loan provider in the Philippines that offers fast cash loans on website application with flexible repayment plans and low-interest rates. Borrowers can apply for loans ranging from 1000 to 20,000 PHP with payment options of 7 or 14 days. The loan application process is streamlined and can be completed online. Cash-Express offers a 0% interest rate for first-time customers and various payment options for loan repayment, including Dragonpay, GCash, CLIQQ, 7-Eleven, and other internet services. The company also provides customer service and data protection assistance.

3. Digido PH

| 🔰 Company | Digido Finance Corp. |

| 🔰 SEC Registration No. | 202003056 |

| 🔰 Certificate of Authority No. | 1272 |

| 🔰 Maximum amount | ₱ 25 000 |

| 🔰 Loan term | 90 – 180 days |

Digido is an online lending service platform in the Philippines that provides easy-operation, no-collateral online cash-lending service to help users solve their problem of money. It is a legit and state-licensed online lender that offers instant online loans up to 10,000 PHP. Digido stands out from its competitors with a fully automated online portal and highly innovative, customer-centric services.

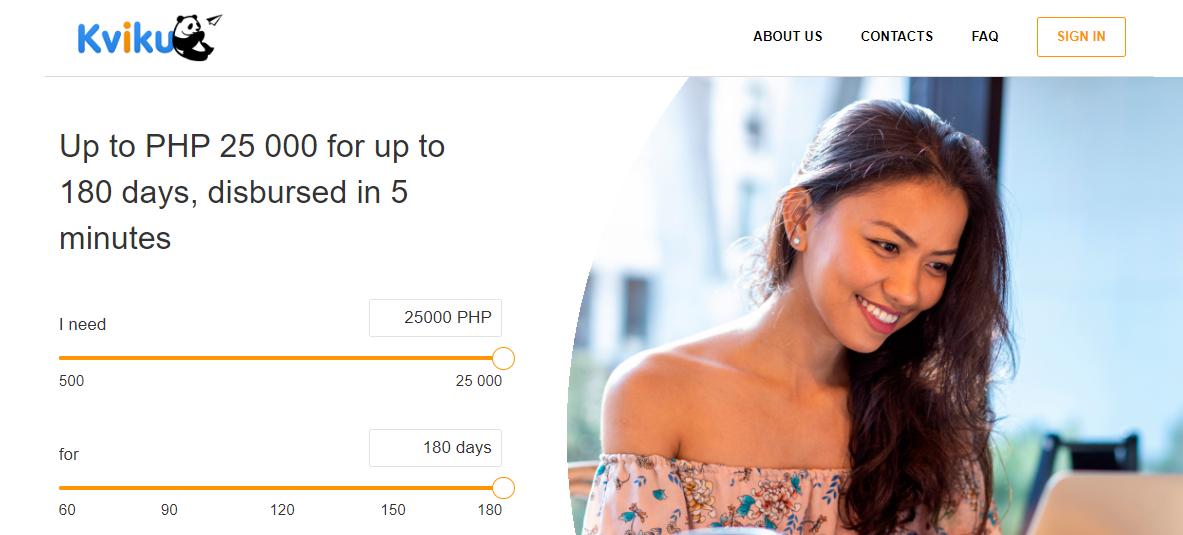

4. Kviku Loan App

| 🔰 Company | Kviku Lending Co. INC. |

| 🔰 SEC Registration No. | CS201918702 |

| 🔰 Certificate of Authority No. | 3169 |

| 🔰 Maximum amount | ₱ 25 000 |

| 🔰 Loan term | 60 – 180 days |

Kviku is an online lending platform that offers quick, easy, and convenient access to short-term loans. It is a fully automated online service that grants loans at any time of the day or night, and the human factor is completely eliminated, so you can be confident in the objectivity of the decisions made. The loan application process is easy, and borrowers can apply for a loan without having to go through a lot of paperwork.

Applying for a Kviku loan is fairly simple, and new applicants need to fill out the application form available on the website. The loan limit at Kviku ranges from 1,000 to 25,000 PHP. Kviku promises cost transparency, with no hidden fees and charges. However, some customers have complained about their high-interest rates and lack of customer service.

Kviku’s contact number is not disclosed on the website, but customers can reach them through their email at [email protected].

