| ✅ Loan Online | ⭐ Digido Loan Philippines |

| ✅ First loan | ⭐ up to 10 000 PHP |

| ✅ Amount | ⭐ 1 000 – 25,000 PHP |

| ✅ Age | ⭐ 21 – 70 |

| ✅ SEC Registration No. | ⭐ 202003056 |

@loansphilippines Loans online with Digido (cashloanph.com/digido/) are fast and reliable to meet some needs. You can apply for a loan 24 hours a day, seven days a week in the Philippines! #tiktokphiliippines #philippines #loansphilippines #loanphilippines #fastloan #loans #cashloanph

Kapag nag-apply ka ng PHP 20,000, PHP 5,000 lamang ang iyong babayaran kada buwan. Ang kabuuang halaga ng iyong loan ay magiging PHP 2,383 kada buwan (APR = 143%)*

What is Digido Loan?

Digido Loan Philippines is a reputable and officially licensed online lender, boasting an extensive network of branches throughout the Philippines. What sets Digido apart from its competitors is its cutting-edge, fully automated online portal, providing customers with innovative and user-friendly financial solutions.

With Digido’s automated loan lending system, swift decisions are made independently for each application, ensuring that funds are transferred within just a few hours. The loan options available are diverse, ranging from enticing 0% interest promotional loans to non-collateral loans of up to PHP 25,000.

Rest assured, as a licensed lender, Digido Loan Philippines strictly adheres to all lending rules and regulations without any compromise. They do not hike up interest rates to compensate for borrowers with a less-than-perfect credit history. Furthermore, unethical practices such as hidden charges or upfront commissions are entirely absent from their process, demonstrating a commitment to fairness and transparency.

Digido understands that not everyone may feel comfortable applying for loans through an online platform or mobile application. To accommodate such individuals, Digido’s banking professionals, with their friendly and expert approach, are readily available to assist in securing the right loans without any confusion or inconvenience. Whether you prefer the convenience of applying online or in-person at a Digido office, the choice is entirely yours.

Sinong mga taong maaaring mag-apply?

- Ang mga taong may edad na 21-70 taong gulang

- Kasama na ang mga may trabaho at mga propesyonal

- Patungong mga mamamayan ng Pilipinas

Online Loans in the Philippines

In the pursuit of financial independence, people from all walks of life seek opportunities to better their circumstances. The age-old advice of “Spend less, avoid loans, save more” has been ingrained in our minds as the ultimate gospel of financial management.

However, there exists a common misconception that loans are malevolent forces, prompting individuals to steer clear of them at all costs, fearing the burden of debt. As a result, many turn their backs on loans even during times of severe financial strain, potentially leading to a significant decline in their quality of life.

The truth is that loans can serve as valuable allies in improving one’s financial well-being if utilized judiciously. When invested in enhancing work productivity or acquiring new skills, loans can yield substantial dividends over time. On the other hand, using loans for indulging in shopping addictions or entertainment can indeed jeopardize one’s financial stability.

Therefore, it is essential to recognize that it is not loans themselves that determine their impact but rather the manner in which they are utilized that makes all the difference.

How do Instant Loans Work in the Philippines?

The Philippines faces a challenge with the uneven distribution of banks, particularly in non-metro areas, leaving around 70% of the population without access to formal banking services. This creates a double problem, forcing many non-urban residents to travel to far-off cities to avail themselves of banking services. Consequently, overcrowded banks and long queues make the loan process tedious and cumbersome, making it an unpleasant experience for the majority.

In contrast, online loans offer a more convenient and accessible solution for most people. With just a valid ID card and proof of income, individuals can apply for a loan online, bypassing the need for physical bank visits. The application and approval process for these loans are straightforward, and as long as someone has internet access, they can secure a loan instantly.

To begin the online loan process, applicants need to create a user account on the lending portal. From there, they can apply for a loan and upload the required documents to demonstrate their creditworthiness. The system quickly evaluates the application, providing a decision within minutes. Once approved, the requested funds are transferred to the specified account within a few hours.

For returning borrowers with no outstanding loans, the documentation process is often streamlined, making it even more convenient for them to obtain a second loan.

