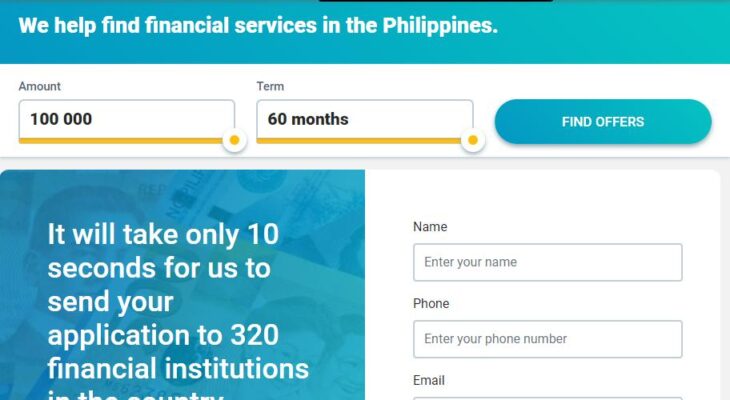

Upfinance PH is a finance service website based in the Philippines. The Upfinance service has been providing information services since 2016. It collects up-to-date financial loan information from banks and credit institutions to help Filipinos find the best loans according to their needs.

UpFinance PH is neither banking nor lending institution factually. The information you share on this website and with their consultants is used for the sole purpose of recommending apt financiers from their network based on your personal requirements and credit ratings.

About UpFinance PH

It’s always desirable to have cash resources to cover immediate requirements in times of uncertainty and emergencies. The economy in the world we live in is prone to oscillations, forcing people to face challenging market times for many reasons. As a result, loans online are rapidly gaining traction, with many Filipinos choosing for quick and simple loans to meet their income needs.

The Philippines is known for having just an average economy, which means that most people earn just enough to meet their basic necessities. It also implies that many people do not have enough money to invest, buy substantial assets, save for emergencies, or even pay for schooling.

Get yourself out on a tight spot-on money. An online loan is a non-traditional sort of loan obtained over the internet from a private lender, which may include personal loans or student loans. Although online lenders are unable to function without a physical location, they often handle applications through their app or website.

Legitimate online lending apps or sites are a more convenient manner of borrowing, from filling out an online loan application form to getting authorized for a loan with no requirements needed. Repayments may be done through the online lender’s partner banks and remittance centers, and loan funds are frequently transferred within 24 hours.

Technology has made it easier for the general population to gain access to the best online loan sites. Online loans are fairly similar to traditional methods of obtaining money from lenders, but they have instant loan that have the benefit of being timelier and more convenient.

Upfinance PH is a website that compiles all of the current loan offerings in the Philippines. Online loans can let you complete the entire borrowing procedure online, with best online loans in the country, from selection and evaluation to loan funding without really having to step foot inside a bank branch. They can be a handy method to borrow money and give Filipinos comprehensive financial services information and assist them in selecting the best deal.

To offer a basic explanation of the two types of consumers of loans, secured and unsecured, secured loans are those in which the borrower has put up collateral as security for the loan. Non collateral loan is also known as unsecured loan. If the borrower defaults, there is nothing to seize and sell.

Listed below are the Top 10 Online Loan Apps in the Philippines which are considered as the best loans. It’s all accessible and will surely provide financial assistance:

Top 10 Online Loan Apps Philippines Recommended by Upfinance PH

Digido PH (old Robocash)

More than 95 percent of loan requests are met by the firm, which specializes in providing online loans to Filipinos.

- Interest rates: 0% – 11,9% per month.

- Loan term: 1 – 6 months.

- Maximum loan amount: 25,000 PHP.

MoneyCat PH

MoneyCat is a global finance firm that has just expanded into the country. We can help you with any of your financial concerns. On how to make a loan, you will be properly counseled and directed.

- Interest rate: 0% – 11,9% per month.

- Loan term: 1 month.

- Maximum loan amount: 20,000 PHP.

AEON Credit PH

AEON Credit released various products such as the Personal Loan, Tricycle Loan, and Vehicle Loan in line with its aim to provide a wide variety of consumer financial services as well as a means of livelihood to the Filipino people.

- Interest rates: 2% per month.

- Loan term: 6 – 24 months.

- Minimum loan amount: 100,000 PHP.

- Processing Fee: 1,000 PHP

Cashalo Loan Application PH

Cashalo is a fintech website that provides Filipinos with digital credit, allowing individuals to improve their financial situation.

