IPeso is an innovative online personal loan platform in the Philippines that aims to provide quick and easy financial assistance to both salaried employees and self-employed individuals. With its simple and user-friendly interface, fast loan processing, and flexible loan options, IPeso has become a popular choice for Filipinos in need of immediate funds.

| Loan App | IPeso Loan |

| Loan Amount | ₱ 1,500 – ₱ 8,000 |

| Loan Term | 120 days, 150 days or 210 days |

| SEC Registration No. | CS201914644 |

Established in 2019, LINK CREDIT LENDING INVESTORS INC. owns and operates IPeso, which has a company registration number of CS201914644 and a certificate of authority number of 3072. This online loan app is designed to help Filipinos cover urgent expenses like education, medical bills, vehicle repair, mobile phone bills, and other unexpected costs. In this article, CashLoanPH will take an in-depth look at IPeso and how it works.

Is IPeso Loan App Legit?

IPeso Loan is a legit loan app in Philippines. It is SEC registered and is certified. Its SEC Registration number is CS201914644 and its Certificate of Authority number is 3072.

The Basics of IPeso Loan

IPeso provides simple and affordable personal loans that range from PHP 1,500 to PHP 8,000. Loan periods can be as short as 120 days or as long as 210 days depending on your financial needs. While the maximum annual percentage rate (APR) is set at 18.25%, the daily interest rate only amounts to 0.05%. This makes IPeso one of the most affordable and most accessible online personal loan providers in the country.

Aside from the reasonable interest rate, IPeso also only charges a transaction fee ranging from PHP 25 to PHP 130. The transaction fee is charged in advance by the transaction channel upon loan approval. Moreover, there is a 0% service fee making it an ideal option for those who want a loan without any additional charges.

For instance, let’s suppose that you want to apply for a loan of PHP 6,000 with a loan period of 120 days or four (4) months. If the transaction fee is PHP 25 and there are no additional fees, your service fee would be PHP 0. The amount you will receive in hand amounts to PHP 5,975 which is the difference between the principal loan amount and the transaction fees. The monthly interest amount you need to pay is PHP 90, and the total repayment bill at the due date (loan amount + total interest) is PHP 6,360. When divided by four (4), the monthly repayment bill amounts to PHP 1,590.

IPeso Loan Eligibility

The minimum age to apply for an IPeso loan is 20 years old, and the maximum age is 60. Additionally, applicants must be Filipino citizens with steady income streams. Whether you’re employed or self-employed, IPeso requires that you demonstrate your capacity to repay your loan. Thus, applicants must meet the minimum requirements, which include a valid ID, a proof of income, and other necessary documents.

Platform Introduction

IPeso is the newest online personal loan platform that offers instant cash and personal loans to Filipinos. It is a highly-rated loan app that enables people to cover their urgent needs, such as bike repairs, emergency medical bills, and other unexpected expenses. IPeso is considered a financial buddy that provides personal loans for salaried employees, as well as self-employed individuals.

Platform Advantages

One of the most significant advantages of IPeso is its simple loan application process. The online application process is easy, and the response time is quick. Within minutes of your application, you’ll know if you’re approved for a loan. Once approved, you can receive your loan amount in as little as a few hours. Another advantage of IPeso is its flexibility when it comes to loan amounts and repayment periods. With its loan options ranging from PHP 1,500 to PHP 8,000 and repayment periods of 120 days to 210 days, borrowers can choose terms that best suit their financial situation.

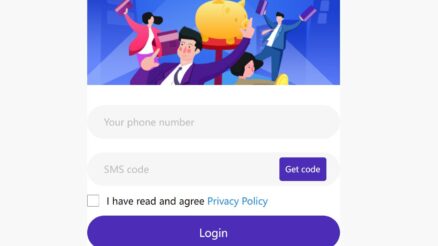

Easy Apply IPeso Loan

- Step 1: To apply for a loan with IPeso, you can download the app.

- Step 2: Fill in your basic information, work information, and contact information in just five minutes.

- Step 3: After submitting your application, you will have to wait for the review process, and if approved, you will receive the money directly to your account.

The platform also provides VIP loans that are borrowed first and repaid in installments.

Repayment Methods

After receiving your loan, you can repay it at any of the following payment channels: 7/11, Mluillier, Gcash, PAYMAYA, or any bank (BPI, UBP) near you. Furthermore, loan repayments and scheduling are made easy through the IPeso Loan app or its website.

Contacts IPeso Loan App

LINK CREDIT LENDING INVESTORS INC.

Company Registration No.Cs201914644 Certificate Of Authority No.3072

- Phone Globe: +639 369861009

- Phone Smart: +639 614294801

- Website: https://www.ipeso.ph

- Email: [email protected]

- Address: 12th Floor, Aseana Three Bldg, , Macapagal Ave cor. Aseana Ave. Aseana City Tambo City of Paranaque, Fourth District, NCR, Philippines, 1701

Conclusion

IPeso offers reliable and affordable online personal loans to Filipinos. With its quick and easy application process, flexible loan options, and convenient repayment methods, it is no wonder why it has become one of the most popular lenders in the Philippines. If you’re in need of immediate funds, IPeso might just be the right loan app for you.