5. PesoRedee – Online Lending App

| 🔰 Company | Peso Redee Financing Co. Inc. |

| 🔰 SEC Registration No. | CS201804564 |

| 🔰 Certificate of Authority No. | 1165 |

| 🔰 Maximum amount | ₱ 20 000 |

| 🔰 Loan term | 30 – 180 days |

PesoRedee is a website that offers online loans in the Philippines. According to a testimonial on their website, PesoRedee was able to approve a loan for the person when other online loan providers did not. The person needed the loan for their grandmother’s medication and was grateful for PesoRedee’s help. The website offers a first loan for free with 0% interest if paid back on the first payment date. They also have a mobile app for a 100% mobile experience. The website is registered with the SEC and is considered legit.

6. Finbro Loan PH

| 🔰 Company | Sofi Lending Inc. |

| 🔰 SEC Registration No. | CS201908275 |

| 🔰 Certificate of Authority No. | 2990 |

| 🔰 Maximum amount | ₱ 50 000 |

| 🔰 Loan term | 30 – 366 days |

Finbro is an online financial solution that offers loans to clients in the Philippines. The website provides an easy and fast service for clients to apply for loans. The loan amount ranges from PHP 2,000 to PHP 50,000 with a loan tenor of 12 months.

The website also offers a processing fee and interest rate for the loan. The customers of Finbro are very satisfied with the service provided by the company. The website provides a login option for existing customers and a separate option for new clients to apply for a loan. The website also provides a FAQ section and contact information for customer support.

7. MoneyCat Loan PH

| 🔰 Company | MoneyCat Financing Inc. |

| 🔰 SEC Registration No. | CS201953073 |

| 🔰 Certificate of Authority No. | 1254 |

| 🔰 Maximum amount | ₱ 20 000 |

| 🔰 Loan term | 90 – 180 days |

VISIT MONEYCAT PH LOAN WEBSITE

MoneyCat PH is a reputable online cash loan website in the Philippines that offers fast approval and professional support staff.

To apply for a loan, customers need to fill out an online registration form and provide any document, phone number, and bank account in their name. The loan application process is simple, and customers can receive approval within 30 minutes after a phone call. MoneyCat has a team of professionally trained staff who are always ready to support customers.

MoneyCat offers a mobile app that allows customers to get loans with minimum documents and receive money in as little as 17 minutes. Customers can also repay their loans online, through bank cash payment, or GCash. MoneyCat has a customer service team that is available to assist customers via phone or email.

8. Tala App Philippines

| 🔰 Company | Tala Financing Philippines Inc. |

| 🔰 SEC Registration No. | CS201710582 |

| 🔰 Certificate of Authority No. | 1132 |

| 🔰 Maximum amount | ₱ 25 000 |

| 🔰 Loan term | 61 days |

The Tala app is an online loan app that offers personal loans with easy monthly payments. The loan app can be downloaded from the Google Play Store. The app is available in the Philippines and offers loans up to PHP 25,000 with fast approvals in 10 minutes. According to a recent survey, almost 90% of people said their ability to manage finances improved after using Tala.