- Interest rates: 10% per month.

- Loan term: up to 1,5 months.

- Maximum loan amount: 10,000 PHP.

MeLoan PH

MeLoan is the Philippines’ first Fintech service that provides loans to students and employees.

- Interest rates: 15% per month.

- Loan term: 1 month.

- Maximum loan amount: 10,000 PHP.

Easycash PH

The financial firm that created an online loan and borrowing platform for Filipinos using scalable infrastructure and technology.

- Interest rates: 24% per month.

- Loan term: up to 2 months.

- Maximum loan amount: 20 000 PHP.

Asteria PH

The firm is based in Makati and has gotten a full SEC license. Their goal is to provide online, hassle-free service to our new and existing customers.

- Interest rates: 27% per month.

- Loan term: up to 3 months.

- Maximum loan amount: 20 000 PHP.

CashCat PH

A financial institutions’ premier marketing consultancy firm.

- Interest rates: 45% per month.

- Loan term: up to 1 month.

- Maximum loan amount: 10 000 PHP.

FundKo PH

Lenders have a selection of authorized loans to pick from. Its main goal is to collect payments from borrowers and distribute the money to lenders.

- Interest rates: 10% – 35% per month.

- Loan term: up to 3 months.

- Maximum loan amount: 10 000 PHP.

Finbro PH

Finbro is an online lending platform, which helps you to get a loan quickly to cover unexpected expenses 24/7. Easy – Simple – Fast – Reliable.

- Interest rates: 1,25% – 15% per month.

- Loan term: up to 12 months.

- Maximum loan amount: 50 000 PHP.

Who are Upfinance PH partners?

As a middleman service company, Upfinance had partnered with several financial organizations. Earlier, it was mentioned that financial institutions are organized in Upfinance according to their types of financial institutions. So far, Upfinance is in touch with banks, investment companies, insurance companies, P2P Platforms, pawnshops, cooperatives, and even payday lenders.

For banks, their most notable partners are BDO, BPI, RCBC, Metrobank, Citibank, and Security Bank. As for investment companies, they are in contact with SM Investment Corporation, Bukas, Angel Investment Network, and more. Sunlife, Manulife, and PHILAM life are the investment companies they work with.

In the P2P platform, Upfinance has Lend.ph, Kiva, Rykom, and so on. They are communicating with cooperatives in the Philippines such as Ayala Coop, Paglaum Multipurpose Cooperative, San Jose Koop, and more. For pawnshops that offer loans, they are in touch with several, including Palawan Pawnshop, Villarica, Tambunting, and Cebuana Lhuillier. Lastly, they also provide the loan services of payday lenders like Cashalo, Money Cat, Robocash, and Tala.

These connections allow Upfinance to access the interest rates of each financial institution for their different types of loans. The Upfinance team can easily inquire about loan proposals on your behalf. Furthermore, they can also send out your one loan application to more than 300 partnered loan organizations mentioned earlier. Thus, you will no longer have to contact and apply to each bank for your loans.

Contacts UpFinance PH

- Address: 60 Gen. Aguinaldo Ave., Araneta Center, Cubao, Quezon City 1109

- Phone: +63 82 226 1169

- Email: [email protected]

Conclusion

It’s crucial to understand if taking out a loan online in the country is legal. Every authorized lending firm in the Philippines must register with the Department of Trade and Industries and pay tax. At UpFinance, they make certain that everything we do complies with existing regulations. They also ensure that their partners receive the finest service possible by keeping them up to date. They carefully choose companies with the lowest interest rate and the best terms.

Many online moneylenders offer easy-to-follow tutorials that explain how the application process works. Upfinance PH believe you will find this information useful, therefore they have outlined the major steps below:

- Click the “Apply” button on the right-hand side of the name of the loan product you choose in the product list above. Fill in the application form.

- You will be sent to a website indicating that your application was successful, and you will also receive an automatic email containing information about your application. You can also be sent to the lender’s application website.

- Upload the necessary documents, which may include your name, Philippine Identification Card, amount of credit you want, and so on.

- Within 24 hours (1 working day) of submitting your application, you should hear from the lender.

- Depending on the lender, the money might be issued in as little as 24 hours or as long as 5 days after approval.

Interested about UpFinance PH? and want to learn more about it? Follow UPFINANCE PH WEBSITE.