When it comes to financial needs, online loans have become a popular option for Filipinos. They provide quick and convenient access to funds without the hassle of traditional bank loans.

In this review, CashLoanPH will explore 5 legit online lenders in the Philippines that offer guaranteed approval for loans. These lenders include Cash-Express, Cashalo, Tala, Digido, and Finbro. We will discuss their features, loan amounts, repayment terms, and interest rates to help you make an informed decision.

Top 5 legit online loans guaranteed approval Philippines

Cash-Express: A Reliable Non-Bank Financial Institution

Cash-Express, established in 2005, is a well-known non-bank financial institution specializing in short-term loans for Filipinos. Over the years, it has grown to become one of the largest microfinance lenders in the Philippines. Cash-Express offers loan amounts ranging from ₱1,000 to ₱30,000, with flexible repayment terms extending up to 36 months. With competitive interest rates starting at 2.5% per month, Cash-Express provides borrowers with a reliable and accessible loan option.

Cashalo: The Leading Digital Lending Platform

Founded in 2014, Cashalo has emerged as a leading digital lending platform offering loans to Filipinos via mobile phones. This innovative approach has made Cashalo one of the most popular online lenders in the country. Borrowers can avail themselves of loan amounts ranging from ₱500 to ₱10,000, typically with a repayment period of 30 days. Cashalo offers competitive interest rates starting at 1% per day, making it an attractive option for individuals seeking short-term financial assistance.

Tala: Global Lending Company Serving Emerging Markets

Tala, founded in 2011, is a renowned global lending company that focuses on providing loans to individuals in emerging markets, including the Philippines. With operations in over 20 countries, Tala has established itself as a trusted lender for borrowers seeking accessible financial solutions. Loan amounts from Tala range from ₱500 to ₱10,000, with a repayment period of up to 30 days. Tala offers competitive interest rates starting at 1% per day, ensuring that borrowers have a viable loan option to meet their immediate needs.

Digido: The New Online Lending Player

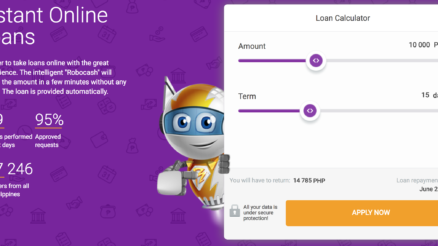

As a relatively new online lender founded in 2020, Digido has quickly gained attention in the Philippines. Backed by prominent venture capital firms, Digido aims to provide accessible loans to Filipinos with a seamless online application process. Loan amounts offered by Digido range from ₱1,000 to ₱10,000, typically with a repayment period of 30 days. With competitive interest rates starting at 1% per day, Digido presents an attractive option for borrowers looking for reliable financial assistance.

Finbro: The Venture Capital-Backed Online Lender

Similar to Digido, Finbro is a recently established online lender founded in 2021, boasting support from reputable venture capital firms. Finbro’s mission is to offer reliable loan options to Filipinos, ensuring quick access to funds when needed. Loan amounts provided by Finbro range from ₱1,000 to ₱10,000, typically with a repayment period of 30 days. With competitive interest rates starting at 1% per day, Finbro serves as a viable choice for borrowers seeking online loan solutions.

The pros and cons of each lender

| Lender | Pros | Cons |

|---|---|---|

| Cash-Express | Long history of lending in the Philippines | Higher interest rates than some other lenders |

| Cashalo | Widely available and easy to apply for | Shorter repayment terms than some other lenders |

| Tala | Offers loans in over 20 countries | Not available in all areas of the Philippines |

| Digido | Backed by some of the biggest names in venture capital | New lender, so there is limited information about its track record |

| Finbro | New lender, so there is limited information about its track record | Offers loans in smaller amounts than some other lenders |

Ultimately, the best lender for you will depend on your individual needs and circumstances. Be sure to compare the terms and conditions of each lender before you make a decision.

Tips for Applying for an Online Loan

- Research: Thoroughly research different lenders to compare their offerings. This will enable you to find the loan that best suits your specific needs and budget.

- Documentation: Prepare the necessary documentation to verify your identity and income. These may include your driver’s license, Social Security number, and recent pay stubs.

- Financial Transparency: Honesty is key when applying for a loan. Provide accurate information about your financial situation, including your income, expenses, and existing debts. Lenders use this information to assess your eligibility and determine the loan terms.

- Interest Rate Comparison: The interest rate is a critical factor to consider when comparing different lenders. Shop around and compare interest rates to secure the most favorable terms for your loan.

- Read the Fine Print: Before signing any loan documents, carefully read and understand the terms and conditions. Pay close attention to details such as the interest rate, repayment period, and any associated fees.

Additional Tips for Loan Approval

- Good Credit Score: Maintaining a good credit score significantly influences lenders’ decisions when approving loan applications. While a poor credit score may not necessarily disqualify you from obtaining a loan, it may result in a higher interest rate.

- Stable Income: Lenders want assurance that you have a steady income to ensure timely loan repayment. If you are self-employed, you may need to provide additional documentation to demonstrate a reliable income source.

- Low Debt-to-Income Ratio: Lenders evaluate your debt-to-income ratio, which indicates the percentage of your monthly income allocated to debt payments. A lower ratio demonstrates financial stability and increases the likelihood of loan approval.

Conclusion

When considering an online loan in the Philippines, it is crucial to conduct thorough research and compare different lenders to find the best deal for your specific needs. Cash-Express, Cashalo, Tala, Digido, and Finbro are reputable lenders that offer guaranteed approval for loans.

By following the tips provided, such as conducting thorough research, preparing necessary documentation, comparing interest rates, and reading the fine print, you can increase your chances of securing an online loan with the best possible terms.

GET ONLINE LOANS IN THE PHILIPPINES UP TO PHP 25,000

Select online loans that come with the best terms and conditions, ensuring a card without any rejections. Numerous companies provide an initial loan at 0% interest and ensure swift money transfers, making them perfect for urgent financial needs.

| Lender | Loan Product Detail |

|---|---|

|

Digido |

Popular - 0% first loan

|

|

MoneyCat |

Fast Approve - 0% first loan

|

|

OLP Loan |

Hot Offer - 0% first loan

|

|

Finbro PH |

Hot - 0% first loan

|

|

Cash-Express |

Express Loan - 0% first loan

|

|

Kviku |

New - 0% first loan

|

![USD to PHP Exchange Rate Today [Latest Update] USD to PHP Exchange Rate Today [Latest Update]](https://cashloanph.com/wp-content/uploads/2023/05/usd-to-php-exchange-rate-today-cashloanph-438x246.jpg)