In an ever-evolving digital landscape, the need for financial solutions that are accessible, efficient, and secure has never been greater. Mr.Cash, an online loan application, has emerged as a leading financial platform in the Philippines, offering quick and convenient access to funds without the need for collateral. CashLoanPH will delve into the various facets of Mr.Cash, exploring its loan products, advantages, limitations, the application process, and frequently asked questions. By the end of this journey, you will have a thorough understanding of how Mr.Cash can be your ideal financial partner.

Summary about Mr.Cash

Mr.Cash is more than just an online loan application; it’s a financial lifeline for many in the Philippines. It offers a streamlined approach to borrowing, characterized by high loan limits and competitive interest rates. What sets Mr.Cash apart is its simplicity; the entire process is online, and once your registration is approved, funds are promptly disbursed into your bank account. This means no more waiting in long lines or dealing with heaps of paperwork. With Mr.Cash, you can meet your financial goals with ease and confidence.

Contact Mr.Cash: In the event that you encounter any issues or need assistance while using the application, Mr.Cash ensures that you have easy access to support. Here are the details to reach out to them:

- Company Name: e-Generation Lending Corporation

- Website: www.mrcash.vip

- Email: [email protected]

- Address: 17th Floor, The Orient Square Building, Ortigas Avenue, Ortigas Center, Pasig City

- Working Hours: Monday-Sunday from 08:00 to 20:00

Detailed Information about the Loan Products at Mr.Cash

Understanding the loan products offered by Mr.Cash is essential for making informed financial decisions. Here’s a comprehensive breakdown:

- Loan Amount: Mr.Cash provides borrowers with a range of options, from as low as ₱1,500.00 to a substantial ₱30,000.00. This flexibility ensures that your specific financial needs are met.

- Loan Tenure: The loan tenure is equally versatile, ranging from 91 days for the shortest tenure, including the extension period, to 120 days for the longest, including the extension period. This variety empowers borrowers to choose a loan term that aligns with their financial circumstances.

- Interest Rates: The Monthly Effective Interest Rate (EIR) at Mr.Cash falls in the range of 14.81% to 15%, ensuring that the interest paid remains reasonable. Moreover, the Maximum Annual Percentage Rate (APR) is capped at 182.5%, providing transparency and predictability to borrowers.

- Service Fee: As a responsible lender, Mr.Cash charges a one-time service fee per transaction, which varies from a minimum of 10% to a maximum of 20%. This fee, while upfront, ensures that you understand the cost associated with your loan. Let’s break this down further with an example:

- If you select a loan amount of ₱4,000.00 with a 91-day tenure, the one-time service fee would amount to ₱400.00 (₱4,000.00 * 10%).

- Coupled with an interest rate of 20.5%, the total interest payable would be ₱820.00 (₱4,000.00 * 20.5%).

- Thus, the total repayment amount would be ₱4,820.00 (₱4,000.00 for the loan amount and ₱820.00 for the interest).

Advantages and Limitations of the Mr.Cash App

Advantages

- Quick and Convenient: Mr.Cash sets a benchmark for quick and hassle-free online loan applications. It takes just a few clicks to get started.

- No Collateral Required: One of the most significant advantages of Mr.Cash is the absence of collateral requirements, which simplifies the borrowing process and minimizes risk.

- User-Friendly Process: The application process is user-friendly, ensuring that even those new to online lending can navigate it with ease.

- Competitive Interest Rates: Despite being an online platform, Mr.Cash offers interest rates that are competitive and devoid of any hidden management fees.

- Data Privacy: Your personal data and financial information are safe and secure with Mr.Cash, ensuring your privacy is protected at all times.

- Compatibility: The Mr.Cash app is compatible with various operating systems, providing convenience to a wide range of users.

- Versatile Usage: Whether you need funds for an emergency, education, or any other purpose, Mr.Cash caters to a diverse array of financial needs.

