The financial landscape is undergoing a transformative shift, and at the forefront of this change is FinApps PH, a platform that is changing the way individuals in the Philippines access cash loans. In this detailed review, we will explore the multifaceted world of FinApps PH, delving into its mission, benefits, application process, advantages, and frequently asked questions.

This article aims to provide an in-depth understanding of how FinApps PH is reshaping the financial lending landscape in the Philippines.

Is FinApps PH Legit?

FinApps PH operates without being overseen by the Securities and Exchange Commission. However, there’s no need for concern as this website does not impose any charges on borrowers who are simply seeking the most suitable loan options for their needs.

Unveiling the Essence of FinApps PH: A Gateway to Financial Inclusion

At its core, FinApps PH is on a mission to redefine financial accessibility for Filipinos. The platform’s primary objective is to streamline the process of obtaining much-needed funds swiftly and efficiently. By leveraging a real-time database of reputable lenders, FinApps PH boasts an astounding 99% success rate in connecting borrowers with the financial resources they require. Beyond just providing loans, FinApps PH serves as a catalyst for personal and economic growth.

The Irresistible Allure of FinApps PH

What sets FinApps PH apart and makes it the preferred choice for many borrowers? Let’s delve into the compelling reasons that make this platform a beacon of financial hope:

- Swift Accessibility: Within a mere two minutes, potential borrowers can access personalized loan offers, making the decision-making process remarkably efficient.

- Speed Coupled with Quality: The hallmark of FinApps PH is its seamless and high-quality service, ensuring that the entire loan journey is devoid of unnecessary complexities.

- Uninterrupted Availability: Operating 24/7, FinApps PH transcends geographical and temporal barriers, providing unwavering assistance round the clock.

- Emphasis on Credibility: With a stringent focus on verified lenders, the platform guarantees the authenticity and reliability of its lending partners.

- The Power of Approval: FinApps PH boasts an impressive loan approval rate, underlining its commitment to empowering borrowers by turning their aspirations into reality.

Navigating the Path to Financial Empowerment

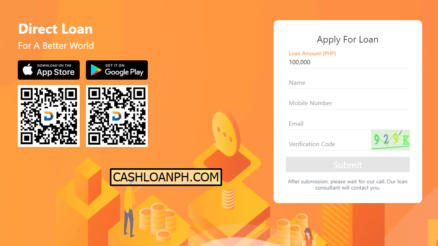

The journey of obtaining a loan through FinApps PH is an intuitive three-step process that ensures ease and clarity for borrowers:

- Step 1: Define Your Loan Amount: Utilizing a user-friendly calculator slider, borrowers can effortlessly select the loan amount that aligns with their unique needs.

- Step 2: Complete the Form: A straightforward online form captures essential details, ensuring that borrowers meet the eligibility criteria for loan consideration.

- Step 3: Personalized Offers Await: Based on the borrower’s specified requirements, FinApps PH presents a curated selection of loan offers, tailored to enhance the chances of approval.

Exploring the Multifarious Advantages of FinApps PH

Peeling back the layers of advantages that come with embracing FinApps PH:

- Seamless Accessibility: The hallmark of FinApps PH is its unwavering 24/7 availability, ensuring that borrowers’ financial needs are met at any hour.

- Personalized Attention: Every loan application is treated with the utmost care, embodying the platform’s commitment to empowering borrowers on an individual level.

- Minimalistic Data Collection: The streamlined form collection process minimizes the burden of unnecessary information, expediting the application process.

- Efficient Lender Matching: Through cutting-edge algorithms, FinApps PH accelerates the identification of lenders that perfectly align with the borrower’s financial requirements.

- Zero-Interest Loan Options: A unique offering of FinApps PH is the availability of loan options at 0% interest, exemplifying the platform’s dedication to supporting borrowers’ financial dreams.

Answering Common Queries

How to Utilize FinApps PH?

Navigating FinApps PH is a straightforward process: complete an application on the website, peruse the list of reputable lenders, select the best-fit option, and receive approval directly through the lender’s website.

Application Processing Timeframe

The time taken to receive funds hinges on the chosen lender, with most approved applicants gaining access to funds on the same day as application.

Loan Amount Spectrum

Loan options span from ₱1,000 to ₱25,000, granting borrowers the flexibility to select an offer aligned with their financial needs.

Boosting Approval Odds

Enhancing application approval odds involves applying to multiple organizations simultaneously, maximizing the likelihood of success.

Financial Accessibility at No Cost

FinApps PH’s services are provided free of charge to all citizens of the Philippines, ensuring that financial empowerment knows no financial barriers.

6. Forging Connections with FinApps PH

For those seeking personalized support, FinApps PH extends a helping hand:

- Operating Hours: The platform’s availability 24/7 guarantees assistance at any time of the day or night.

- Email Support: Reach out to [email protected] for tailored guidance and assistance.

Conclusion

In an era where financial accessibility is paramount, FinApps PH stands as a trailblazer, bridging the gap between financial aspirations and reality. With its commitment to accessibility, verified lending partnerships, and customer-centric approach, FinApps PH propels Filipinos towards their financial aspirations with unparalleled ease. Embrace this platform to redefine your financial journey and seize control of your economic destiny today. As the financial landscape evolves, FinApps PH remains a steadfast companion, dedicated to propelling you towards financial success.