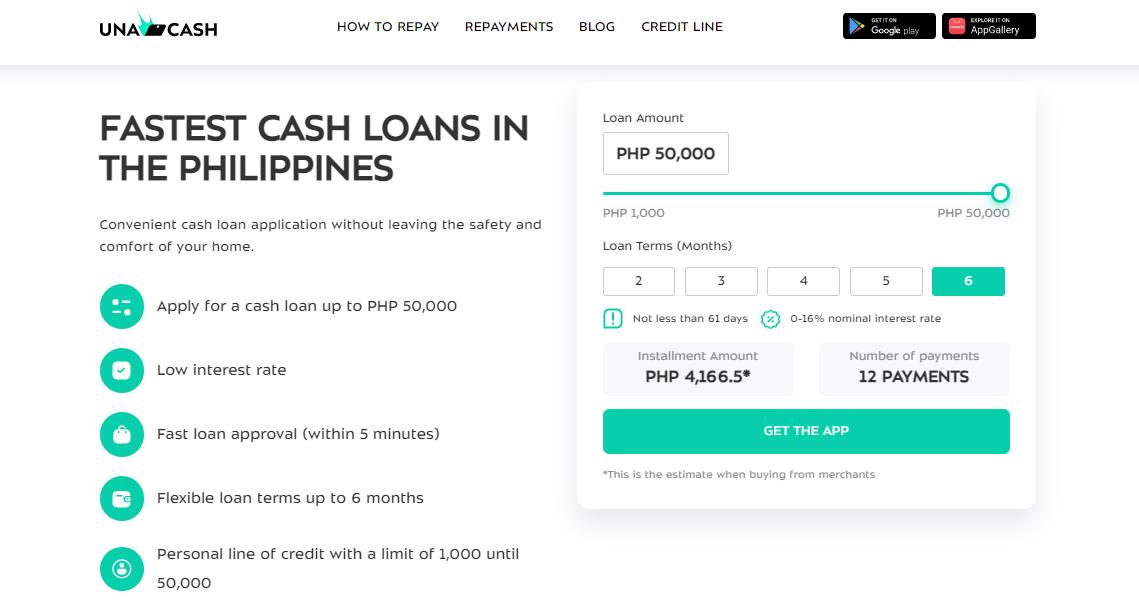

9. Unacash App Philippines

| 🔰 Company | Digido Finance Corp |

| 🔰 SEC Registration No. | CS202003056 |

| 🔰 Certificate of Authority No. | 1272 |

| 🔰 Maximum amount | ₱ 50 000 |

| 🔰 Loan term | 1 – 6 months |

UnaCash is a loan service that offers cash loans and revolving credit for buying goods on a Buy Now, Pay Later plan from its partner merchants. It is an all-digital cash loan application that gives customers a convenient and seamless experience with low interest rates. The loan application process is done online, and customers can apply for a cash loan up to PHP 50,000 with fast loan approval within 5 minutes.

UnaCash is owned and run by Digido Finance Corp, which offers 24/7 online financial solutions to all its clients. The company is legitimate and has received the appropriate permission from the Securities and Exchange Commission. UnaCash offers competitive interest rates on their cash loans, and their customer service is efficient and friendly.

10. Vamo Loan Philippines

| 🔰 Company | Vamo Lending Inc. |

| 🔰 SEC Registration No. | CS20200000915 |

| 🔰 Certificate of Authority No. | 3261 |

| 🔰 Maximum amount | ₱ 30 000 |

| 🔰 Loan term | 30 days – 10 months |

Vamo.ph is an online lending platform that provides unsecured loans in the Philippines. It is a part of an international fintech company operating in Europe and the Asia-Pacific region. Vamo offers quick and convenient loans online to individuals with competitive terms, an easy and quick application process, and minimal requirements. The company is legal and fully digital.

Vamo provides loans up to PHP 10,000 for the first time, and if repeated loan, up to PHP 30,000. The main requirements for borrowers are minimal, as the service provides unsecured loans. Vamo Lending Inc., the parent company of Vamo.ph, is registered with SEC under Registration No. CS20200000915 with Certificate of Authority No. 3261.

11. Skyro Loan Philippines

| 🔰 Company | Jungle Lending, Inc. |

| 🔰 SEC Registration No. | CS202002223 |

| 🔰 Certificate of Authority No. | 3249 |

| 🔰 Maximum amount | ₱ 250 000 |

| 🔰 Loan term | 6 – 12 months |

Skyro is a financial services provider that offers personal loans in the Philippines. Skyro was launched in 2022 to provide Filipinos with secure and effective access to a range of financial services, including personal loans, business loans, and salary loans. Skyro charges no hidden fees or commissions and offers fair interest rates. The company is committed to serving its customers quickly, efficiently, and with respect.

Skyro representatives visit customers for free anywhere in Manila to answer any questions about the loan application process and help them make informed decisions before getting a loan.

Skyro is the new brand name of Monery, which was rebranded in line with the company’s strategy to build the leading go-to digital financial services provider for Filipinos.

12. Mr.Cash Loan App

| 🔰 Company | e-Generation Lending Corporation |

| 🔰 SEC Registration No. | 2021070020530-12 |

| 🔰 Certificate of Authority No. | L-21-0036-70 |

| 🔰 Maximum amount | ₱ 1500 – ₱ 23 000 |

| 🔰 Loan term | 91 – 120 days |

Mr. Cash is an online lending app that provides financial convenience and cash services to Filipinos. The app can be downloaded from Google Play or APKCombo.