Given the high internet penetration in the Philippines, online loans have become the go-to choice for urgent financial needs, such as medical emergencies or vehicle repairs, rather than relying on distant brick-and-mortar banks.

Is Digido Online Loan Philippines Legit?

Not all online money lending companies are legit.

Legitimate online lending companies must register their existence under the DTI (Department of Trade and Industry) and maintain a physical office within the Philippines to be traceable by enforcement authorities in case of any issues.

Unfortunately, there are several illegal lenders that exclusively operate in the online realm, disregarding regulations and engaging in unethical practices, causing harm to customers.

For borrowers seeking instant loans online, distinguishing between legitimate and illegal lenders can be challenging. To ensure the lender is trustworthy, always verify their details on the website https://www.sec.gov.ph/. For instance, Digido is a fully legal company with SEC Registration No. 202003056 and Certificate of Authority No. 1272. Clients can verify this information on the state website in the list of financial companies.

What are Online Loans?

Financial independence requires a well-thought-out plan, regardless of your income level. However, unforeseen financial needs can disrupt even the most carefully crafted plans. During such times, individuals often rely on loans from friends, family, banks, or other lenders.

Traditionally, banks have been the preferred option for loans due to their lower interest rates and flexible terms. However, the stringent requirements of providing a wide array of documents, maintaining a good credit score, and enduring lengthy approval processes can dissuade borrowers from choosing banks, leading them to seek alternatives like private lenders.

In response to the need for more convenient borrowing options, banks and financial institutions now offer an online solution known as “Online Loans” These loans can be processed entirely through online interfaces, allowing borrowers to access funds quickly and without the need to physically visit multiple lenders or bank branches to compare loan terms. This convenience proves invaluable during emergencies when time is of the essence.

Online loans give a slew of irresistible features for a prospective borrower:

- One can easily compare the loan terms from different lenders from his or her computer or smartphone without leaving the home or office.

- Online lenders operate 24/7 enabling one to secure a loan while traveling or at the wee hours without bothering about off days or weekends.

- Typically online loans are unsecured loans with minimal documentation requirements. These loans don’t require collateral, guarantor, or excellent credit score.

- An automated system performs loan evaluation, decision-making, and transfer of funds in a completely unbiased and instantaneous way.

- There is no need to disclose your financial details to the banking professional, and it assures the confidentiality of your sensitive data.

- The entire process of loan application and disbursal happens within a few hours. Hence, online loans are known as Single Day Loans.

- The loan approval rate for online loans is as high as 90%.

- Online lenders do not perform cross-selling of products, as in the case of banks.

- Online loans are generic loans, which means one can use it for any purpose.

- Tracking of your loans and their payment are quite easy on an online loan.

Minimal documentation, high loan approval rate, and immediate fund availability, even for people with lousy credit history, make online loans the most popular type of loans for the Filipinos.

How to Secure an Instant Loan Responsibly and Beneficially?

The allure of obtaining quick online loans with minimal documentation can be quite enticing. However, it’s essential to approach these loans responsibly to avoid potential financial troubles and debt traps. Here are some crucial points to consider when seeking an instant loan:

- Provide Accurate Information: Always be truthful and transparent when providing your personal and financial details. Concealing your previous loan history could lead to hard credit checks, negatively impacting your credit score and making it harder to secure favorable loan terms in the future.

- Avoid Multiple Applications: Resist the temptation to apply for loans with multiple lenders simultaneously. Each application triggers credit checks, and an excessive number of inquiries can significantly lower your credit score. Instead, carefully consider your options and choose a suitable lender before applying.

- Compare Loan Offers: Take the time to compare loan options from different lenders. Look for competitive interest rates, favorable repayment terms, and any additional fees or charges. Opt for the loan that best suits your financial needs and capabilities.

- Ensure Timely Repayment: Before committing to a loan, assess your ability to repay it within the agreed-upon timeframe. Adhering to the repayment schedule is crucial as any delay or default can adversely affect your credit score and hinder your chances of obtaining favorable loans in the future.

- Understand Loan Terms: Thoroughly read and comprehend all the loan documents and conditions before accepting any loan offer. Pay attention to the interest rates, repayment terms, and any potential penalties for early repayment or late payments.

