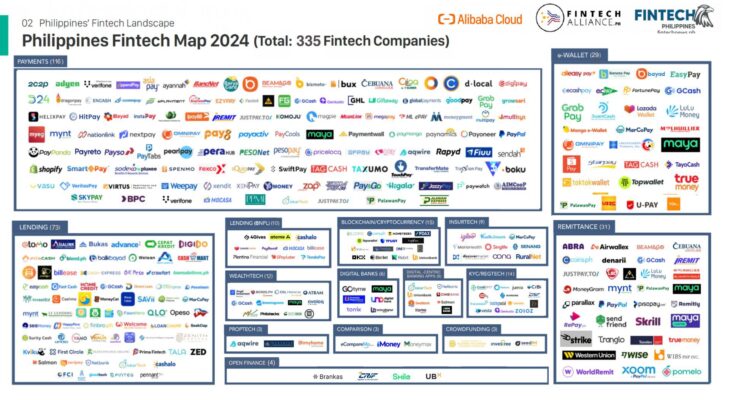

In the Philippines Fintech Map 2024, the lending sector is a significant part of the fintech ecosystem, with 73 companies offering various types of lending services. These companies cater to a wide range of financial needs, including personal loans, business loans, installment plans, and micro-financing, particularly targeting those underserved by traditional banking systems. Below is a detailed list of the lending companies:

Philippines Fintech Lending Companies (2024)

| No. | Company Name | Description |

|---|---|---|

| 1 | Eton | A platform offering both consumer and business loans, with a focus on providing accessible credit. |

| 2 | Asialink | Leading financial institution providing a wide range of loan services, from personal loans to business financing. |

| 3 | Bukas Advance | A loan platform focused on education, allowing students to pay tuition fees through installment plans. |

| 4 | CepaT Kredit | Specializes in quick, short-term loans for consumers and small businesses, providing fast access to funds. |

| 5 | Digido | An online lending platform offering fast, paperless personal loans for individuals with immediate financial needs. |

| 6 | PITACash | Provides easy-to-access cash loans for Filipino consumers, with simple application processes and fast approval. |

| 7 | Blend PH | A peer-to-peer lending platform where individuals can borrow money directly from investors. |

| 8 | Balikbayad | Offers loan services targeted at returning overseas Filipino workers (OFWs), helping them reintegrate and support their families. |

| 9 | Weloan | An app-based platform providing personal loans, focusing on ease of use and quick disbursement of funds. |

| 10 | Cash Mart | Specializes in fast cash loans for consumers, providing a range of financial products tailored to everyday needs. |

| 11 | Cashalo | Offers a variety of financial services, including personal loans and Buy Now, Pay Later options. |

| 12 | BillEase | A popular Buy Now, Pay Later platform allowing users to make purchases and pay in installments. |

| 13 | Home Credit | Global company offering consumer financing for household goods, focusing on installment payments. |

| 14 | GCash | Digital wallet that offers GLoan, a micro-lending feature allowing users to borrow money directly through the app. |

| 15 | BPI Family Savings Bank | Traditional bank offering personal and business loans with convenient online application processes. |

| 16 | BlendBayad | A loan provider focused on small personal loans with a digital interface for ease of access. |

| 17 | BillEase | Provides installment-based lending for online purchases. |

| 18 | EasyCash | A mobile loan platform offering quick, short-term loans with minimal documentation. |

| 19 | TALA | Mobile app providing small, short-term loans using alternative data for credit assessment. |

| 20 | Pawnhere | Digital pawnshop platform allowing individuals to secure loans using personal assets as collateral. |

| 21 | FDFC | Offers a range of credit solutions, including personal loans and installment plans. |

| 22 | TendoPay | A Buy Now, Pay Later platform allowing purchases in installments without needing a credit card. |

| 23 | QLO | Quick access to personal loans with a digital platform aimed at simplifying the borrowing process. |

| 24 | Opeso | A mobile-based loan service providing small personal loans for urgent needs. |

| 25 | SeekCap | Platform specializing in providing loans to SMEs to support their growth. |

| 26 | Fast Cash | Offers quick cash loans to consumers with a focus on rapid approval processes. |

| 27 | Lendpinoy | Provides affordable personal loans through a mobile app for quick access. |

| 28 | Advance | A salary advance platform allowing employees to access earned salary before payday. |

| 29 | GoTyme | Digital bank offering personal loan services as part of its financial product portfolio. |

| 30 | FINTQ (Lendr) | Comprehensive digital lending platform connecting borrowers with various lending institutions. |