To get started, users need to provide a valid ID and a selfie photo for verification. The loan procedure is simplified and hassle-free, and various payout methods are supported, including M.Lhuillier, RD Pawnshop, Gcash, and 45 bank channels.

Mr. Cash offers low interest rates, fast approval, and perks for new users. Users can also earn rewards by signing up using a referral code and applying for a loan.

13. Peramoo Loan

| 🔰 Company | Magician of Money Lending Corp. |

| 🔰 SEC Registration No. | CS201918391 |

| 🔰 Certificate of Authority No. | 3157 |

| 🔰 Maximum amount | ₱ 2,000 – ₱ 10,000 |

| 🔰 Loan term | 91 – 360 days |

PeraMoo is a business name of an online platform owned and operated by Magician of Money Lending Corp. that provides cash loans in compliance with Philippine law. The loan requirements include being over 18 years old, a citizen of the Philippines, and having a stable income.

The loan amount ranges from ₱2,000.00 to ₱10,000.00 with a minimum repayment term of 91 days and a maximum repayment term of 360 days. The minimum Annual Percentage Rate (APR) is 10%, and the maximum APR is 26%. A one-time service fee of 5%-15% is deducted upon loan disbursement depending on the user’s risk profile evaluation.

14. CashCano Loan App

| 🔰 Company | JT PHILIPPINES LENDING TECHNOLOGIES INC. |

| 🔰 SEC Registration No. | CS 202000182 |

| 🔰 Certificate of Authority No. | 3197 |

| 🔰 Maximum amount | PHP 2000 – PHP 120,000 |

| 🔰 Loan term | 3 – 12 months |

CashCano, an instant cash loan online app in the Philippines. The app offers loan amounts up to PHP 120,000 with a maximum loan term of 12 months. CashCano is registered with the SEC under CS 202000182 and aims to provide smooth and transparent transactions to its customers. The app is committed to providing express cash credit services to individuals in the Philippines who are in urgent need of financial assistance. Customers can apply for a loan through the app and gain access to instant cash. CashCano’s contact information is also provided on the website, including email, operating hours, and address.

