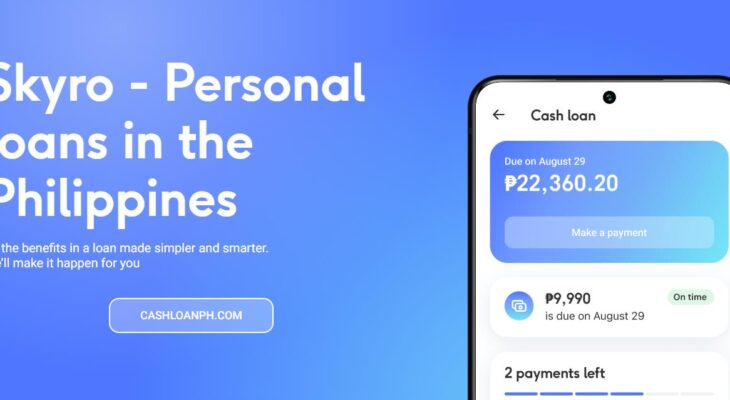

In the Philippines, personal loans are often the go-to source of extra funding for individuals who are in need of financial assistance. However, traditional banks can be quite restricting and exhausting when it comes to loan applications, causing some borrowers to opt for alternative lending companies. That’s where Skyro comes in. Skyro (old name Monery) is a new lending company that aims to provide a seamless and hassle-free lending experience to Filipinos.

In this article, CashLoanPH will provide a more in-depth analysis of Skyro’s offering- from their application process to their customer support, to let you know if they are the ideal lending company for you.

| Loan Name | Skyro Loan |

| Loan Amount | ₱15,000 to ₱250,000 |

| Loan Term | 6 – 12 months |

| Registration No. |

|

GET MONEY FROM SKYRO LOAN WEBSITE

Loan Application Process

Skyro’s online platform is impressive, allowing borrowers to begin and finish their loan application process within minutes. All you need to do is fill out an online form with your personal details and loan requirements. Once done, you will be asked to submit the application form. Skyro’s team will evaluate your application and then contact you to set up a meeting so that they can finalize the details of your loan. During the meeting, you will sign the loan agreement and provide any additional documents, making the lending process smooth and easy.

Loan Terms and Fees

Skyro offers personal loans ranging from ₱15,000 to ₱250,000 with a loan tenure of between three and twelve months. Their interest rate ranges from as low as 1.5% up to 7% per month, while their origination fee is set at a maximum of 16.6% of the approved loan amount or ₱5,000- whichever is lower. Late payment fees are set at ₱500, but not higher than 5% of the loan amount. Their competitive rates make them an attractive option compared to traditional banks.

Eligibility Criteria

Before applying for a loan with Skyro, you have to meet certain eligibility criteria. The first is that you must have a valid ID and be at least 21 years old. You must also prove you have a stable source of income to be eligible for their loan offering. The lending company values transparency, and if you’re eligible for a loan, they will process it as soon as possible, and you will receive the funds within 24 hours!

Payment Options

Skyro understands that convenience is crucial for their customers, and as such, they provide customers with three payment options. You can pay through online banks, e-wallets, or over-the-counter payments at partner outlets such as 7-Eleven, GCash, Maya, UnionBank, or BPI, among others. Their multiple payment options cater to Filipinos from all walks of life, making it easier for them to make payments that suit them.

Customer Support

Skyro values their customers and, as a result, has a team of knowledgeable and experienced customer support personnel to attend to their needs. They have various online and offline channels for customers to get in touch, including their website, email, phone or through their official Facebook page.

Company Legitimacy

Skyro (old is Monery) is a real lending company operating with the advanced financial solutions brand name. Advanced Financial Solutions, Inc. and Jungle Lending, Inc., both registered under the Securities and Exchange Commission (SEC), are the parent company of Skyro.

- Advanced Financial Solutions, Inc., currently operating under Financing company license No.: F‑22‑0029‑37 with SEC Registration No.: 2022080063542‑00, and they are located in 20F Cyber Sigma, Lawton Avenue, Bonifacio South, Taguig City, 1637 Metro Manila.

- Jungle Lending, Inc., on the other hand, is currently operating under lending company license No.: 3249 with SEC Registration No.: CS202002223. They are located in 3006 30F, One Corporate Centre, Meralco Avenue corner Julia Vargas Avenue, San Antonio, Pasig City, 1605 Metro Manila.

Conclusion

Skyro offers flexible loan terms and competitive interest rates, making them a preferred lending company among Filipinos. The easy application process coupled with the multiple payment options makes borrowing from them a hassle-free experience.

Their 24-hour disbursement means you will get your funds quickly, making it easier to plan and manage your finances. Skyro values their customers and offers excellent customer support through various channels for smooth loan applications and customer services.

Although there are some complaints about their strict requirements and high fees, we conclude that Skyro is a great alternative source for personal loans in the Philippines.

Mag-apply ng cash loan online through Skyro website

Meet with their representative

Get money credited sa bank account or e-wallet mo!

Isang valid ID lang ang kailangan! 👉 SKYRO LOAN WEBSITE

Best 10+ online loans in philippines

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / monthLoan amount

PHP 20,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

728 daysRate ()

365.00% / yearLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Long termFor a period of

4 monthsRate (PSK)

0.00% / monthLoan amount

PHP 25,000Approval in

5 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

180 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

61 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 50,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

90 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

30 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

30 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

30 daysRate ()

0.00% / dayLoan amount

PHP 20,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

PHP 25,000Approval in

15 minutesFirst loan free

no

Loan type

Short termFor a period of

730 daysRate ()

0.00% / dayLoan amount

PHP 50,000Approval in

15 minutesService Fee

₱500

Loan type

Short termFor a period of

365 daysRate ()

0.00% / dayLoan amount

₱ 25,000Approval in

15 minutesFirst loan free

yes