By following these guidelines, you can navigate the process of obtaining an instant loan responsibly, safeguard your financial discipline, and potentially benefit from better loan opportunities in the future.

Conclusion

Loans are just another financial product. It alone won’t do any harm. But if you cannot set your priorities right and do not follow a financial strategy, a loan can be problematic. As long as you make a clear judgment about your financial needs and follow the plan, loans can be a great tool to reach financial independence.

FAQ

Digido Online Loan Requirements

Any Filippino citizen within the age group of 21-70 years, with a working mobile connection, may apply for a loan with Digido Loan Philippines.

The applicant has to submit a government-issued identity card. Inclusion of documents such as payslips, COE, ITR, company ID, DTI (if self-employed or with business) along with the loan application will increase your chances of loan approval.

Advantages of Digido Loan Philippines

Some of the attributes of Digido loans are the following:

- No hidden charges, upfront fees, or commissions;

- We are open 24/7 without any holidays or weekends

- Easy loan application process and instantaneous decisions

- Multiple modes of loan application: Web, Mobile App and through branches

- A loan approval rate of more than 90%

- Loans for any purpose

- Online loan calculator to choose the right loan amount and duration

- Loans without any collateral and guarantors

- Better loans for repeat buyers

- Loans even without bank accounts

- Multiple Loan Repayment Options – bank transfer, remittance centre, 7-Eleven, offline branches, Dragonpay.

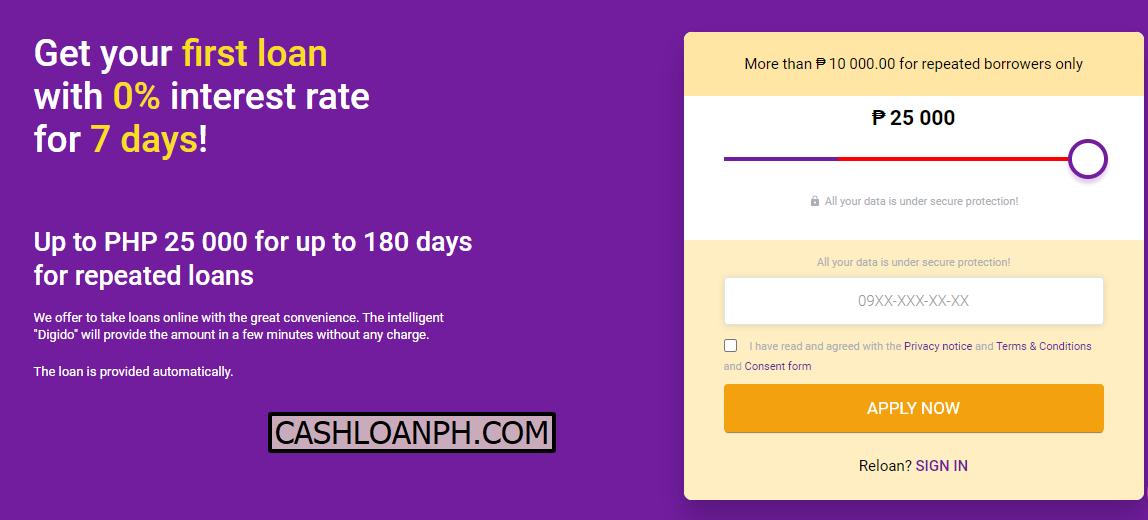

Digido First Loan with no Interest

Digido Philippines offers loans of PHP 1,000 – 25,000 with no interest on the first loan for seven days. The only requirement is proof of identity and income.

The availability of quick loans with no interest is a great help for those who just started earning and is building a credit history.

The loan eliminates the over-dependence on loan sharks to overcome the initial financial obligations and improves the borrower’s possibilities for a better loan in the future.

An Example of the Interest Rate Calculation

Each one has different requirements for the loan amount and loan duration. Our online loan calculator is an exceptional tool that shows the exact repayment amount for each combination of loan amount and loan term.

Let’s look at a sample calculation.

The maximum annual loan rate is 143%. Take the amount of PHP 20,000 and a period of 6 months.