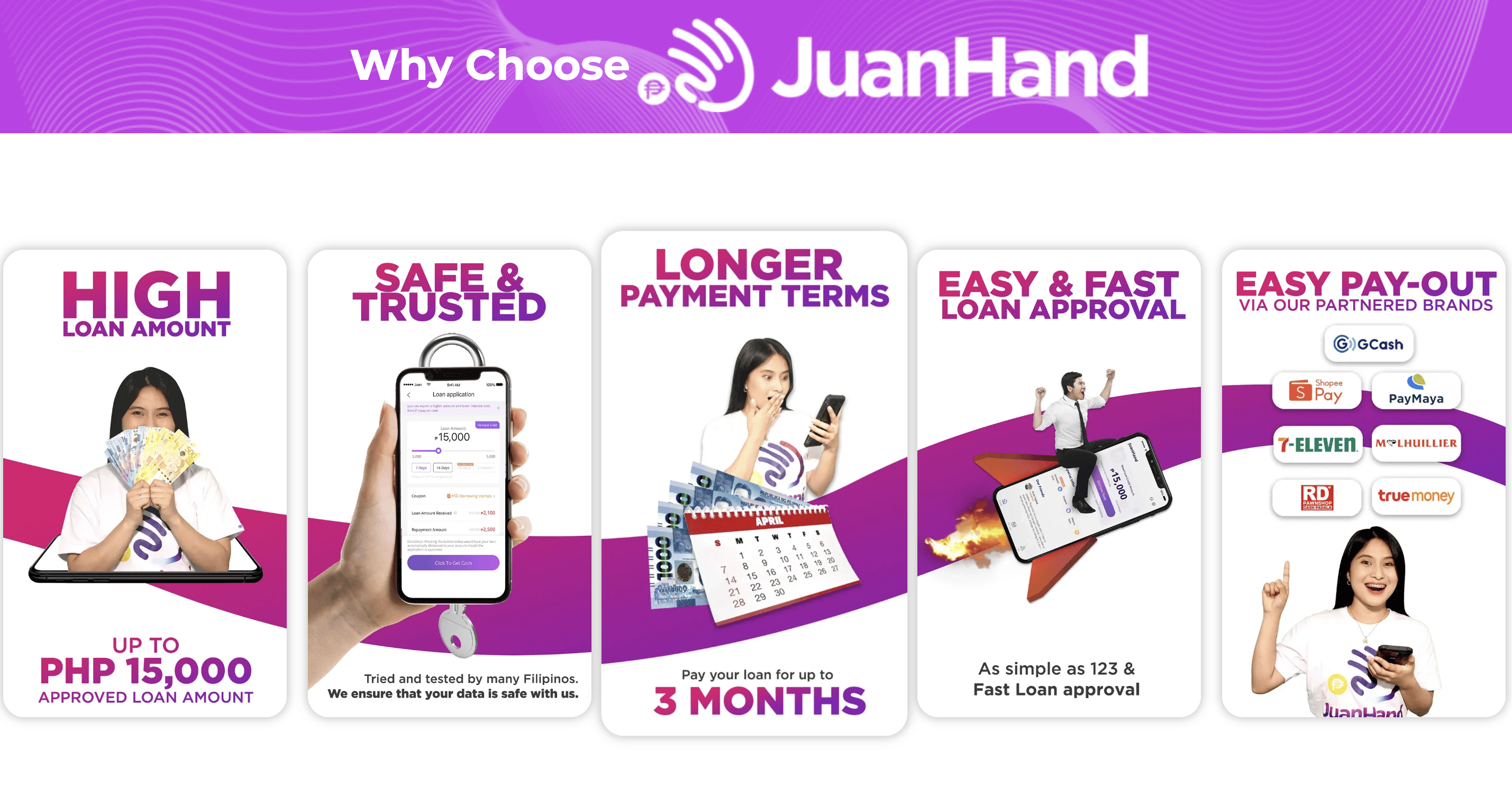

15. JuanHand Loan App

| 🔰 Company | WeFund Lending Corp. |

| 🔰 SEC Registration No. | CS201825672 |

| 🔰 Certificate of Authority No. | 2844 |

| 🔰 Maximum amount | ₱ 2,000.00 – ₱ 25,000.00 |

| 🔰 Loan term | 91 days – 180 days |

JuanHand offers instant lending and other personalized financial services to Filipinos with a smartphone, regardless of their credit history . Users can download the JuanHand app, sign up using their mobile number, complete their profile with the required personal and contact information, and apply for a loan. JuanHand believes in the power of communication and offers customer service via the JuanHand app and email, 7 days a week.

They also have a referral program partnership with SeekCap to provide more financial opportunities. JuanHand emphasizes responsible borrowing and encourages users to choose the best loan app for their needs. Related what types of loans does JuanHand offer how does JuanHand verify the borrower’s identity what are the interest rates for loans from JuanHand