| 31 | MooCash | A micro-lending platform providing cash advances for personal needs. |

| 32 | SALMON | A consumer finance provider offering flexible personal loans. |

| 33 | Finbro | A lending platform offering small loans with a straightforward application process. |

| 34 | SAvi | Fast personal loans with a streamlined online application process. |

| 35 | Atome | A BNPL platform allowing consumers to shop and pay in installments from partner merchants. |

| 36 | RupiahPlus | Provides micro-loans with quick approval for urgent financial assistance. |

| 37 | CashXpress | Offers personal loans with flexible repayment terms. |

| 38 | LoanSolutions.ph | A marketplace connecting borrowers with lenders, helping individuals find the best loan products. |

| 39 | PayMaya | Digital wallet that includes lending features for personal and business needs. |

| 40 | EverGreen | A loan provider offering tailored financial solutions for personal and business financing. |

| 41 | LandBank | A traditional bank with digital solutions for personal and business loans. |

| 42 | LoanChamp | Focuses on quick approval personal loans for various consumer needs. |

| 43 | Credo | A digital lending platform providing small loans with an easy application process. |

| 44 | Unacash | Offers installment loans for larger purchases, simplifying the payment process for consumers. |

| 45 | Primeline Finance | Specializes in consumer loans with flexible terms, focusing on customer service. |

| 46 | EasyCredit | Provides fast personal loans with flexible repayment terms and minimal paperwork. |

| 47 | Lendr | A loan marketplace that connects borrowers with a network of banks and financial institutions. |

| 48 | LoanChamp | A mobile lending platform offering quick personal loans for urgent financial needs. |

| 49 | SeekLoan | Provides digital loan services for personal and business needs with fast approval. |

| 50 | TendoPay | Buy Now, Pay Later service for customers to purchase from partner merchants. |

| 51 | Kashalo | Mobile app that provides small, short-term loans to consumers quickly. |

| 52 | Capitall | Offers personal loans and SME financing to underserved segments of the population. |

| 53 | Robocash | Automated loan platform offering short-term personal loans using AI for quick approval. |

| 54 | Kivra | Provides financial services, focusing on personal loans for individuals. |

| 55 | Finbro | Offers small loans with an easy online application process. |

| 56 | Welcome Finance | Financial services provider offering personal loans to the underserved. |

| 57 | SeekCap | Focuses on providing loans to SMEs, supporting growth and development. |

| 58 | Asteria Lending | Digital platform offering personal loans with flexible repayment terms. |

| 59 | Fast Fund | Provides quick cash loans with a focus on simplicity and efficiency. |

| 60 | Unacash | Offers installment-based loans and BNPL services for easier payment management. |

| 61 | Asteria Lending | A platform providing personal loans with flexible terms for urgent financial needs. |

| 62 | Tala | Uses alternative data to offer personal loans through its app, focusing on financial inclusion. |

| 63 | BlendPH | Peer-to-peer lending platform connecting lenders and borrowers for various financial needs. |

| 64 | Pinoy Lender | Online marketplace for personal loans, allowing borrowers to compare offers. |

| 65 | RupiahNow | Provides short-term loans with fast approval for immediate financial assistance. |

| 66 | Mynt | Offers a range of financial services, including lending through its GCash app. |

| 67 | Binhi Lending | Microfinance solutions for individuals and SMEs in rural areas, promoting financial inclusion. |

| 68 | Weloan | App-based platform providing quick personal loans with minimal documentation. |

| 69 | Capitall Finance | Business loans and personal financing solutions for cash flow management. |

| 70 | Salmon | Consumer finance provider offering flexible personal loans for urgent needs. |

| 71 | Primeline Finance | Consumer loans with flexible terms and a user-friendly application process. |

| 72 | Global Credit Pros | Loan provider offering personal loans and SME financing with a focus on quick access. |

| 73 | FinQ | Online platform offering personal loans with a simple digital application process. |

These 73 lending companies in the Philippines fintech landscape offer diverse products that range from personal loans, small business financing, peer-to-peer lending, to Buy Now, Pay Later services. Their innovations focus on increasing financial inclusion, particularly for the unbanked or underbanked population, by leveraging technology to provide quick, easy access to funds.

Many of these companies utilize mobile platforms and alternative data for credit scoring, allowing individuals with limited or no credit history to borrow money. As the fintech ecosystem continues to evolve, the lending sector remains crucial in bridging the gap between traditional banking services and the growing demand for flexible, accessible credit solutions.