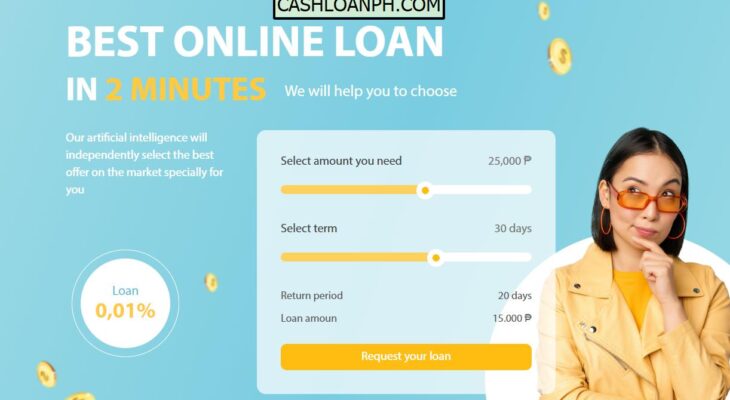

Finloo PH compare offers of the best online loan companies in Philippines. Their services are free and the results are instant. With the help of Finloo website you will quickly find a loan on the most favorable terms. Filter the results by the options you choose and get the best deals. Find out the details of each available online loan to choose the one that suits you best.

| Loan Name | Finloo PH |

| Loan Amount | up to PHP 25,000 |

| Loan Term | 30 days |

| Loan Types | Online Loan 0%, Quick loan, Consumer loan.. |

About Finloo PH

Finloo PH are an online service that completely free of charge helps to find and select a suitable company for obtaining a consumer loan in the Philippines. They carefully analyze the market, study the conditions and offers from each credit company in order to select only those lenders that meet the following criteria:

- Matches your request

- Trusted company with good reviews

- High probability of application approval

Advantages of Finloo PH

- Have helped hundreds of thousands of people find the right lender quickly and efficiently. And most importantly – completely free!

- In just a couple of minutes you can find and compare online and choose the best offers for your request.

- After choosing a suitable offer, your request is instantly sent to the right company to the lender and you will receive your money as soon as possible.

Eligibility to apply for a loan from Finloo PH

- Compliance with the acceptable age category (over 18 years old)

- Citizenship of Philippines

- Have an ID card

- Have a valid phone number and a bank account

Steps to Apply Loan Online Finloo PH

The step-by-step instruction:

- Step 1: Select a lender and click on the application field.

- Step 2: Passage of all stages of registration. Entering truthful data into the cells of the online form intended for this.

- Step 3: Completion of registration through confirmation.

- Step 4: Adding personalized information to the questionnaire.

- Step 5: Granting the lender’s consent to verify all online survey data.

- Step 6: Waiting for the result (approval or rejection).

Why Choose Finloo PH

Finloo PH is a site for people who are in a difficult situation. Here, for free, you can find an offer that will satisfy your request. Their specialists have compiled a database that ensures the conclusion of a profitable online loan agreement with particular convenience:

- It takes less than 15 minutes to fill out an online form and send a request;

- There is no need to visit banking institutions or offices – all transactions are made via the Internet;

- Round-the-clock service without breaks for weekends or holidays.

Finloo PH is №1 consultant in choosing a loan:

- Only verified companies are included in the rating.

- The result is free and does not require registration.

- Find the best loan with us.

- Select offers according to your criteria.

Finloo PH’s Reminder for Borrowers

The service provides for a refund at the earliest opportunity. Thus, clients receive a unique right not to pay inflated interest rates. After all, the shorter the term of using the product of the institution, the less the commission is charged for it.

Finloo PH do not recommend categorically delaying the return of contractual contributions – life circumstances can turn sharply in the other direction, but the debt remains. But if it is returned, in the same case it will be possible to take another loan. Moreover, if at the first application the lender provides a small amount, then the next time the client is offered much more.

The most important point is time control. The debt should be paid off as quickly as possible to make sure that there will be no trouble in the future. Another recommendation from experienced users: carefully read every line of the contract drawn up by the lender. Often people are sincerely surprised: where could such a crazy amount of debt come from? The answer is extremely simple: there were “hidden” obligations to pay commissions in the document, and the consumer was in such a hurry to get cash that he did not notice it.

In most cases, credit companies publish a maximum of initial data on their official Internet resources. You just need to go to the lender’s page and read carefully.

FAQ About Finloo PH

Is Finloo PH legit?

Yes. Finloo.ph website serves as a source of information to help you find the best solution for your needs. Interest rates vary depending on the lender, the recommended rate will depend on your situation and credit history. The information on this website is taken from the websites of the lender and is provided as an example and may contain incomplete or outdated information for which they are not responsible.

Finloo PH strongly recommend that you review the offers on the lender’s website and/or ask them for information if you are contacted by phone. They emphasize that they are NOT a financial institution, bank or lender. The service is not responsible for any credit arrangements. This website does not charge a fee for use and is not responsible for your actions.

How long does it take to get a loan online?

On average 10 – 20 minutes.

What are the mandatory requirements for borrowers?

- Philippine citizenship.

- Valid mobile phone number.

- Age of majority required.

- Additional requirements for borrowers depend on the size of the requested loan, as well as the financial policy pursued by a particular lender.

Can I borrow money in the evening or on the weekend?

Of course. Finloo PH service is available 24/7. To do this, simply have access to the Internet. However, the contracting process with a particular lender will depend on lenders work schedule, as well as whether incoming applications are processed there manually or automatically. Currently, many lenders offer online loans around the clock without an operator.

Can I get a loan if I have a bad credit history?

Yes, you can. As a rule, this requires in the application to honestly and in detail indicate when and why the loan was not repaid on time. It is quite possible to get a loan online with bad credit, but keep in mind that in this case it may be a minimum amount and for a short period of time.

However, if you repay the loan on time, in the future you can count on more loyal lending conditions – low interest rates, long terms and large loan amounts. As a result, your credit history will improve and then you can count on long-term bank loans.