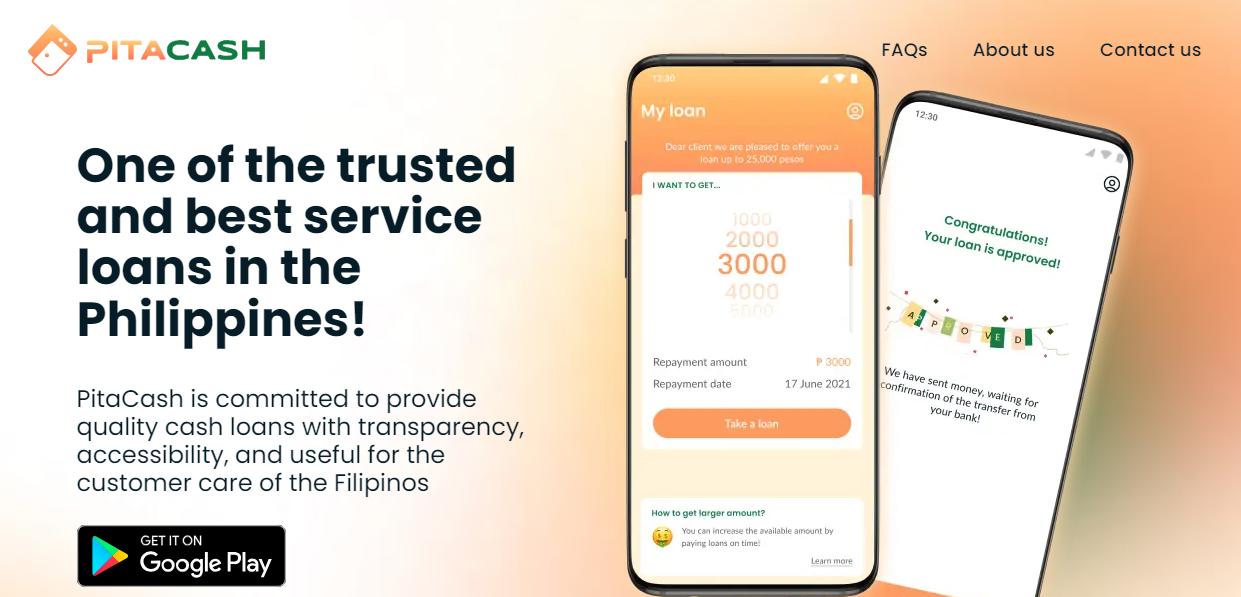

16. Pitacash (Finance Technologies Inc.)

| 🔰 Company | Finance Technologies Inc. |

| 🔰 SEC Registration No. | CS201902369 |

| 🔰 Certificate of Authority No. | 1200 |

| 🔰 Maximum amount | up to ₱ 25,000 |

| 🔰 Loan term | Flexible term |

PitaCash is a loan service in the Philippines that provides quality cash loans with transparency, accessibility, and customer care. To apply for a loan, customers can sign up and fill out an application form, choose the required amount and term, and wait for approval. Loyal customers get more money and faster approval. PitaCash offers fast payouts, no hidden fees, and a transparent tariff scale. They are customer-focused and aim to provide the best customer support system. They also protect customers’ credit history and have a simple system for extending loans.

17. Lendpinoy (Etomo)

| 🔰 Company | AND Financing Corporation (AND FC) |

| 🔰 SEC Registration No. | CS201840930 |

| 🔰 Certificate of Authority No. | 1187 |

| 🔰 Maximum amount | up to ₱ 100,000 |

| 🔰 Loan term | 6, 9 and 12-months installments |

VISIT ETOMO (LENDPINOY) LOAN APP

Securing an Etomo (Lendpinoy) loan is a straightforward process! Ensure you have your necessary documents prepared, then simply download the etomo app. Once you’ve done that, patiently await your application result and proceed to apply for your initial loan. Timely repayments not only help you fulfill your financial obligations but also allow you to accumulate bonus points, which can be utilized to boost your credit limit!

Other Loan Apps

- Abenson Lending

- AEON Credit

- Akulaku

- Allied Digital Finance

- American Express

- BDO Loan

- CIMB Bank

- Citibank

- Credit One Bank

- Eastwest Bank

- First Republic Bank

- Home Credit

- KOMO.PH

- Lending Club

- Loan Origination

- MoneyMax

- Mynt

- PayMaya

- PNB LoanExpress

- RCBC Flexi Loan

- Security Bank Loan

- Smart Padala

- UnionBank

- UBP Loan

- Vanquis Bank

- Voyager

- Wow! Loan

- Cash Club – Fast loan: Company Name:Sweet Pie Lending Corporation. SEC Registration No: 2022010037384-15. CA Number: L-22-0113-41

What is Online Loan App?

An online loan app is a mobile app that allows users to apply for and receive loans online. These apps typically offer quick and easy approval, and they can be a convenient way to get the money you need quickly.

To use an online loan app, you will typically need to provide some basic information about yourself, such as your name, address, and income. You may also need to provide information about your credit history. Once you have submitted your application, the lender will review it and make a decision about whether to approve your loan. If your loan is approved, the funds will be deposited into your bank account within a few days.

Online loan apps can be a convenient way to get the money you need quickly. However, it is important to compare different lenders and loan terms before you apply for a loan. You should also be aware of the risks associated with taking out a loan, such as high interest rates and fees.

Here are some of the benefits of using an online loan app:

- Convenience: Online loan apps can be a convenient way to get the money you need quickly. You can apply for a loan from the comfort of your own home, and you will typically receive a decision within minutes or hours.

- Speed: Online loan apps can offer quick approval and funding. This can be helpful if you need money quickly for an unexpected expense or to consolidate debt.