In this case, your monthly payment will be only PHP 5,000, and the total cost of interest will be 2,383 pesos monthly.

The availability of a loan calculator in the Philippines helps the Filipino have a clear idea about the optimal loan amount, term, and repayment before subscribing to any loans.

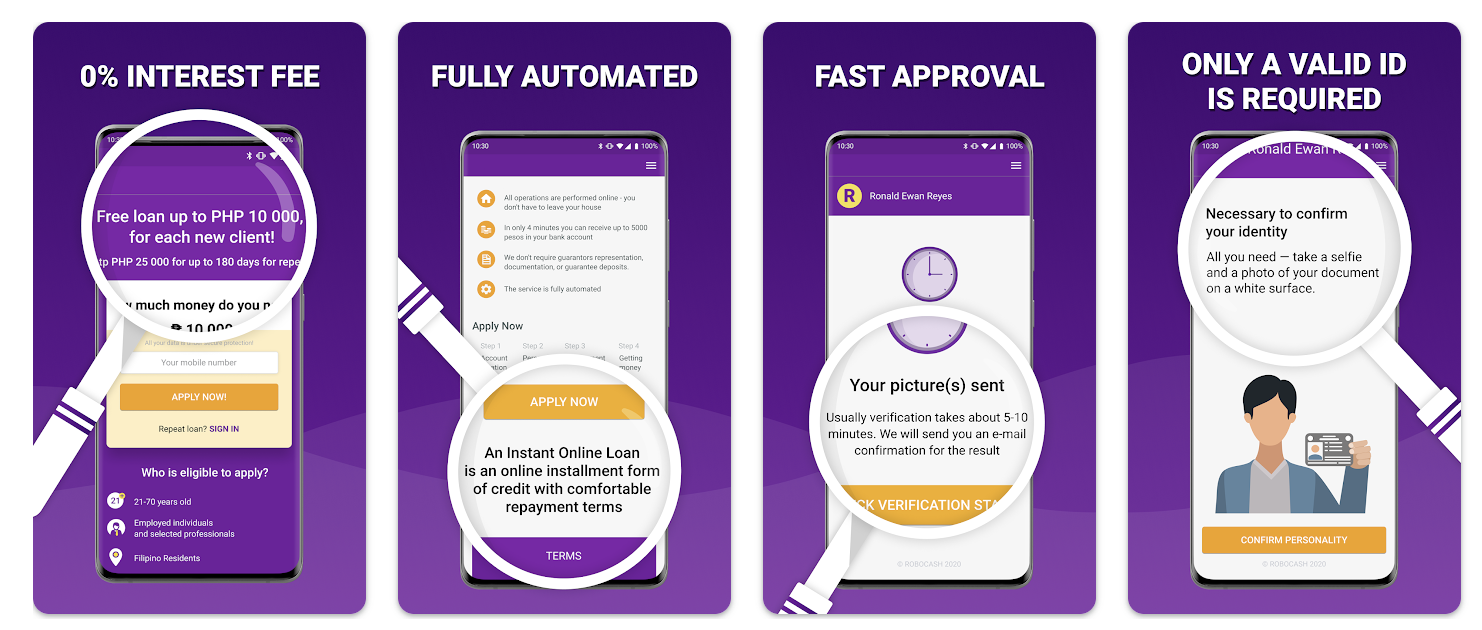

What is the Best Loan App in the Philippines?

The ever increasing netizens of the Philippines use smartphones as their primary device for Internet connectivity.

Digido cash loan mobile App is well optimized and loaded with features. It helps the Internet-savvy Filipinos enjoy the benefits of online lending in a seamless way.

If you want to skip a long line in the banks and just apply for an online loan through your phone, we suggest that you download the Digido Philippines for Android or Apple mobile application and appreciate its convenience.

The application is highly evaluated by users and has many positive feedback from those who have already received money with its help.

Contacts

Telephone contact: (02) 8876-84-84 From 8AM to 5PM every day.

DIGIDO FINANCE CORP.

Units P107003R, P107007R, P107008R, Level 7 Cyberpark Tower1, 60 Gen. Aguinaldo Ave., Cubao, Quezon City, Philippines 1109