- Rapid Disbursement: With Mr.Cash, you can expect funds to be deposited into your bank account in just 15 minutes.

Limitations

- Interest Rates: While Mr.Cash offers various advantages, it’s important to note that interest rates may be higher when compared to traditional banks and some other online financial institutions.

- Short Repayment Periods: Although Mr.Cash provides generous loan limits, the repayment periods are relatively short. This might require careful financial planning to ensure timely repayment.

- Occasional Application Errors: Users may encounter occasional errors when accessing online loan services. While Mr.Cash strives to provide a seamless experience, technical glitches can happen.

The Process of Online Loan Registration at Mr.Cash

Meeting the Registration Requirements

To embark on your financial journey with Mr.Cash, it’s crucial to meet the following straightforward requirements:

- Philippine Citizenship: You must be a citizen of the Philippines to be eligible for a loan.

- Age Criteria: Borrowers should be between 18 and 60 years old.

- Primary Identification: Possess at least one primary ID, which can include SSS, UMID, TIN, Driver’s License, or Passport.

- Employment: Have a job or be self-employed. This ensures that you have a stable source of income.

- Bank Account and Phone Number: A bank account and a personal phone number are necessary for smooth transactions and communication.

Documents Required for Registration

Before you embark on the registration process, make sure you have the following information and documents at hand:

- Personal details, including full name, address, phone number, date of birth, and ID card number.

- Information regarding your monthly income and the source of your income.

- Images or scanned copies of necessary documents, such as your ID card or Passport, proof of address, and any other required documents.

- Ensure you have a mobile phone, and if you don’t have the Mr.Cash app already, download and install it.

Loan Registration Guide

The loan registration process at Mr.Cash is designed to be as straightforward as possible. Follow these steps to successfully register for a loan:

Step 1: Download and install the Mr.Cash app from https://www.mrcash.vip/. The app is available for both APK and IOS platforms.

Step 2: Open the app and initiate the registration process. Provide your personal information, including:

- Full name

- Address

- Date of birth

- Phone number

- Bank account information

Step 3: Next, you will need to provide financial information. The app may request details about your monthly income and employment or source of income.

Step 4: It’s time to provide images or scanned copies of the necessary documents. This includes your ID card or Passport, proof of address, and any other documents as requested.

Step 5: Double-check all the information you’ve provided and confirm your registration.

Step 6: Now, you will need to be patient as Mr.Cash reviews and approves your registration.

Step 7: If your application is approved, the loan amount will be disbursed directly into your bank account.

Note: The registration process may have slight variations depending on the policies and regulations of the application. Make sure to check the detailed information and instructions on the app or the Mr.Cash website for the most accurate registration process.