- Flexibility: Online loan apps typically offer a variety of loan terms and amounts, so you can find a loan that fits your needs.

Here are some of the risks of using an online loan app:

- High interest rates: Online loan apps can have high interest rates. This means that you will pay more money in interest over the life of the loan.

- Fees: Online loan apps may charge fees, such as origination fees or late payment fees. These fees can add up, so it is important to read the terms and conditions carefully before you apply for a loan.

- Debt trap: If you are not able to repay your loan, you may end up in a debt trap. This is when you take out more loans to pay off existing loans, and you end up owing more money than you can afford.

If you are considering using an online loan app, it is important to weigh the benefits and risks carefully. Make sure that you understand the terms and conditions of the loan before you apply, and make sure that you can afford the monthly payments.

Verifying Registration Status

It is crucial to note that relying solely on this list may not provide comprehensive information. To confirm the registration status of a loan app, it is advisable to visit the official SEC website or contact the app’s customer service.

Taking this step helps ensure that you are dealing with a registered loan app and reduces the risk of falling victim to fraudulent activities.

Benefits of Sec Registration App

The SEC registration app is a free, online tool that allows companies to register their securities with the Securities and Exchange Commission (SEC). The app provides a step-by-step guide to the registration process, and it includes a number of features that can help companies to complete their registration more quickly and easily.

Some of the benefits of using the SEC registration app include:

- Ease of use: The app is designed to be user-friendly, and it includes a number of features that can help companies to complete their registration more quickly and easily.

- Accuracy: The app helps companies to ensure that their registration statements are accurate and complete.

- Time savings: The app can help companies to save time by automating many of the tasks involved in the registration process.

- Cost savings: The app is free to use, which can save companies a significant amount of money.

The SEC registration app is a valuable tool for companies that are looking to register their securities with the SEC. The app can help companies to complete the registration process more quickly, easily, and accurately, which can save them time and money.

In addition to the benefits listed above, the SEC registration app also offers a number of other features that can be helpful to companies, including:

- A built-in checklist: The app includes a built-in checklist that helps companies to ensure that they have completed all of the necessary steps in the registration process.

- A help center: The app includes a help center that provides answers to frequently asked questions about the registration process.

- A support team: The SEC registration app team is available to provide support to companies that are using the app.

If you are a company that is considering registering your securities with the SEC, I encourage you to use the SEC registration app. The app can help you to complete the registration process more quickly, easily, and accurately, which can save you time and money.

Tips for Choosing a Safe and Reliable Loan App

- Verify SEC Registration: Always check if the loan app is registered with the SEC. This confirms its compliance with regulatory requirements and increases the likelihood of a secure lending experience.

- Read Terms and Conditions: Carefully review the terms and conditions of the loan app before proceeding. Pay attention to interest rates, fees, repayment terms, and any other relevant details to make an informed decision.

- Beware of High Rates and Fees: Exercise caution when dealing with loan apps that offer excessively high interest rates or hidden fees. Compare rates and fees across different apps to ensure you are getting a fair deal.

- Protect Personal Information: Only provide personal information that you are comfortable sharing. Be cautious of apps that request unnecessary or excessive data, as this may indicate potential risks.

- Report Concerns: If you have any concerns about a loan app’s legitimacy or suspect fraudulent activities, contact the SEC or the app’s customer service to seek clarification and report any potential issues.

SEC’s Commitment to Consumer Protection

On February 9, 2023, the SEC issued a statement regarding its campaign against illegal lending. As part of this initiative, the SEC ensured that unregistered lending platforms were no longer available for download online.

As of January 30, 2023, they successfully caused the removal of 33 online lending platforms (OLPs) from Google Play. This action underscores the SEC’s dedication to combatting illegal lending and protecting consumers from fraudulent lending practices.

Seeking Up-to-Date Information

While the search results provided may not directly mention specific SEC-registered loan apps in 2023, it is advisable to visit the official website of the Securities and Exchange Commission in the Philippines or contact them directly for the most accurate and current information. This ensures you have the most up-to-date and reliable details regarding SEC registered loan apps.

Please note that the information provided is based on available search results up until my knowledge cutoff in September 2021. Developments and changes may have occurred since then. For the latest and most accurate information on SEC registered loan apps in 2023, it is always recommended to refer to official sources and contact the relevant authorities.