In the ever-evolving landscape of financial services, finding a trustworthy and reliable partner for fast loans can be quite challenging. However, CashClub Loan App emerges as a shining beacon in the Philippine market, offering unparalleled convenience and flexibility to borrowers seeking financial assistance.

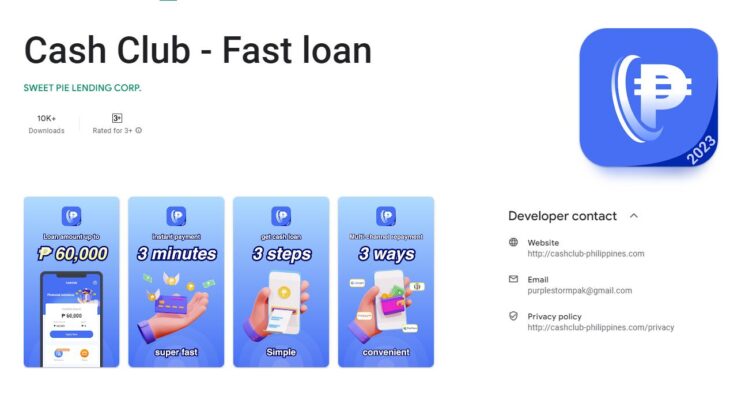

As an affiliate of SWEET PIE LENDING CORPORATION, CashClub operates under the registration number 2022010037384-15, and with CA NUMBER L-22-0113-41, they have gained recognition as a dependable provider of efficient loan solutions.

VISIT CASHCLUB LOAN APP PHILIPPINES

Unveiling the CashClub Loan App

In this digital age, convenience is key, and CashClub has fully embraced this philosophy with its innovative loan app. Empowering users to access personal credit without intermediaries or agents, CashClub’s application process is smooth and hassle-free. With just a few taps on their mobile devices, borrowers can explore an array of loan products tailored to their unique needs.

A Closer Look at CashClub’s Products

At the core of CashClub’s mission is the commitment to cater to the diverse financial requirements of its customers. The loan options available are both flexible and customizable, allowing borrowers to secure amounts ranging from 5,000 pesos to a generous maximum of 60,000 pesos. To accommodate varying repayment capabilities, CashClub offers loan periods spanning from 91 days to 120 days, providing the ideal timeframes for different financial scenarios.

Of paramount importance to borrowers is the interest rate, and CashClub ensures that borrowers are not burdened by exorbitant charges. With a maximum annual interest rate of 14% and a daily interest rate capped at 0.04%, borrowers can confidently plan their repayments, knowing that there are no hidden fees to mar their financial decisions. To provide clarity, CashClub offers an illustrative example of a 5,000-peso loan with a 100-day term, outlining the monthly repayment amount and total interest charge, fostering transparency and trust.

It is essential to highlight that while CashClub endeavors to maintain these competitive interest rates, final rates may vary based on individual credit assessments. However, the overarching theme of transparency remains unwavering, ensuring that borrowers are well-informed throughout their borrowing journey.

Utilizing CashClub with Ease

Emphasizing user-friendliness, CashClub ensures that accessing financial assistance has never been easier. With the CashClub loan app readily available on the Google Play Store, users can effortlessly download the app to their smartphones. After completing a straightforward registration process and furnishing the necessary personal information, borrowers are free to select their desired loan amount and term. Once the loan application is submitted, the review process commences, with the promise of swift approval.

Upon successful approval, the loan amount is promptly credited to the borrower’s bank account, alleviating any anxieties related to delayed fund disbursement. To foster responsible borrowing habits, CashClub encourages borrowers to adhere to the agreed-upon loan term and make timely repayments, which in turn contributes to enhancing their credit rating.

Moreover, CashClub believes in rewarding responsible borrowers by offering the opportunity to apply for a subsequent loan, thereby allowing access to higher loan amounts and further bolstering their credit rating. This empowering approach is a testament to CashClub’s dedication to its customers’ financial success and well-being.

The Power of CashClub – Empowering Financial Freedom

CashClub firmly believes in the potential of its customers and seeks to empower them on their financial journey. With loan amounts reaching up to 60,000 pesos (subject to approval), CashClub stands as a formidable ally in navigating life’s financial challenges. Whether it’s addressing medical emergencies, educational expenses, home repairs, or any other unforeseen financial demands, CashClub’s high loan ceilings are designed to provide comprehensive financial coverage.

Speed is of the essence, and CashClub recognizes this. Embracing the digital era, CashClub’s streamlined application process, coupled with fast approval and fund transfer, ensures that users can promptly access the financial support they require. No more long waits and tedious paperwork—CashClub’s emphasis on efficiency promises an unparalleled experience.

In addition to its fast and flexible loan offerings, CashClub is committed to maintaining transparent fees and facilitating flexible repayments. Borrowers can choose from various repayment methods, allowing them to find a schedule that aligns seamlessly with their financial capabilities. This flexibility exemplifies CashClub’s commitment to understanding the unique circumstances of its borrowers and crafting solutions that genuinely meet their needs.

Furthermore, CashClub values the security and confidentiality of its users’ personal information. With advanced encryption protocols, users can trust that their data is safeguarded against any unauthorized access, fostering a sense of security and peace of mind throughout the borrowing process.

Becoming Part of the CashClub Community

To avail themselves of CashClub’s efficient loan services, aspiring borrowers must meet certain eligibility criteria. As proud proponents of responsible lending, CashClub extends its services exclusively to residents of the Philippines who are at least 18 years old and possess a stable source of income. By ensuring these requirements are met, CashClub strives to create a reliable and sustainable lending environment, benefiting both borrowers and the broader financial ecosystem.

Connect with CashClub – Customer Support and Assistance

Effective communication is vital in any financial service, and CashClub takes great pride in its responsive customer support team. For inquiries or assistance, users can reach out via email at [email protected]. The dedicated support team operates during regular business hours, Monday through Friday, from 9:00 am to 6:00 pm.

For those who prefer face-to-face interactions, CashClub provides a physical office address: UNIT-18A, 18TH FLOOR TRAFALGAR PLAZA 105 H.V DELA COSTA ST. SALCEDO VILLAGE BEL-AIR MAKATI CITY, CITY OF MAKATI, FOURTH DISTRICT, NATIONAL CAPITAL REGION (NCR), 1209. This accessibility underlines CashClub’s commitment to engaging with its customers and fostering an environment of trust and collaboration.

Conclusion

CashClub Loan App emerges as a beacon of reliability and innovation in the realm of fast loans in the Philippines. Driven by a mission to empower its customers and promote financial freedom, CashClub offers flexible loan options, transparent pricing, and unmatched convenience through its user-friendly loan app.

VISIT CASHCLUB LOAN APP PHILIPPINES

As a responsible lender, CashClub remains steadfast in ensuring the security of its users’ personal information and fostering transparent communication throughout the borrowing process. With CashClub as a trusted financial ally, borrowers can confidently navigate life’s financial challenges and strive towards a more prosperous future.