Payment Options

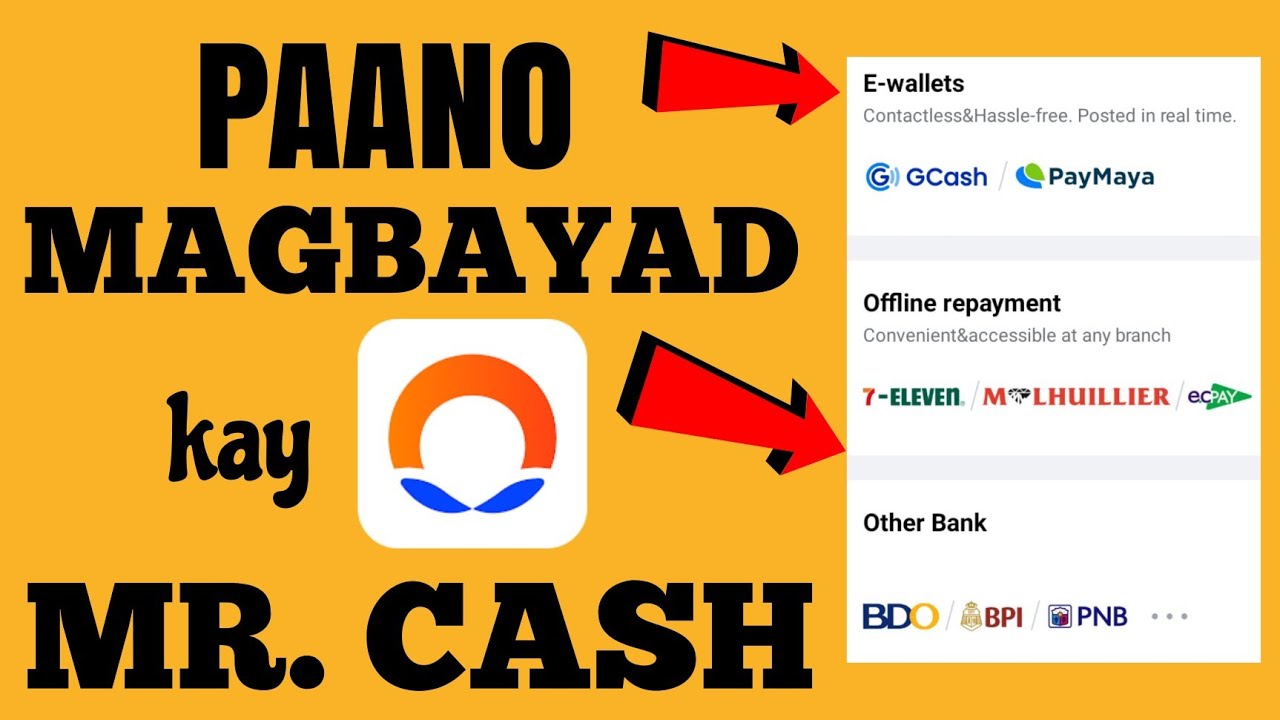

Mr.Cash recognizes the importance of convenient repayment methods. Thus, they offer multiple payment options, allowing borrowers to choose the one that best suits their preferences. These options include bank transfers, mobile banking, online banking, e-wallets, or even convenience stores. After you’ve made the payment, you will receive an SMS notification confirming the successful transaction.

Frequently Asked Questions about Mr.Cash

Navigating the world of online lending can bring up a multitude of questions. Here are some frequently asked questions related to Mr.Cash to provide you with more clarity:

How much can I borrow for the first-time registration?

As a new customer using the Mr.Cash app, you can typically borrow online in the range of ₱1,500.00 to ₱10,000.00. Additionally, the app evaluates the personal information you provide to determine the most suitable loan limit for you. This approach ensures that you are borrowing within your means.

Where can I view my loan repayment history?

Customers can easily access their loan repayment history through the app installed on their mobile phones. The app keeps you updated on payments made and the remaining balance, ensuring complete transparency in your financial dealings.

Does Mr.Cash have any promotional policies?

Staying competitive and attentive to their customers’ needs, Mr.Cash offers promotional programs for both new customers and loyal patrons. These promotions may include reduced interest rates and increased loan limits. To stay updated and take advantage of these promotions, simply access the app.

Can students borrow money?

It’s important to note that students may not be eligible to borrow from Mr.Cash. To qualify, you typically need to have stable employment and a steady monthly income. This approach ensures that you have the financial capacity to manage repayments.

Conclusion

In the fast-paced world of online lending, Mr.Cash shines as a beacon of accessibility and convenience. It offers a comprehensive array of advantages, from quick and hassle-free application processes to high loan limits without the need for collateral. While it’s essential to be mindful of the interest rates, Mr.Cash strives to provide a secure and reliable platform for meeting various financial needs. By downloading the Mr.Cash app, you can access a world of financial possibilities and meet your goals with ease. Whether it’s an unexpected emergency or an exciting opportunity, Mr.Cash is ready to support you. For any queries or assistance, reach out to them using the contact information provided. Your financial partner is just a few clicks away. Download Mr.Cash and embark on your financial journey today.